Navigating Ohio’s resale certificate process is essential for businesses aiming to purchase goods tax-free for resale. This guide simplifies obtaining and verifying an Ohio resale certificate, ensuring compliance with state regulations.

As an online seller or e-commerce store owner who serves customers in the US, you may have to deal with sales tax in some states. Ohio is one of the states that obliges online sellers to collect sales tax from their customers. In this blog post, we will show you what an Ohio resale certificate is, how to obtain one, how to use it correctly, and how it can benefit you.

What is an Ohio Certificate of Resale or Reseller License?

An Ohio Certificate of Resale (also called a Sales and Use Tax Blanket Exemption Certificate) is not a license, but a document that allows businesses to buy goods tax-free for resale in Ohio, as long as you intend to resell them to your customers.

By showing this certificate to sellers, you avoid paying sales tax upfront on merchandise you’ll eventually sell to your customers.

Lastly, an Ohio certificate of resale is sometimes also known as a reseller license, reseller permit, or tax exemption certificate.

How Does an Ohio Resale Certificate Work

An Ohio resale certificate helps businesses avoid paying sales tax on purchases intended for resale. When a qualified business provides a valid resale certificate (Form STEC) to their supplier, the supplier doesn’t charge sales tax. This saves the business money upfront, but the sales tax is eventually collected when the item is sold to the end consumer.

For example, if you buy a book from a wholesaler for $10 and resell it to a customer for $15, you don’t have to pay sales tax on the $10 purchase, but you have to collect and remit sales tax on the $15 sale.

However, an Ohio resale certificate does not exempt you from paying sales tax on purchases of items that you use for your own personal or business purposes, such as office supplies, equipment, or software. You also cannot use an Ohio resale certificate to buy items that are not subject to sales tax in Ohio, such as food, clothing, or prescription drugs.

What is the Ohio Resale Certificate Number or Reseller Tax ID

There isn’t a separate Ohio Resale Certificate Number. Instead, businesses in Ohio use their Ohio Vendor’s License number to act as their resale certificate.

This vendor’s license allows qualified businesses to purchase goods for resale without paying sales tax upfront.

Is an Ohio Seller’s Tax Permit the Same as an Ohio Resale Certificate

No, an Ohio Seller’s Permit (Vendor’s License) and an Ohio Resale Certificate are not the same. Here’s the difference:

- Seller’s Permit (Vendor’s License): Allows you to collect and remit sales tax on taxable sales to customers in Ohio.

- Resale Certificate: Allows you to buy goods tax-free for resale later. You provide this certificate to the seller to exempt the purchase from sales tax.

You need both an Ohio sales tax permit and an Ohio resale certificate to be compliant with Ohio sales tax laws. You can apply for both documents at the same time, or separately, depending on your situation.

Is the Ohio Resale Exemption Certificate the Same as an Ohio Resale License

No, an Ohio resale exemption certificate is not the same as an Ohio resale license. A resale exemption certificate is a document that allows you to avoid paying sales tax on purchases you intend to resell. You provide it to the seller to claim the exemption. Ohio doesn’t require registration to obtain one, while for a resale license: Ohio doesn’t issue resale licenses. If you collect sales tax in Ohio, you’ll need a vendor’s license to register for a sales tax permit.

Who Needs an Ohio Resale Certificate

Businesses that buy products to resell them in Ohio typically need an Ohio Resale Certificate. This certificate, formally called the Ohio Sales and Use Tax Blanket Exemption Certificate, exempts them from paying sales tax on those purchases. It’s important to note that Ohio doesn’t require businesses to register for the certificate itself but to have it on hand when buying for resale.

Why Do You Need a Certificate of Resale in Ohio

You need a certificate of resale in Ohio to avoid paying sales tax twice: once when you buy the goods, and again when you sell them. By presenting a valid Ohio resale certificate to your supplier, you can claim exemption from sales tax on your purchases for resale, and only pay sales tax when you sell the goods to your customers.

You also need a certificate of resale in Ohio to comply with Ohio sales tax laws and avoid penalties and interest. If you fail to provide a valid Ohio resale certificate to your supplier, you may have to pay sales tax on your purchases for resale, and you may not be able to claim a refund or credit later. If you provide a false or fraudulent Ohio resale certificate to your supplier, you may face civil or criminal charges.

What Information is on an Ohio Resale Certificate

The information on the Ohio resale certificate includes; your name and address, your Ohio resale certificate number or reseller tax ID, your Ohio sales tax permit number, if applicable, the name and address of your supplier, a description of the goods or services that you are buying for resale, a statement that you are buying the goods or services for resale in the regular course of your business, and your signature and date.

