Understanding the varying sales tax rates across New York’s counties is crucial for both consumers and businesses. These rates can significantly impact purchasing decisions and compliance requirements. This guide provides a comprehensive overview of New York’s county-specific sales tax rates, ensuring you’re well-informed and compliant with state regulations.

How do you apply for a resale certificate in California?

If you are a small business owner who sells online to customers in the US or have an e-commerce store and sell to customers in the US, you may need to know about resale certificates. Resale certificates are documents that allow you to buy products from wholesalers or distributors without paying sales tax, as long as you intend to resell them in your business. In this blog post, we will explain what a resale certificate is, how it works, how to get one in California, and how to use it properly.

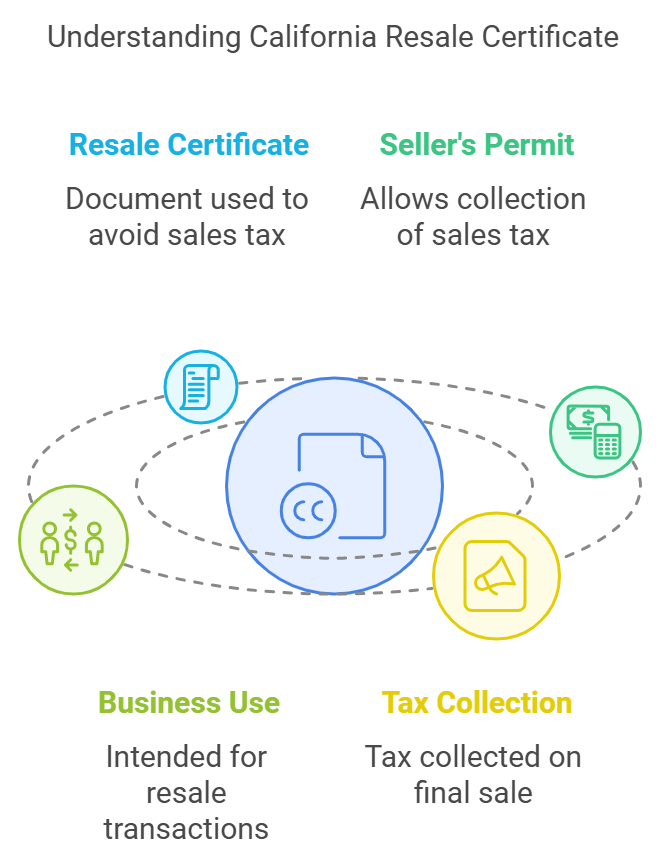

What is a California Resale Certificate or Reseller Permit

A California resale certificate is a document, not a permit, used by businesses to avoid paying sales tax on purchases intended for resale. It’s different from a seller’s permit, which allows you to collect sales tax from your customers.

Businesses with a valid seller’s permit can provide this certificate to their suppliers during checkout. This exempts the purchase from sales tax since the tax will be collected when the item is eventually sold to the final consumer.

Is California Seller’s Permit the same as a California Resale Certificate

No, a California Seller’s Permit and a California Resale Certificate are different. A seller’s permit is issued by the state and allows you to collect sales tax on taxable sales. You’ll need this if you make retail sales in California. On the other hand, a resale certificate, which is provided by you to your supplier, exempts you from paying sales tax on purchases you intend to resell. You’ll need a seller’s permit to issue resale certificates.

Another difference is that a seller permit is valid for as long as you are in business, while a resale certificate is valid only for a specific transaction. You need to issue a new resale certificate for each purchase that you make from your supplier. You also need to update your resale certificate if any of the information on it changes, such as your name, address, or seller’s permit number.

How Does a California Resale Certificate Work

A California resale certificate works as follows: When a business registered (sellers) with the California Franchise Tax Board (FTB), buy items for resale, they provide a resale certificate to their supplier. This exempts the purchase from sales tax. The seller then collects sales tax when they finally sell the item to the end customer. Remember, resale certificates are only for legitimate purchases intended for resale.

Who needs a California resale certificate

California resale certificates are for businesses that buy tangible personal property to resell in their regular course of business. This allows them to delay paying sales tax until they eventually sell the item to a customer. To use a resale certificate, you’ll typically need a seller’s permit from the California Department of Tax and Fee Administration (CDTFA).

