If you find sales tax rules confusing and ever-changing, you’re not alone. Whether you’re a new business owner or have years of experience, understanding Alabama sales tax is crucial for compliance and smooth operations.

This comprehensive guide will break down everything you need to know about Alabama sales tax for 2024, from determining your sales tax nexus to managing exemptions and reporting.

Let’s simplify the process and help you stay on top of your tax obligations effortlessly!

Section 1: Determining Sales Tax Nexus in Alabama

In this section, we explained how a business establishes a connection with Alabama strong enough to require collecting and remitting sales tax, the Alabama economic nexus threshold and its implications, what’s required to comply with Alabama sales tax if you have nexus.

What is Alabama Sales Tax Nexus?

Alabama Sales Tax Nexus refers to the legal connection a business, that is, seller must have with the state of Alabama that requires them to collect and remit sales tax on sales made to customers within the state.

Do You Need a Sales Tax Permit to Sell Online From or To Alabama?

Yes, you need a sales tax permit to sell online in or to Alabama, and collect and remit sales tax on in-state sales.

- If you have a physical presence in Alabama (such as warehouse, office, employee) or

- If you don’t have a physical presence in Alabama but reach certain sales thresholds within the state. This particular is known as economic nexus

What Triggers or Creates a Sales Tax Nexus in Alabama?

A sales tax nexus is established when a business has a sufficient connection to a state to require it to collect and remit sales tax. In Alabama, nexus can be triggered by s two main types of nexus: physical nexus and economic nexus:

Physical Nexus

- Physical presence: Operating a retail store, warehouse, or office in Alabama.

- Employees: Having employees based in the state.

- Inventory: Storing products within the state

- Sales representatives or agents: who regularly visit Alabama

Economic Nexus

- Sales threshold: Generating over $250,000 in annual sales within Alabama.

- Transactions threshold: Reaching a certain number of transactions within the state

- Affiliate Relationships: Having business relationships with other entities in Alabama that assist in selling your products.

What is Alabama’s Sales Tax Economic Nexus Threshold?

Alabama’s sales tax economic nexus threshold is $250,000 in annual sales. This means that out-of-state businesses that generate at least $250,000 in sales to Alabama customers in a calendar year must register for an Alabama sales tax permit, collect sales tax on their Alabama sales, and remit the tax to the state starting January 1 of the following year..

What are Alabama Sales Tax Nexus Requirements

There isn’t a specific set of requirements for establishing a nexus besides having a physical presence or exceeding the economic threshold. However, once you have nexus, you’ll need to register for an Alabama sales tax permit.

- Register for a Sales Tax Permit: Obtain a permit through the Alabama Department of Revenue. The registration process is free and typically takes 3-5 business days to complete.

- Collect Sales Tax: Ensure you collect the appropriate sales tax on all taxable sales.

- Remit Collected Tax: Regularly remit the collected tax to the state, typically on a monthly, quarterly, or annual basis depending on your sales volume.

- Maintain Records: Keep detailed records of all sales, exemptions, and remitted taxes for compliance and audit purposes.

Alabama Sales Tax Nexus Calculator

To simplify determining your sales tax obligations, you can use an Alabama sales tax nexus calculator. These tools help you assess whether your business activities have created a nexus in Alabama or determine if you’ve reached the $250,000 threshold, ensuring you stay compliant with state regulations. By entering your sales data and business activities, the calculator provides a clear picture of your tax responsibilities.

Section 2: Understanding Alabama Sales Taxability, Exemptions and Resale Certificates

In this section, we explained the difference between Alabama exemption certificate and a resale certificate, what is subject to sales tax in Alabama and what is exempt, the validity period, required information on the form, and how to obtain one. We also clarified how out-of-state sellers typically don’t qualify for exemption, how qualified nonprofits can get a certificate to purchase certain items tax-free for exempt functions and more.

Alabama Sales Tax Certificate of Exemption vs. Resale Certificate – What’s the Difference

The key difference between an Alabama Sales Tax Certificate of Exemption and a Resale Certificate is that a resale certificate is for businesses that will resell the purchased items, while a certificate of exemption is for entities that won’t resell but are exempt from paying sales tax.

- Resale Certificate: This document allows businesses to purchase goods for resale without paying sales tax. It verifies that the purchaser intends to resell the items and will collect sales tax from end consumers.

- Sales Tax Certificate of Exemption: This certificate exempts specific entities or purchases from sales tax. It is used for organizations like government agencies, religious institutions, or for specific purchases like manufacturing machinery.

What and Who is Exempt from Sales Tax in Alabama?

Individual and organizations or entities that are excluded from paying sales tax in Alabama include:

- Food: Most non-prepared food items for individuals.

- Prescription drugs: Medications prescribed by a licensed healthcare provider.

- Agricultural Supplies: Seeds, fertilizers, and other supplies used in farming are exempt.

- Governmental Entities: Purchases made by federal, state, and local government agencies.

- Nonprofit Organizations: Specific nonprofits that meet statutory requirements, such as churches, charitable organizations, and civic groups.

- Educational Institutions: Public and private schools, colleges, and universities, excluding daycare centers.

- Healthcare Facilities: Hospitals, nursing homes, and other healthcare providers owned by city or county entities.

- Certain Public Service Organizations: Includes fire departments, economic development boards, and entities like the YMCA and YWCA.

To qualify for these exemptions, organizations must provide proof of their exempt status, typically through an exemption certificate.

What is an Alabama Sales Tax Certificate of Exemption?

A sales tax exemption certificate in Alabama is a document that allows qualified purchasers to buy goods and services without paying sales tax. This certificate serves as proof to the seller that the transaction is exempt from tax. There are two primary types of exemption certificates:

How Long is an Alabama Sales Tax Certificate of Exemption Valid For?

An Alabama Sales Tax Certificate of Exemption is valid for one year from the date of issuance. It must be renewed annually before the end of its expiration month to remain active. Failure to renew will prevent tax-exempt purchases or rentals

.

What Goods are Taxable in Alabama?

In Alabama, most tangible personal property sold to consumers is subject to sales tax and these taxable goods include:

- Consumer Electronics: TVs, computers, smartphones

- Clothing and Footwear: All types of apparel and accessories

- Household Goods: Furniture, appliances, and home decor items

- Food and Beverages: Grocery items, snacks, and non-alcoholic beverages (with certain exceptions)

- Automobiles: Cars, motorcycles, and other vehicles.