How to Get a Resale Certificate in Ohio (Steps)

Ohio doesn’t require registration for a resale certificate, you don’t need to register with the state to get one. Ohio’s resale certificate is the Sales and Use Blanket Exemption Certificate (STEC B). Simply download the (STEC B form, fill it out with your business information, and present it to your suppliers when making tax-exempt purchases for resale.

How Long Does it Take to Get an Ohio Reseller’s License?

In Ohio, getting a reseller’s license generally takes about 2 to 4 weeks. You can obtain it immediately by applying online through the Ohio Business Gateway. However, you’ll need to create an account on the Gateway first. There’s also the option to apply in person at your county auditor’s office.

However, the processing times may vary slightly for in-person applications because of the volume of applications, the method of application, and the accuracy of the information provided.

You can check the status of your application online through the Ohio Business Gateway, or by calling the Ohio Department of Taxation at 1-888-405-4039.

How much is a reseller’s permit in Ohio

In Ohio, the cost of a reseller’s permit (also known as a vendor’s license) is $25 for in-state businesses with a physical location in Ohio and Free for out-of-state sellers who are considered “remote sellers” and have sales tax nexus in Ohio.

How to Fill Out an Ohio Resale Certificate

To fill out an Ohio resale certificate, you’ll need:

- Business information: Name, address, phone number

- Tax ID: Ohio sales tax license number (if applicable)

- Resale Purpose: Briefly describe how you’ll resell the items

- Vendor details: Name and address of the seller you’re buying from

- Retail sales: Indicate if you also sell at retail (not for resale)

- Signature and title: Authorized representative’s signature and title

There are two forms:

- STEC-U: One-time purchase

- STEC-B: Blanket certificate for ongoing purchases

Find the forms and instructions on the Ohio Department of Taxation website.

How to Use an Ohio Resale Certificate

To use an Ohio resale certificate, you need to:

- Obtain the right form: Choose either a single-use certificate (STEC-U) or a blanket certificate (STEC-B) for ongoing purchases from the same vendor.

- Fill out the form: Include your business name, address, vendor license number (if applicable), and signature.

- Present it to the seller: Do this at the time of purchase to avoid paying sales tax.

How Long Is an Ohio Resale Certificate Good For

Ohio resale certificates don’t technically expire. However, the information on the certificate needs to be accurate for it to remain valid. This means if your business name, address, or permit number changes, you’ll need to obtain a new certificate. It’s also good practice to renew your resale certificate every few years to ensure you have the most up-to-date information on file.

How to Verify an Ohio Resale Certificate

Ohio doesn’t offer online resale certificate verification. However, you can check the validity of a resale certificate by searching the Ohio Department of Taxation’s “List of Active Vendors.” This downloadable spreadsheet contains businesses with active vendor licenses, allowing them to purchase tax-exempt.