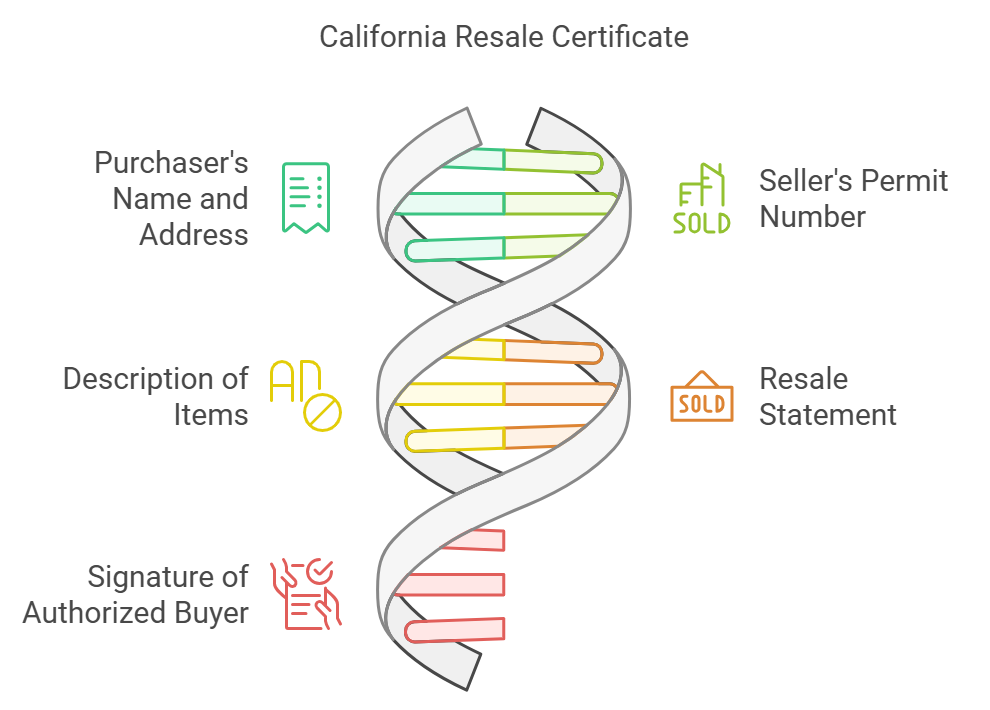

What information is on a California Resale Certificate

A California resale certificate usually includes:

- Purchaser’s name and address

- Seller’s permit number (if applicable)

- Description of items being purchased for resale

- Statement confirming the purchase is for resale

- Signature of authorized buyer

This document helps California businesses avoid paying sales tax on items they’ll resell, ultimately collecting tax when they sell the item themselves.

You can use any form of resale certificate, as long as it contains the above information. However, the CDTFA provides a blank resale certificate that you can download and print from their website.

What is a California Resale Certificate Number or Reseller Tax ID

A California resale certificate number or reseller tax ID is the same as your seller’s permit number. It is a unique number that identifies you asselleristered seller in California. You need to have a seller’s permit number before you can issue a resale certificate to your supplier. You can apply for a seller’s permit online at the CDTFA website or in person at a local CDTFA office.

California Seller Permit vs Resale Certificate

The main difference between a California seller permit and a resale certificate is that a seller permit is a license that you need to obtain from the CDTFA before you start selling products in California, while a resale certificate is a form that you fill out and give to your supplier when you buy products for resale. A seller permit allows you to collect and remit sales tax from your customers, while a resale certificate allows you to buy products without paying sales tax to your supplier.

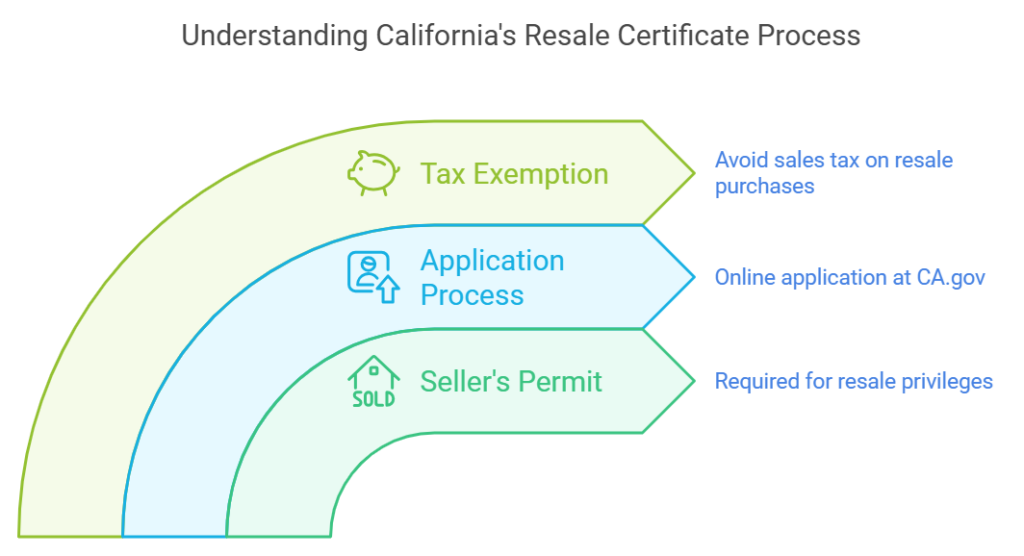

Why Do You Need a Certificate of Resale in California

California resale certificates help businesses avoid paying sales tax upfront on purchases they intend to resell. This saves you money on the initial purchase, and you’ll only collect sales tax when you sell the final product to your customer.