What Services are Taxable in Alabama?

While Alabama generally does not tax most services, there are notable exceptions and they include:

- Manufacturing Services: Services that produce or fabricate tangible personal property.

- Installation Services: If these services are part of the sale price of taxable goods, they are taxable.

- Telecommunications Services: Services like mobile phone usage and prepaid wireless charges are subject to sales tax.

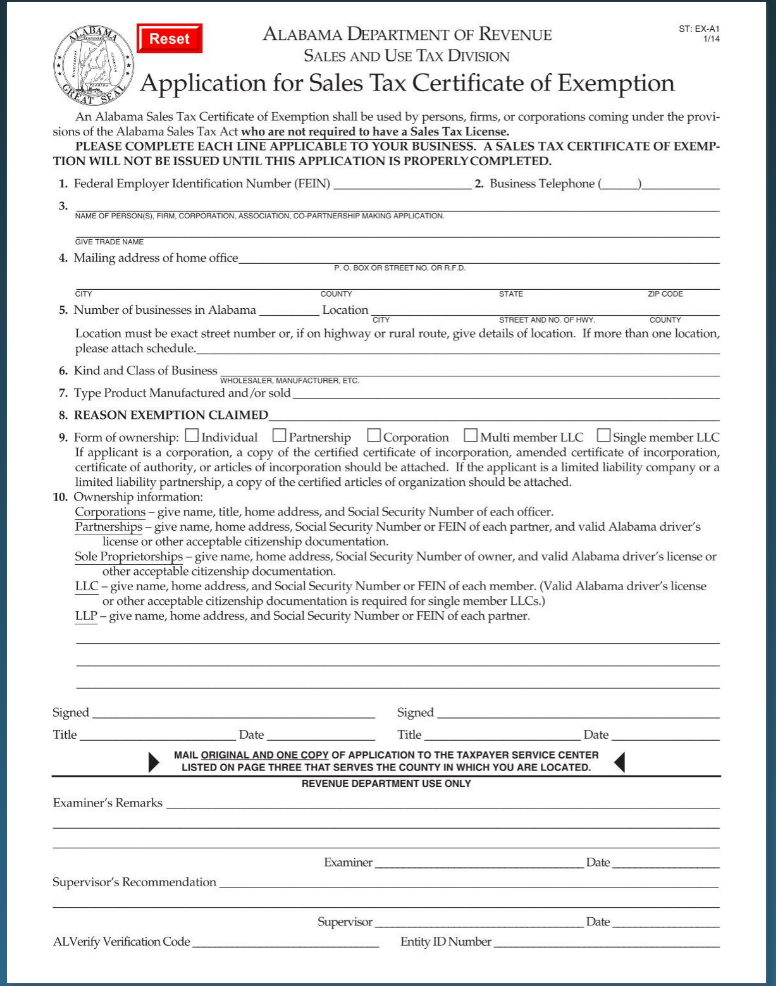

How Does an Alabama Sales Tax Exemption Form Look Like?

The Alabama sales tax exemption form, such as the ST: EX-A1 or ST: EX-A1-SE, includes sections for:

- Purchaser Information: Name, address, and tax ID number of the exempt entity.

- Description of Goods or Services: Detailed information about the items being purchased.

- Reason for Exemption: Explanation of why the purchase qualifies for exemption, including any relevant statutory references.

- Certification: Signature and date from an authorized representative of the exempt entity, attesting to the validity of the exemption claim.

These forms are available from the Alabama Department of Revenue and must be filled out accurately and submitted to the seller to avoid being charged sales tax.

Types of Alabama Sales Tax Certificate of Exemption:

Alabama provides several exemption forms available for download in PDF format. These include:

- Alabama Nonprofit Organization Requesting to Purchase Items Exempt from Sales Tax (ST: EX-A1-SE)

- Alabama Government Entity or Public School Requesting to Purchase Items Exempt from Sales Tax

- Alabama Resale Certificate

- Fertilizer, Insecticide, Fungicide, and Seedlings Certificate of Exemption

- Alabama Certificate for Feed Exemption Only

- Alabama also allows the use of uniform sales tax exemption certificates, which can be used across multiple states. This is particularly useful for businesses operating in multiple jurisdictions.

These forms can be printed and submitted as needed for tax-exempt purchases. You can find these forms on the Alabama Department of Revenue’s official site.

To use an exemption certificate, the purchaser must ensure the form is completed accurately and submitted to the seller at the time of purchase. The seller is responsible for maintaining records of these certificates for verification purposes.

Do Out-of-State Sellers Qualify for Sales Tax Exemption in Alabama

Generally, no, out-of-state sellers do not qualify for sales tax exemption in Alabama. However, out-of-state retailers who participate in the Simplified Sellers Use Tax Program are required to collect and remit a flat 8% use tax on sales to Alabama customers and as such may be eligible for some sales tax exemptions. Additionally, out-of-state sellers with a physical presence or who meet the economic nexus criteria (e.g., exceeding $250,000 in sales) are required to collect Alabama sales tax and are eligible for some exemptions.

Alabama Sales Tax Exemption for Manufacturing

Alabama provides specific sales tax exemptions for manufacturing machinery and equipment. These exemptions are intended to reduce costs for manufacturers by allowing tax-free purchases of machinery used in the production process. The exemption applies to both new and used machinery as long as it is essential for manufacturing.

Alabama Sales Tax Exemption Certificate for Non-profits

Nonprofit organizations in Alabama that qualify for sales tax exemptions must obtain a Certificate of Exemption. This certificate allows nonprofits to purchase items without paying sales tax, provided these items are used in their exempt functions.

The application for this certificate, such as the ST: EX-A1 for general exemptions or ST: EX-A1-SE for statutorily exempt entities, is available on the Alabama Department of Revenue’s website.

How to Apply and Get an Alabama Sales Tax Certificate of Exemption or Resale License

To obtain or apply for an Alabama sales tax exemption certificate, follow these steps:

- Visit the Alabama Department of Revenue website: https://www.revenue.alabama.gov/

- Identify the Appropriate Form: Determine which form applies to your entity. For example, use ST: EX-A1 for general exemptions (wholesalers, manufacturers) and ST: EX-A1-SE for statutory exemptions (nonprofits, government entities).