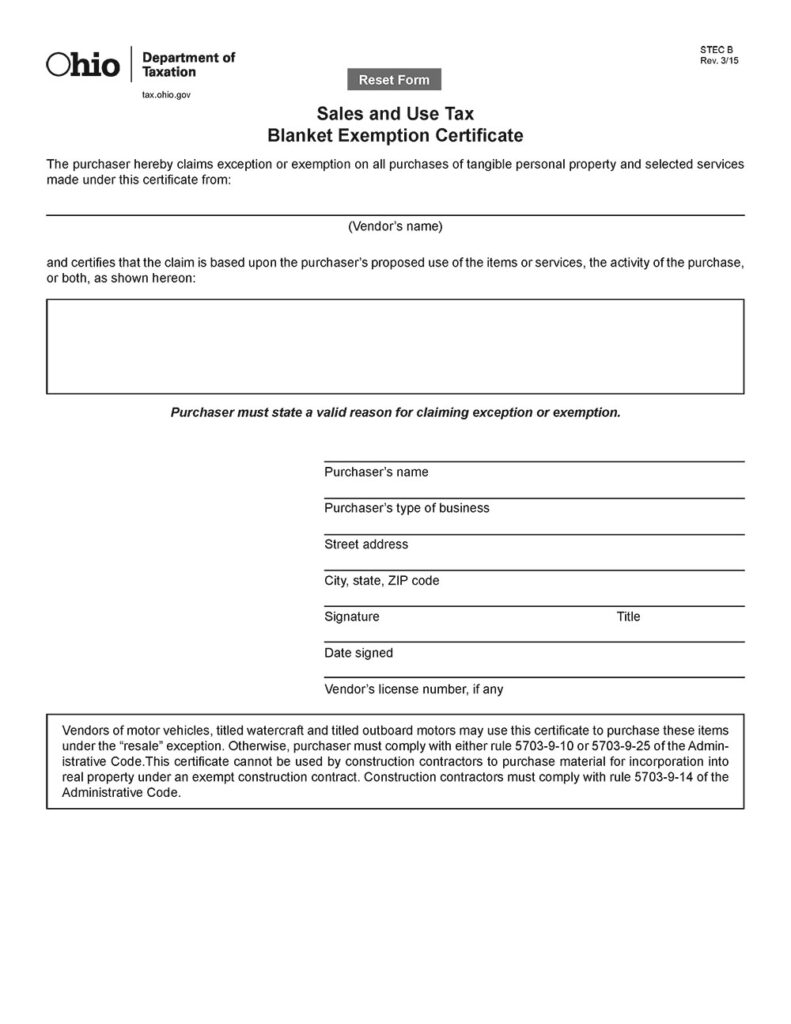

What Does an Ohio Resale Certificate or Form Look Like and What is the Information on it

An Ohio resale certificate typically includes:

- Purchaser’s information: Business name, address, and Ohio sales tax license number.

- Vendor information: Name and address of the seller you’re buying from (optional).

- Reason for exemption: Indicate “resale” as the reason for not paying sales tax.

- Signature and title: An authorized representative of your business must sign and date the certificate.

This form verifies you’re a qualified reseller who will resell the purchased items, exempting you from paying sales tax upfront.

Here’s how a typical Ohio resale certificate or form looks

Do Ohio Resale Certificates Expire

No, Ohio resale certificates (Form STEC B) do not expire. This means you can continue using the same certificate as long as the business information on it remains accurate. However, it’s good practice to keep your certificate updated if your business name, address, or permit number changes.

How Often Do I Need to Renew My Ohio Resale Certificate

You do not need to renew your Ohio resale certificate, as long as you are in business and making purchases for resale in the regular course of your business. However, you may need to update your Ohio resale certificate if any of your information changes, such as your name, address, or business structure. You may also need to renew your Ohio sales tax permit and your Ohio seller permit, if applicable, every year.

Does Ohio Accept Out-of-State Resale Certificates

Yes, Ohio accepts the Uniform Sales and Use Tax Certificate issued by the Multistate Tax Commission (MTC) for purchases you plan to resell. This simplifies things for online sellers who operate across multiple states. However, Ohio may require you to register for a state sales tax permit if you have other reasons for economic nexus in the state, like storing inventory there.

Are Ohio Resale Certificates Good in Other States

No, an Ohio resale certificate is generally not valid for purchases in other states. Each state has its own rules for sales tax and resale certificates. While some states accept out-of-state certificates, others require you to register for a seller’s permit in their state to get a resale certificate.

Do All Sellers Accept Ohio Resale Certificates

No, not all sellers accept Ohio resale certificates. While Ohio accepts valid resale certificates to exempt sales tax on purchases for resale, sellers are not obligated to accept them. They may have concerns about certificate validity or prefer to collect tax and let the buyer claim a refund.

Ohio Resale Certificate Lookup

Unfortunately, Ohio doesn’t offer an online resale certificate lookup tool. However, you can verify a vendor’s resale certificate using the Ohio Department of Taxation’s list of active vendors. This downloadable spreadsheet includes businesses with valid sales tax permits.

Conclusion

An Ohio resale certificate is a document that allows you to buy goods from a supplier without paying sales tax, as long as you intend to resell them to your customers. You need an Ohio resale certificate if you are a person or business that makes purchases of tangible personal property or selected services for resale in the regular course of your business. You also need an Ohio sales tax permit and an Ohio seller permit, if applicable, to be compliant with Ohio sales tax laws.

To get an Ohio resale certificate, you need to register for an Ohio sales tax permit, if you don’t have one already, and apply for an Ohio resale certificate, if you don’t already have one. You can do both online through the Ohio Business Gateway, or by filling out and mailing the relevant forms. You will receive your Ohio resale certificate by mail or email, depending on how you applied.

To use an Ohio resale certificate, you need to present it to your supplier when you make purchases for resale and provide your Ohio resale certificate number or reseller tax ID, your Ohio sales tax permit number, and your Ohio seller permit number, if applicable. You also need to collect and remit sales tax from your customers when you sell the goods or services that you bought for resale unless they are exempt from sales tax in Ohio.

An Ohio resale certificate is good for as long as you are in business and making purchases for resale in the regular course of your business. However, you may need to update your Ohio resale certificate if any of your information changes, such as your name, address, or business structure. You may also need to renew your Ohio sales tax permit and your Ohio seller permit, if applicable, every year.