How to Get (Apply for) a Resale Certificate in California

California doesn’t issue resale certificates directly. Businesses need a Seller’s Permit to obtain resale privileges. You can apply for a California seller’s permit online for free at CA.gov. With a valid permit, you can then present your permit number to sellers to avoid paying sales tax on purchases intended for resale.

How Long Does it Take to Get a California Resale License

In California, processing a seller’s permit application (also known as a resale license) typically takes around 2 weeks. This timeframe applies to online applications submitted through the California Department of Tax and Fee Administration (CDTFA). Expedited processing options may be available for an additional fee.

How Much Does a California Resale Permit Cost

Obtaining a California resale permit itself is free. as it is not a separate license or registration. It is simply a form that you fill out and give to your supplier when you buy products for resale. However, the California Department of Tax and Fee Administration (CDTFA) may require a security deposit to cover potential future sales tax liabilities

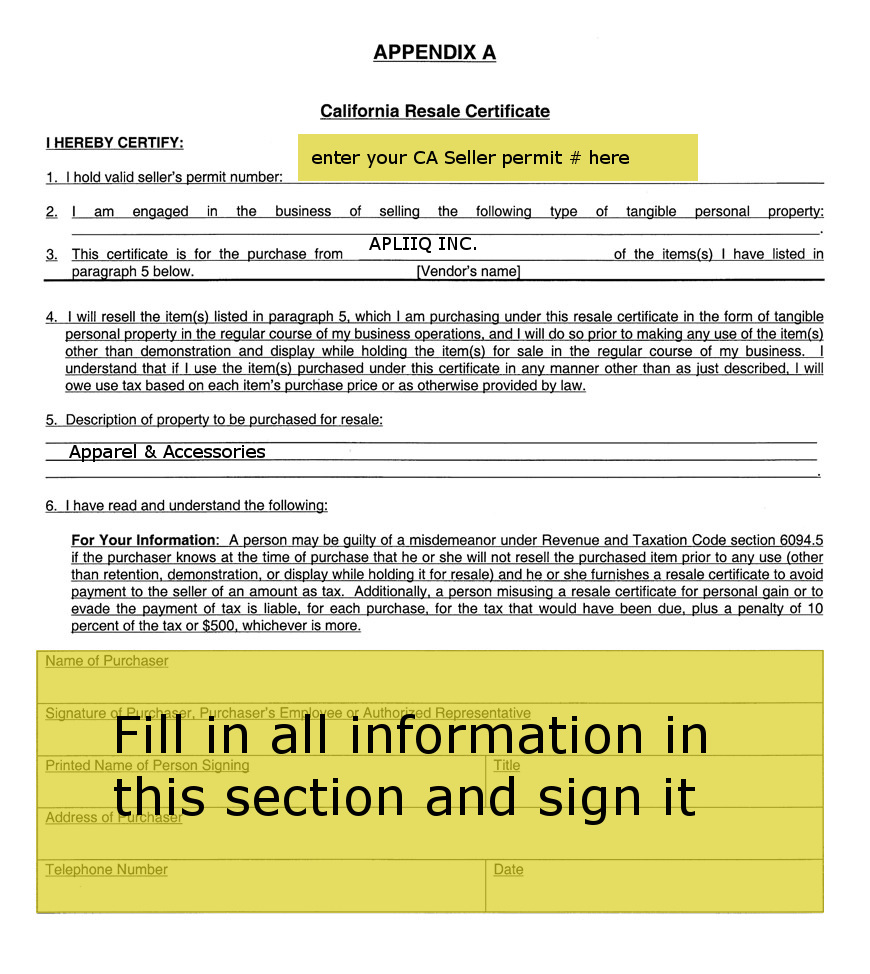

How to Fill Out a California Resale Certificate

To fill out a California Resale Certificate, you’ll need:

- Seller’s permit number: Your unique ID for collecting sales tax.

- Business description: Briefly describe what you resell.

- Item description: List the specific products you’re buying for resale.

- Resale statement: Confirm you’ll resell the items and collect sales tax.

- Signature and information: Sign and include your business name, address, and date.

California accepts resale certificates in any format, but this ensures all necessary details are included.

How to Use a California Resale Certificate (Permit)

To use a California resale certificate, you need to follow these guidelines:

- Only use a resale certificate when you buy products for resale, not for your own use or consumption.