- Complete the Application: Download and fill out the form with accurate details about your organization and the nature of the purchases.

- Provide required information: Include your business name, address, social security number (for sole proprietorships) or federal identification number (for corporations or LLCs), picture identification (for sole proprietorships), IRS-issued letter verifying Federal Identification Number (for corporations or LLCs), and other relevant details.

- Submit the Application Form: Submit the completed form to the Alabama Department of Revenue. The ST: EX-A1 form should be mailed to the appropriate Taxpayer Service Center, while the ST: EX-A1-SE can be emailed or mailed to the Sales and Use Tax Division’s Exemption Unit.

- Approval Process: Once submitted, the Department of Revenue will review your application. Upon approval, you will receive the exemption certificate which can be used for tax-free purchases.

Is an Alabama Seller’s Permit the Same as an Alabama Tax Exempt Certificate?

No, an Alabama seller’s permit is not the same as a tax exempt certificate. A seller’s permit allows a business to collect and remit sales tax on taxable sales within the state. In contrast, a tax exempt certificate permits the purchaser to buy goods without paying sales tax, typically for resale or other exempt purposes.

To obtain a resale certificate, a business must first apply for a seller’s permit, which provides a sales tax ID number used in the resale certificate application process.

How to Verify Alabama Sales Tax Exemption Certificate

To verify an Alabama sales tax exemption certificate, businesses must ensure the certificate is valid and not expired. Verification can be done through the Alabama Department of Revenue’s website or by contacting the department directly.

This step is important to avoid liability for uncollected taxes if the certificate is found to be invalid.

Do You Have to Renew Your Seller’s Permit in Alabama?

In Alabama, seller’s permits do not typically require renewal. However, businesses must keep their information up to date with the Alabama Department of Revenue. Any significant changes, such as a change in business structure or location, should be reported to ensure continued compliance.

What is the Sales Tax Exemption for Farming in Alabama?

Alabama provides specific sales tax exemptions aimed at reducing costs for farmers and agricultural producers. These exemptions cover various essential items used in agricultural operations. Here’s a detailed explanation of what is included and how farmers can benefit from these exemptions:

Items Covered by the Exemption

- Seeds: Seeds purchased for planting purposes are exempt from sales tax. This helps farmers reduce the initial cost of crop production.

- Fertilizers: Fertilizers used to enhance soil fertility and crop yields are exempt from sales tax, making it more affordable for farmers to maintain productive fields.

- Insecticides: Products used to control pests that can damage crops are also exempt. This is crucial for protecting agricultural produce and ensuring quality.

- Livestock Feed: Feed for livestock, including grain and other nutritional supplements, is exempt from sales tax, supporting livestock farming and reducing operational costs.

What is an Alabama Resale Certificate?

An Alabama resale certificate, also known as a reseller’s permit or tax exemption certificate, allows businesses to purchase goods tax-free if they intend to resell them. This certificate ensures that sales tax is only collected at the final point of sale to the end consumer. To obtain a resale certificate, a business must first secure a seller’s permit.

How Much Does an Alabama Resale Permit Cost?

Obtaining an Alabama resale permit, or seller’s permit, is generally free. However, there may be a small fee for processing or filing depending on the service provider used to submit the application.

How Long Does it Take to Get an Alabama Resale License?

Typically, it takes 3-5 business days to receive an Alabama sales tax permit or account number after applying online through My Alabama Taxes (MAT). A physical license will be mailed to you separately – the processing time can be longer due to the additional steps of postal delivery and manual handling by the ADOR. Expect this method to take several days to a few weeks, depending on postal service speed and ADOR’s workload.

How Do I Get a Resale License Number in Alabama? (Application)

The process to get a resale license number in Alabama which is also known as certificate of exemption is the same , follow these steps:

How to Verify an Alabama Sales Tax Resale Certificate

To verify an Alabama sales tax resale certificate, follow these steps:

- Log in to My Alabama Taxes: Access the Alabama Department of Revenue’s online portal.

- Locate Account ID: Find the account ID associated with your tax account.

- Click “Verify Account Number”: This option is usually found under the “I want to” menu.

- Enter Required Information: Provide the necessary details to confirm the certificate’s validity.

Section 3: Understanding Sales Tax Rates in Alabama

In this section, we explored the base state sales tax rate and how local jurisdictions contribute to varying overall rates. We explained how to determine specific tax rates for any location in Alabama using readily available tools, how to calculate sales tax on purchases and identify areas with the highest tax burdens. Finally, we provided a comprehensive table of county-by-county breakdown of sales tax rates, including their corresponding zip codes in Alabama.

What is Alabama Sales Tax Rate?

The state of Alabama imposes a base sales tax rate of 4% while the average combined sales tax rate is approximately 9.11%.The local governments (cities and counties) levy additional sales taxes, resulting in varying total sales tax rates from 4% to as high as 12.5% across the state.

How to Find or Lookup Your Alabama Sales Tax Rate

You can determine the specific sales tax rate for any location in Alabama by using this online tool – Alabama sales tax rate lookup tool

How to Calculate Alabama Sales Tax Rate

To calculate the sales tax for a purchase in Alabama, follow these steps:

- Determine the Total Sales Tax Rate: Identify the combined state and local sales tax rate for the specific location. This can be done using the tools mentioned above.

- Apply the Rate to the Purchase Amount: Multiply the total sales tax rate by the purchase price of the taxable item.

- For example, if the combined tax rate is 9% and the purchase amount is $100, the sales tax would be $100 x 0.09 = $9.

- Add the Sales Tax to the Purchase Price: Add the calculated sales tax to the original purchase amount to get the total cost.

What City Has the Highest Sales Tax Rate in Alabama?

Shelby County, with some cities within it, has one of the highest combined sales tax rates in Alabama, reaching up to 12%. Other cities with high sales tax rates include Birmingham, Mobile, and Montgomery, where the rates can be around 10%.

Alabama Sales Tax Rate by County and Zip Codes

There are 67 counties in Alabama. Each county in Alabama can impose its own sales tax rate, which is added to the state rate. The table below shows the sales tax rate by county along with the zip codes of each state:

| County Name | Tax Rate | Primary Zip Codes |

| Autauga County | 10% | 36067, 36066, 36008 |

| Baldwin County | 11% | 36535, 36532, 36542 |

| Barbour County | 9.5% | 36027, 36016, 36311 |

| Bibb County | 10% | 35034, 35184, 35188 |

| Blount County | 12% | 35079, 35121, 35133 |

| Bullock County | 10% | 36089, 36061, 36034 |

| Butler County | 10% | 36037, 36033, 36015 |

| Calhoun County | 10% | 36201, 36203, 36207 |

| Chambers County | 10% | 36854, 36863, 36850 |

| Cherokee County | 10% | 35960, 36275, 35983 |

| Chilton County | 11% | 35045, 35046, 35085 |

| Choctaw County | 10% | 36904, 36925, 36908 |

| Clarke County | 10% | 36545, 36784, 36524 |

| Clay County | 9.5% | 36251, 36266, 36255 |

| Cleburne County | 9% | 36264, 36269, 36273 |

| Coffee County | 10% | 36330, 36323, 36316 |

| Colbert County | 10% | 35674, 35661, 35660 |

| Conecuh County | 10% | 36401, 36432, 36441 |

| Coosa County | 10% | 35089, 35136, 35183 |

| Covington County | 10% | 36420, 36421, 36467 |

| Crenshaw County | 10% | 36049, 36009, 36047 |

| Cullman County | 10% | 35055, 35057, 35058 |

| Dale County | 10% | 36322, 36350, 36360 |

| Dallas County | 10% | 36701, 36703, 36767 |

| Dekalb County | 11.5% | 35967, 35968, 35961 |

| Elmore County | 10.5% | 36092, 36054, 36024 |

| Escambia County | 11% | 36426, 36441, 36445 |

| Etowah County | 12% | 35901, 35903, 35904 |

| Fayette County | 9.5% | 35555, 35546, 35542 |

| Franklin County | 10% | 35653, 35654, 35582 |

| Geneva County | 9.5% | 36340, 36344, 36477 |

| Greene County | 10% | 35462, 35443, 35464 |

| Hale County | 10% | 36732, 36744, 35441 |

| Henry County | 10% | 36310, 36345, 36353 |

| Houston County | 10% | 36301, 36303, 36305 |

| Jackson County | 9% | 35768, 35769, 35740 |

| Jefferson County | 10% | 35203, 35209, 35210 |

| Lamar County | 9.5% | 35574, 35570, 35559 |

| Lauderdale County | 9.5% | 35630, 35633, 35634 |

| Lawrence County | 10% | 35650, 35672, 35643 |

| Lee County | 10% | 36830, 36832, 36804 |

| Limestone County | 10.5% | 35611, 35756, 35613 |

| Lowndes County | 10.5% | 36040, 36752, 36775 |

| Macon County | 11.5% | 36083, 36039, 36075 |

| Madison County | 10.5% | 35801, 35758, 35806 |

| Marengo County | 10% | 36732, 36736, 36782 |

| Marion County | 11% | 35570, 35563, 35541 |

| Marshall County | 12.5% | 35950, 35951, 35957 |

| Mobile County | 10% | 36602, 36603, 36604 |

| Monroe County | 10% | 36460, 36471, 36445 |

| Montgomery County | 10% | 36104, 36106, 36109 |

| Morgan County | 9% | 35601, 35603, 35640 |

| Perry County | 10% | 36756, 36745, 36775 |

| Pickens County | 10% | 35442, 35447, 35461 |

| Pike County | 10% | 36081, 36079, 36082 |

| Randolph County | 10% | 36274, 36278, 36276 |

| Russell County | 9.75% | 36867, 36875, 36869 |

| Shelby County | 12% | 35124, 35007, 35114 |

| St Clair County | 10% | 35125, 35120, 35173 |

| Sumter County | 11% | 35470, 35460, 35464 |

| Talladega County | 10% | 35160, 35161, 35014 |

| Tallapoosa County | 10% | 35010, 36861, 36850 |

| Tuscaloosa County | 10% | 35401, 35404, 35405 |

| Walker County | 10% | 35501, 35503, 35504 |

| Washington County | 10% | 36558, 36569, 36548 |

| Wilcox County | 11% | 36768, 36726, 36722 |

| Winston County | 10% | 35565, 35541, 35548 |

Section 4: Registering for Sales Tax Permits in Alabama

Overview: This section outlines the process of obtaining an Alabama Sales Tax Permit, a mandatory license for businesses collecting sales tax in the state. It covers key points like:

- What is an Alabama Sales Tax Permit and its purpose.

- Eligibility for a Sales Tax Permit: Who needs one and why.

- Cost of Obtaining a Permit: Explains that the permit itself is free, with potential for related costs.

- Steps to Register: A detailed guide on online and offline registration with required information.

- Approval Process and Issuance: Explains processing times and how you receive your permit.

- Sales Tax ID vs. Permit: Clarifies the difference and how the ID is obtained.

- Sales Tax on Out-of-State Purchases: Explains when out-of-state businesses need to collect Alabama sales tax.

What is an Alabama Sales Tax Permit

An Alabama Sales Tax Permit is a required license for businesses operating within the state that collect sales tax on tangible goods and certain services.It allows businesses to collect and remit sales tax to the Alabama Department of Revenue. Obtaining a permit is typically free and can be done online through the Alabama Department of Revenue website.

Do You Need a Sales Tax Permit in Alabama?

Yes, you do, if you sell tangible personal property within the state, collect sales tax from customers, have a physical presence in Alabama (storefront, employees, inventory), or engage in economic activity that creates nexus (online sales, affiliate marketing)

Both in-state and out-of-state businesses that meet these criteria are required to register and collect Alabama sales tax.

How Much Does it Cost to Get an Alabama Seller’s Permit?

Obtaining a seller’s permit in Alabama is free. There are no charges for applying for the permit itself. However, businesses may incur other related costs, such as business registration fees or costs associated with obtaining a federal tax ID (EIN) if they don’t already have one.

How to Register for Sales Tax License in Alabama

To register for sales tax in Alabama, you need to follow these steps:

- Gather Necessary Information: Before starting the application process, ensure you have the following details:

- Federal tax ID (EIN)

- Personal identification (SSN, address)

- Business entity type (e.g., LLC, corporation)

- Business start date in Alabama

- NAICS code for your business activity

- Estimated annual tax liability in Alabama.