- Only use a resale certificate when you buy products that are subject to sales tax, not products that are exempt from sales tax, such as food, medicine, or services.

- Only use a resale certificate when you buy products from a supplier who is located in California or who is registered to collect California sales tax.

- Only use a resale certificate that is valid and accurate. Do not use a resale certificate that is expired, revoked, suspended, or falsified.

- Only use a resale certificate that matches your seller’s permit number and business name. Do not use a resale certificate that belongs to someone else or that has a different name or number.

- Give the resale certificate to your supplier when you place your order or when you pick up your products. Keep a copy of the resale certificate for your records, and make sure that your supplier does not charge you sales tax on your purchases.

- Resell the products to your customers and collect and remit sales tax to the CDTFA. Report your sales and tax payments on your sales and use tax return, which you can file online at the CDTFA website or by mail.

How Long is a California Resale Certificate Good For

California resale certificates don’t expire! They remain valid until revoked by the CDTFA (California Department of Tax and Fee Administration) in writing. However, it’s good practice to keep your seller’s permit number up-to-date and provide updated certificates to vendors every few years.

How to Verify a California Resale Certificate

To verify a California resale certificate quickly online, simply enter the California Department of Tax and Fee Administration (CDTFA) website, search for “Verify a Permit, License or Account,” and choose “Seller Permit” to enter the seller’s permit number. This free tool lets you confirm if the permit is valid and in good standing.

Below are other key things to take note of when you want to verify the validity of the resale certificate

- The name and address of the purchaser match the name and address on their seller’s permit.

- The purchaser’s seller’s permit number is valid and active. You can verify the seller’s permit number online at the CDTFA website or by calling the CDTFA at 1-800-400-7115.

- The description of the property to be purchased for resale matches the type of products that you sell.

- The resale certificate is signed and dated by the purchaser or their authorized representative.

What Does a California Resale Certificate or Form Look Like

A California resale certificate or form can look like any document that contains the required information, such as the

- Name and address of the purchaser

- Purchaser’s seller’s permit number

- Description of the products to be purchased for resale

- A statement that the products are being purchased for resale

- Date of the document,

- Signature of the purchaser or their authorized representative.

Do California Resale Certificates Expire

No, California resale certificates do not expire, as long as you are in business and your seller’s permit is valid. However, you need to issue a new resale certificate for each purchase that you make from your supplier. You also need to update your resale certificate if any of the information on it changes, such as your name, address, or seller’s permit number.

How Often Do I Need to Renew My California Resale Certificate

You do not need to renew your California resale certificate, as it is not a separate license or registration. However, you need to issue a new resale certificate for each purchase that you make from your supplier. You also need to update your resale certificate if any of the information on it changes, such as your name, address, or seller’s permit number.

Does California Accept Out-of-State Resale Certificates

Yes, California accepts out-of-state resale certificates from customers who are registered sellers in other states, as long as the resale certificate contains the required information and the products are being purchased for resale. However, California does not accept out-of-state resale certificates from customers who are not registered sellers in any state, or who are buying products for their own use or consumption.

What license do I need to buy wholesale in California

California doesn’t require a specific “wholesale license” to buy wholesale. You’ll need a Seller’s Permit issued by the California Department of Tax and Fee Administration (CDTFA). This permit allows you to collect and remit sales tax when you sell taxable items at retail. It also enables you to issue resale certificates to wholesalers, exempting you from paying sales tax on inventory you plan to resell.

Are California Resale Certificates Good in Other States

No, California resale certificates are not good in other states, as each state has its own rules and regulations regarding sales tax and resale certificates. If you are a California seller who wants to buy products for resale from a supplier in another state, you need to obtain and use a resale certificate from that state, if applicable. You also need to comply with the sales tax laws of that state, such as registering as a seller, collecting and remitting sales tax, and filing sales and use tax returns.

Do All Sellers Accept California Resale Certificates?

No, not all sellers accept California resale certificates, as some sellers may have their own policies or preferences regarding sales tax and resale certificates. For example, some sellers may require you to provide additional information or documentation, such as a copy of your seller’s permit or a letter of authorization. Some sellers may also charge you sales tax on your purchases, even if you give them a resale certificate, and then refund you the sales tax later, after verifying your resale certificate. Therefore, it is important to check with your supplier before you make a purchase, and to keep a record of your transactions and communications.

Conclusion

Resale certificates are important documents that allow you to buy products from wholesalers or distributors without paying sales tax, as long as you intend to resell them in your business. In this blog post, we explained what a resale certificate is, how it works, how to get one in California, and how to use it properly. We hope that this blog post has helped you understand the basics of resale certificates and how they can benefit your business.

Need help navigating New York’s complex sales tax landscape? Contact us today to ensure your business remains compliant and optimized for success.