- Online Registration:

- Visit the Alabama Department of Revenue’s My Alabama Taxes (MAT) portal.

- Create an account if you don’t already have one.

- Select “Obtain a New Tax Account Number” to start the application.

- Complete the application form with the gathered information and submit it.

- Offline Registration:

- Download the sales tax permit application form from the Alabama Department of Revenue website.

- Complete the form and mail it to the Department of Revenue. The processing time for mailed applications may be longer compared to online submissions.

- Approval Process:

- After submission, the approval process typically takes 3-5 business days if applied online, and 2-4 weeks if applied offline.

- Once approved, you will receive your sales tax permit and account number via mail.

How to Get a Sales Tax ID in Alabama?

The sales tax ID, also known as the sales tax permit number, is issued once you complete the registration process described above. This ID is essential for reporting and remitting sales tax collected from customers. It must be displayed at your business location and used on all tax-related correspondence with the Alabama Department of Revenue.

Does Alabama Sales Tax Apply to Out-of-State Purchases?

Alabama sales tax applies to out-of-state purchases if the seller has nexus in Alabama. This includes physical presence or economic nexus (exceeding $250,000 in sales to Alabama customers). Out-of-state sellers meeting these criteria must collect and remit Alabama sales tax on taxable sales to customers in the state.

Section 5: Setting Up Your Online Store, Recordkeeping, and Calculating Sales Tax in Alabama

In this section, we delve into the intricacies of calculating sales tax, considering both state and local rates. Additionally, we explore the specific sales tax implications for eBay sellers, including how the platform handles tax calculations and collections. To round out the section, we offer guidance on calculating sales tax for car purchases in Alabama, outlining the relevant tax rates and steps involved.

How Do I Calculate Sales Tax in Alabama?

To calculate sales tax in Alabama, you need to consider both the state and local sales tax rates. Alabama has a base state sales tax rate of 4%, and local governments can levy additional sales taxes, which vary by location.

Here’s how you can calculate it:

- Determine the Total Sales Tax Rate: Find the combined state and local sales tax rate for the location where the sale occurs. This can range from 4% to 11% depending on the locality.

- Apply the Rate to the Purchase Amount: Multiply the total sales tax rate by the purchase price of the taxable item. For example, if the total tax rate is 8% and the purchase amount is $100, the sales tax would be $100 x 0.08 = $8.

- Add the Sales Tax to the Purchase Price: Add the calculated sales tax to the original purchase amount to get the total cost.

What is the sales tax on eBay in Alabama?

eBay collects a flat 8% sales tax on taxable items shipped to Alabama. This is known as Simplified Sellers Use Tax (SSUT). The collected tax is remitted to the Alabama Department of Revenue

Note: While Alabama doesn’t issue sales tax licenses to remote businesses, eBay is considered a market facilitator and is responsible for collecting and remitting the ta

eBay Sales Tax Alabama Calculator

For eBay sellers, the platform automatically calculates and collects sales tax based on the buyer’s location. eBay uses its internal tax engine to determine the correct rate by considering both state and local sales taxes. Sellers don’t need to manually calculate sales tax, as eBay handles the entire process. However, understanding the rates can help you set your pricing accurately.

How to Calculate Sales Tax on a Car in Alabama

To calculating sales tax on a car purchase in Alabama, follow the following steps:

- State Sales Tax: Apply the state base rate of 2% for new and used vehicles.

- Local Sales Tax: Add any applicable local taxes, which can vary by county and city. Local rates can add up to several additional percentage points.

- Total Sales Tax: Combine the state and local tax rates to get the total tax rate. Multiply this rate by the car’s purchase price to get the total sales tax due.

For instance, if you buy a car for $20,000 in a location with a combined tax rate of 3%, the sales tax would be $20,000 x 0.03 = $600. You can check the exact rates for your locality using the Alabama Department of Revenue’s resources.

Reverse Sales Tax Calculator Alabama

A reverse sales tax calculator helps you find out the pre-tax amount when you know the total price including tax. This is useful for businesses to determine the original price of goods before tax.

To use a reverse sales tax calculator:

- Enter the Total Price Including Tax: Input the total amount paid.

- Enter the Sales Tax Rate: Input the combined state and local tax rate.

- Calculate: The tool will calculate the original price before tax and the amount of tax paid.

For example, if the total price is $108 and the tax rate is 8%, the reverse calculator will determine that the pre-tax price is $100 and the sales tax is $8.

Read Also: Huntsville Alabama sales tax rate lookup & calculator

Section 6: Charging & Collecting Sales Tax

In this section we covered when and how to charge and collect sales tax, the taxability of various goods and services, distinction between charging and collecting sales tax, the specific conditions under which sales tax must be charged in Alabama, and the step-by-step process of remitting, collecting, and calculating sales tax. Furthermore, we clarified the taxability of labor, shipping, food, and services, providing examples to illustrate the nuances. Finally, we addressed the taxability of rental equipment and delivery charges.

What Does it Mean to Charge Sales Tax vs. Collect Sales Tax?

Charging sales tax involves adding the appropriate tax rate to the sale price of a taxable item or service at the point of sale. This tax is calculated based on the combined state and local tax rates applicable to the buyer’s location.

Collecting sales tax means taking the charged tax from the customer and holding it until it is time to remit it to the state tax authorities. The seller acts as a trustee, collecting tax on behalf of the state and ensuring it is passed on to the revenue department.

When to Charge Sales Tax in Alabama?

In Alabama, sales tax must be charged on all retail sales of tangible personal property and certain services unless a specific exemption applies. This includes sales made in physical stores, online sales to Alabama residents, and sales by out-of-state sellers who have established nexus in Alabama.

How to Charge and Collect Sales Tax in Alabama?

To charge and collect sales tax in Alabama, follow these steps:

- Determine the Total Sales Tax Rate: Combine the state base rate of 4% with any applicable local tax rates. Local rates vary, so use tools like the Alabama Department of Revenue’s website to find the exact rate for the buyer’s location.

- Add Sales Tax to the Sale Price: When making a sale, calculate the sales tax based on the total sales tax rate and add it to the sale price.

- Collect Sales Tax at the Point of Sale: Whether selling in a physical store or online, ensure the sales tax is collected from the customer at the time of purchase.

- Remit Collected Taxes: Regularly remit the collected sales taxes to the Alabama Department of Revenue. This can be done monthly, quarterly, or annually, depending on your assigned filing frequency. Ensure you use the My Alabama Taxes (MAT) system for electronic filing and remittance.

Does Alabama Collect Sales Tax on Out-of-State Sales?

Yes, Alabama requires out-of-state sellers to collect and remit sales tax if they have nexus in the state. This includes sellers with a physical presence in Alabama and those who exceed the economic nexus threshold of $250,000 in annual sales to Alabama customers.

These sellers must register for a sales tax permit, collect the appropriate sales tax on taxable sales to Alabama residents, and remit it to the Alabama Department of Revenue.

Do Contractors Charge Sales Tax on Labor in Alabama?

In Alabama, the taxability of labor depends on the nature of the service provided:

- Labor to Repair or Install: Labor charges for repairing or installing tangible personal property are exempt from sales tax, provided these charges are separately stated on the customer’s invoice.

- Labor to Fabricate: Labor charges for fabricating tangible personal property are taxable. This includes any work done to create or produce an item from raw materials or components.

- Contractor’s Gross Receipts Tax: Contractors are subject to a separate gross receipts tax on their work. This tax applies to the total receipts from construction contracts but does not apply to labor separately billed for repairs or installations.

Does Alabama Charge Sales Tax on Shipping?

Alabama generally charges sales tax on shipping costs. So, if the shipping charges are included in the sale price of the goods, then the shipping charges are subject to sales tax but If the shipping is done through a common carrier (like UPS, FedEx, or USPS) and the shipping charges are listed separately on the invoice, they are not subject to sales tax and if the seller delivers the goods using their own vehicle,

In Alabama, the taxability of shipping charges depends on how the delivery is made and how the charges are listed on the invoice

Does Alabama Charge Sales Tax on Services?

Generally, Alabama does not impose sales tax on most service-based transactions. This includes professional services, advertising, and cleaning services. However, if a service is directly tied to the creation or fabrication of a tangible item that is sold, the labor charges for that service can be subject to sales tax.

For example, labor to manufacture a product that will be sold is taxable.

Does Alabama Charge Sales Tax on Food?

Alabama charges a state sales tax on food, but the rate is decreasing. Alabama is in the process of reducing its sales tax on food. As of September 1, 2023, the state sales tax on most food items dropped from 4% to 3%. However, some food products are still subject to the full 4% state sales tax. The tax reduction applies to foods that qualify for the federal Supplemental Nutrition Assistance Program (SNAP)

Do Photographers Charge Sales Tax in Alabama?

Photographers in Alabama generally do not charge sales tax on photography services. However, they may collect sales tax on tangible products like prints, albums, or digital downloads.

- Photography services (e.g., sitting fees, consultations) are exempt from sales tax if clearly itemized.

- Tangible products (e.g., prints, albums, digital downloads) are subject to sales tax

Does Amazon Charge Sales Tax in Alabama?

Yes, Amazon charges sales tax in Alabama. Alabama has implemented a Simplified Sellers Use Tax (SSUT) program, which allows eligible sellers, including Amazon, to collect a flat 8% sales tax on all sales made within the state. This tax is remitted to the Alabama Department of Revenue

Does eBay Charge Sales Tax in Alabama?

Yes, eBay charges sales tax on behalf of sellers for purchases made by buyers in Alabama. This is due to the marketplace facilitator laws, which require eBay to collect and remit sales tax for transactions in states where such laws are enacted, including Alabama.

eBay uses its internal tax engine to calculate the appropriate sales tax based on the buyer’s shipping address and adds it to the total purchase amount at checkout.

Does Wayfair Charge Sales Tax in Alabama?

Yes, Wayfair charges sales tax in Alabama. Following the U.S. Supreme Court’s Wayfair decision, online retailers like Wayfair are required to collect sales tax from customers in states where they have economic nexus, even without a physical presence. Alabama adopted this economic nexus standard, meaning Wayfair must collect sales tax on orders shipped to Alabama address

Wayfair complies with Alabama’s economic nexus law, which mandates sales tax collection if the seller exceeds $250,000 in sales or has 200 or more transactions in the state.

The sales tax is automatically calculated and added to the purchase price during the checkout process, ensuring that buyers pay the correct amount of tax based on their location.

Do You Charge Sales Tax on Rental Equipment in Alabama?

Rental equipment in Alabama is generally subject to sales tax. The tax applies to the rental or lease of tangible personal property. The applicable sales tax rate includes both the state base rate of 4% and any local sales taxes. Businesses renting out equipment must collect sales tax from the customer at the time of the rental and remit it to the Alabama Department of Revenue.

Can You Charge Sales Tax on Delivery in Alabama?

In Alabama, the taxability of delivery charges depends on the nature of the shipping and how the charges are presented on the invoice:

- Separately Stated Shipping Charges: If the shipping charges are separately stated on the invoice and the delivery is performed by a common carrier or the U.S. Postal Service, these charges are generally not subject to sales tax.

- Combined with Sale Price: If the shipping charges are included in the sale price or the delivery is made using the seller’s own vehicles, the entire amount (including the shipping charges) is subject to sales tax.

Do Restaurants Charge Sales Tax in Alabama?

Restaurants in Alabama must charge sales tax on the sale of food and beverages. This includes both dine-in and take-out orders. The applicable sales tax rate includes the state base rate of 4% plus any local taxes. The total tax rate can vary depending on the location of the restaurant. For instance, in some areas, the combined state and local tax rate can be as high as 10% or more.

Section 7: Reporting, Paying, Filing & Remitting Sales Tax Returns

In this section, we explained the difference between reporting, paying, filing, and remitting sales tax.explore who is responsible for paying sales tax, where and how to make payments, and the deadlines for filing and remitting sales tax returns. We will also address common questions about sales tax, such as whether wholesalers and individuals buying homes or leasing cars owe sales tax.

What is Sales Tax Reporting vs. Payment vs. Filing vs. Remittance?

Sales Tax Reporting

This involves documenting and declaring the total sales, taxable sales, and sales tax collected within a reporting period. The report is typically submitted to the tax authorities.

Sales Tax Payment

This is the actual transfer of the collected sales tax funds from the seller to the state tax authority. It involves making a payment for the sales tax amount that was reported.

Sales Tax Filing

Filing is the process of submitting the completed sales tax return form to the tax authority. It includes providing detailed information about sales and the corresponding sales tax collected during the reporting period.

Sales Tax Remittance

Remittance is the act of sending the collected sales tax funds to the tax authority. This usually occurs simultaneously with filing the return and making the payment.

Who Pays Sales Tax in Alabama?

In Alabama, the responsibility to pay sales tax falls on the retailer. The retailer collects the tax from the consumer at the point of sale and then remits it to the Alabama Department of Revenue. All businesses making retail sales of tangible personal property or taxable services are required to collect and remit sales tax.

Where Do I Pay Alabama Sales Tax?

Sales tax payments in Alabama are made through the Alabama Department of Revenue’s My Alabama Taxes (MAT) portal. This online system allows businesses to file their returns and make payments electronically. Payments can also be made via Electronic Funds Transfer (EFT) for larger businesses or those preferring this method.

How to Pay Sales Tax in Alabama

Paying sales tax in Alabama involves several steps to ensure compliance and avoid penalties.

Methods of Payment

- Electronic Payments: The most convenient method is through the My Alabama Taxes (MAT) portal, where you can quickly process your payment online.

- Bank Transfers: Direct transfers from your bank account can be set up for paying your sales tax.

- Credit Card Payments: You can use your credit card for payments through the MAT portal.

- Mailing Checks: For those who prefer traditional methods, you can mail a check to the Alabama Department of Revenue.

Ensure the payment is scheduled by the due date to avoid penalties.

Submission Process:

- Log into the MAT Portal: Access the portal using your business credentials.

- Enter Payment Information: Fill in the required details, including the amount owed.

- Select Payment Method: Choose whether to pay electronically, via bank transfer, credit card, or by mailing a check.

- Complete the Transaction: Follow the prompts to finalize your payment.

How to File Sales and Use Tax in Alabama

Filing sales and use tax in Alabama involves a clear understanding of the requirements, gathering necessary information, and utilizing the My Alabama Taxes (MAT) portal.

- Sales Tax: This tax is collected by businesses on sales of goods and services to customers within Alabama.

- Use Tax: This tax is applicable on goods purchased out-of-state but used, stored, or consumed in Alabama.

To file sales and use tax in Alabama, follow these steps:

- Access the My Alabama Taxes (MAT) Portal: Visit My Alabama Taxes.

- Log In: Use your username and password. If you don’t have an account, you’ll need to create one.

- Navigate to the Sales Tax Account: Select the appropriate account from the dashboard.

- Complete the Return: Enter gross sales, taxable sales, and any deductions. The system will calculate the tax due.

- Submit and Pay: Review the information, submit the return, and proceed with the electronic payment. Ensure payments are scheduled by the due date.

What is the Deadline to Pay Sales Taxes in Alabama? (Sales Tax Due Dates, and Deadlines)

The sales tax deadline to pay sales taxes in Alabama is the 20th of the month following the reporting period. This means that if you collected sales tax in January, the payment and filing are due by February 20th. It is crucial to adhere to these sales tax due dates to avoid penalties and interest charges.

Filing Frequencies

- Monthly Filing: Required for businesses with high sales volumes. Taxes collected each month must be reported and paid by the 20th of the following month.

- Quarterly Filing: For businesses with moderate sales volumes. Quarterly returns are due on the 20th of the month following the end of the quarter (April 20th, July 20th, October 20th, and January 20th).

- Annual Filing: For businesses with lower sales volumes. Annual returns are due on January 20th of the following year.

Adjustments to the Sales Tax Deadline

If the sales tax deadline falls on a weekend or holiday, the due date is extended to the next business day. Ensuring payments are scheduled and submitted on time is essential to avoid any late fees or penalties.

Do Wholesalers Pay Sales Tax in Alabama?

Wholesalers typically do not pay sales tax on goods purchased for resale. They must provide a resale certificate to their suppliers to avoid paying sales tax. However, wholesalers are responsible for collecting and remitting sales tax when they sell to end consumers.

Do You Pay Sales Tax on a Leased Car in Alabama?

Yes, sales tax applies to leased vehicles in Alabama. The tax is typically applied to the monthly lease payments and any upfront costs associated with the lease. The applicable rate includes both the state base rate and any local sales taxes.

Do You Pay Sales Tax When You Buy a House in Alabama?

No, sales tax does not apply to the purchase of real estate in Alabama. However, there may be other taxes and fees associated with real estate transactions, such as recording fees and property taxes, but these are not classified as sales taxes.

Section 8: Sales Tax Holidays and Refunds in Alabama

This section explores the various aspects of sales tax refunds and holidays in Alabama. We delve into the eligibility for sales tax refunds, including whether foreigners can claim them, and outline the process for claiming a refund. Additionally, we provide an overview of Alabama’s sales tax holidays, their purpose, and the items typically exempt during these periods

Does Alabama Do Sales Tax Refunds?

Alabama offers sales tax refunds. A sales tax refund in Alabama allows taxpayers to recover overpaid sales taxes. This typically applies to situations where too much sales tax was charged on a purchase or when a sale was exempt but the tax was still collected.

To claim a refund, the taxpayer must file a petition for refund with the Alabama Department of Revenue. The petition should be submitted within three years from the date the return was filed or two years from the date of payment, whichever is later.

Does Alabama Refund Sales Tax to Foreigners?

Alabama does not typically refund sales tax to foreigners. Sales tax refunds are generally reserved for overpaid taxes by residents or businesses operating within the state. Foreigners who purchase goods in Alabama are subject to the same sales tax rules as residents and are not eligible for refunds under normal circumstances.

Is it Illegal Not to Refund Sales Tax in Alabama?

It is not illegal for businesses to collect sales tax; however, it is required by law to refund overpaid taxes when a valid claim is submitted and approved. The Alabama Department of Revenue has processes in place to ensure that overpaid taxes are returned to taxpayers who submit proper documentation and meet the criteria for a refund.

How to Claim Sales Tax Refund in Alabama?

To claim a sales tax refund in Alabama, follow these steps:

- File a Petition for Refund: Complete the appropriate form, such as the ST-5 or ST-6, available on the Alabama Department of Revenue website.

- Submit Documentation: Provide supporting documentation, such as proof of the overpayment and details of the transactions in question.

- Submit the Petition: Send the completed form and documentation to the Alabama Department of Revenue either electronically via the My Alabama Taxes (MAT) portal or by mail.

- Await Processing: The department will review the claim and notify you of the decision. Processing times can vary, so check the status periodically through the MAT portal.

Does Alabama Give Sales Tax Holiday?

Alabama offers sales tax holidays.

A sales tax holiday is a temporary period during which certain items can be purchased tax-free. Alabama typically has two main sales tax holidays:

- Back-to-School Sales Tax Holiday: Usually held in July, this holiday exempts items such as school supplies, clothing, and computers from sales tax.

- Severe Weather Preparedness Sales Tax Holiday: Typically held in February, this holiday exempts items like batteries, weather radios, and generators from sales tax.

These holidays are designed to provide tax relief to consumers and encourage spending on necessary items during specific periods.

Section 9: Sales Tax Audits and Penalties in Alabama

This section delves into the potential consequences of non-compliance with Alabama sales tax regulations. We explore the penalties associated with late tax payments, the audit process including common triggers, and the potential penalties resulting from an audit.

Additionally, we provide information on the possibility of obtaining a sales tax penalty waiver.

What is the Penalty for Paying Sales Tax Late in Alabama?

In Alabama, penalties for late payment of sales tax are significant.

If you fail to file or pay your sales tax by the due date, you will be subject to a penalty of 10% of the tax due or $50, whichever is greater.

Additionally, interest accrues on any unpaid tax from the original due date until the payment is received. This interest rate is determined annually by the Alabama Department of Revenue.

Does Alabama Do Sales Tax Audits?

Alabama conducts sales tax audits to ensure compliance with state tax laws. The Alabama Department of Revenue regularly audits businesses to verify that the correct amount of sales tax is being collected and remitted. These audits can be triggered randomly or due to specific factors that may raise red flags during routine reviews of tax returns.

What Triggers a Sales Tax Audit in Alabama?

Several factors can trigger a sales tax audit in Alabama, including:

- Inconsistent Filing: Frequent discrepancies or inconsistencies in sales tax returns.

- High Sales Volume: Businesses with high sales volumes or significant increases in sales.

- Industry Norms: Variances from industry norms or benchmarks.

- Customer Complaints: Reports or complaints from customers about sales tax practices.

- Non-compliance: Previous history of non-compliance or late payments.

What is the Penalty for an Audit After the Due Date in Alabama?

If an audit reveals unpaid sales tax after the due date, the penalties can be substantial. The penalty for failing to file a tax return on time is 10% of the tax due or $50, whichever is greater.

If the tax is not paid by the due date, an additional penalty of 10% of the tax due is imposed. Interest also accrues on the unpaid amount from the original due date until the tax is fully paid.

What is Alabama Sales Tax Penalty Waiver?

The Alabama Department of Revenue may grant a waiver for sales tax penalties under specific circumstances. To request a waiver, you must demonstrate that the failure to file or pay on time was due to reasonable cause and not willful neglect.

Common reasons for granting a waiver include natural disasters, serious illness, or other extraordinary circumstances. To apply for a waiver, you must submit a formal request to the Department of Revenue, providing detailed documentation to support your claim.

Section 10: Alabama Sales Tax Software

Simplify Your Sales Tax Compliance with AtomicTax

AtomicTax offers an automated solution for managing sales tax compliance, specifically designed to meet the needs of e-commerce businesses. Here’s how AtomicTax can help you streamline your sales tax processes:

- Automated Sales Tax Management

Accurate Calculation: AtomicTax automates the accurate calculation of sales tax across multiple jurisdictions, ensuring compliance with both state and local tax rates.

Nexus Monitoring: The software proactively monitors your sales tax nexus in real-time, providing instant alerts and insights on when and where you need to collect and remit sales tax. This feature helps prevent unexpected compliance issues and penalties.

Audit-Ready Records: Maintain comprehensive, organized, and audit-ready records to ease the anxiety of tax audits. AtomicTax ensures that all your sales tax data is accurate and up-to-date with real-time data synchronization.

- Easy Integration

Effortlessly connect your software with popular e-commerce platforms like Shopify, QuickBooks, and more. This reduces the hassle of manual data entry and minimizes the risk of errors through automated data synchronization.

- Robust Reporting and Filing

Detailed Reporting: Generate detailed sales tax reports for each jurisdiction. This aids in better decision-making and ensures that you have a comprehensive view of your sales tax obligations.

Automated Filing: Automate the filing of sales tax returns to the states you’re registered in, reducing the burden on your team and minimizing the risk of costly reporting errors and penalties.

- State Sales Tax Registration

Receive expert support throughout the registration process to ensure full compliance with state-specific registration requirements. Quick multi-jurisdiction sales tax setup saves time and resources while expanding your business presence.

- Customization and Flexibility

Choose which data points and functions to integrate, giving you full control over your sales tax processes.

- Real-Time Monitoring and Alerts

Receive alerts about upcoming reporting deadlines and potential compliance issues, helping you stay ahead and avoid penalties.

- 24/7 Support

Access 24/7 customer support and detailed technical documentation to assist you with any issues or questions you may have.

Streamline Your Sales Tax Management Today

Take the stress out of sales tax compliance with AtomicTax. Our automated sales tax calculations, reporting, and filings will save you time and reduce errors. Simplify your business operations and focus on growth with the peace of mind that comes from knowing your sales tax management is handled accurately and efficiently.

Start your free trial today and experience the AtomicTax difference. Visit the AtomicTax eCommerce Sales Tax Software now and streamline your sales tax management effortlessly.

Wrapping Up!

Managing sales tax compliance is essential for your business, but it can be complex and time-consuming. By understanding the key aspects such as charging and collecting sales tax, meeting deadlines, and staying compliant with state regulations, you can streamline your processes and avoid costly penalties.

Using efficient tools, like AtomicTax eCommerce Sales Tax Software, you can automate and streamline your sales tax processes, ensuring accurate calculations, timely reporting, and full compliance with all regulations.

This powerful tool not only saves you time and reduces errors but also frees you up to focus on what truly matters—growing your business. Embrace the convenience and efficiency of AtomicTax, and transform sales tax management from a tedious task into a seamless, effortless process.