Illinois boasts one of the highest combined state and local sales tax rates in the United States. This means that shoppers in the state, especially those in Chicago and Cook County, often pay more in taxes than their counterparts in other states. This can significantly impact consumer spending habits and business operations.

To navigate this complex tax landscape, it’s essential to understand Illinois’s state sales tax laws and regulations. This guide provides you with valuable information on determining if you need a sales tax permit, identifying taxable items, and ensuring compliance with Illinois’ tax requirements. So, whether you’re a local business owner, an online seller, or simply curious about the state’s tax policies, this resource will help you make informed decisions and avoid costly mistakes.

Section 1: Determining Sales Tax Nexus in Illinois

This section explains how to determine if your business needs to collect sales tax in Illinois. We outline the criteria for establishing sales tax nexus, including economic and physical presence thresholds. Additionally, we provide guidance on complying with Illinois sales tax regulations once nexus is determined.

What is Illinois Sales Tax?

Illinois has a state sales tax rate of 6.25%. However, the actual rate you’ll pay can vary depending on your location, as many counties and municipalities also impose additional local sales taxes.

For example, in Chicago, the combined state and local sales tax rate is typically around 10.25%.

It’s important to note that certain items, such as groceries and prescription medications, may be exempt from sales tax in Illinois.

To find the exact sales tax rate for a specific location, you can use online tax calculators or contact the Illinois Department of Revenue.

Do You Need a Sales Tax Permit to Sell Online in or to Illinois?

Yes, you generally need a sales tax permit to sell online in or to Illinois if you meet certain criteria. This includes having a physical presence in the state, such as a warehouse or office, or exceeding economic nexus thresholds. These thresholds are typically based on annual sales volume (over $100,000 annually) or transaction numbers (more than 200 transactions annually).

To obtain a sales tax permit, register with the Illinois Department of Revenue. You’ll need to provide necessary documentation and determine the appropriate tax rates for your products or services. Once you have the permit, you’ll be required to collect sales tax from your customers and remit it to the department according to the established deadlines.

Thus, to determine if you need this permit, you’ll first need to assess whether your business has a sales tax nexus in Illinois.

What Triggers or Creates a Sales Tax Nexus in Illinois?

A sales tax nexus in Illinois is established or triggered when a business has a sufficient physical or economic presence within the state. This can occur or be triggered by various factors, such as:.

Key Triggers for Sales Tax Nexus:

Physical Presence: Maintaining a physical location, such as a store, office, or warehouse, in Illinois can create a nexus.

Employees: Additionally, having employees physically present in the state, even if they work remotely, can establish a nexus.

Inventory: Storing inventory in Illinois, even temporarily, or using a third-party to drop-ship products from the state can trigger a nexus.

Affiliated Nexus: : If your business is affiliated with another entity that has a nexus in Illinois (through ownership, control, or common management), you may also be subject to a nexus.

Economic Nexus: Businesses that generate more than $100,000 in gross revenue from sales to Illinois customers or perform more than 200 transactions in Illinois within a year may have an economic nexus.

Click-and- Mortar Nexus: Selling products or services online to Illinois customers may create a nexus if the business has a physical presence in the state or meets the economic nexus threshold. Additionally, allowing customers to order online and pick up purchases at a physical location in Illinois can trigger a nexus.

A sales tax nexus in Illinois is a connection that requires a business to collect and remit sales tax on sales made to Illinois customers.

What is Illinois Sales Tax Economic Nexus Threshold?

Generally, Illinois has an economic nexus threshold of over $100,000 in annual sales or more than 200 transactions in a calendar year. This means that businesses making more than $100,000 in annual sales within Illinois or 200 transactions in the state during a calendar year are generally subject to the economic nexus law.

Illinois’ Economic Nexus Threshold is the minimum amount of sales activity a business must have within the state before it is required to collect and remit Illinois sales tax. This threshold is set to ensure that businesses with a significant economic presence in Illinois contribute to the local economy through tax revenue.

Out-of-state businesses that meet the economic nexus threshold, known as remote sellers, must register with the Illinois Department of Revenue and collect and remit sales tax on their Illinois sales. Online marketplaces that facilitate sales by third-party sellers may also be subject to economic nexus laws, depending on the volume of sales they facilitate within Illinois.

Illinois Sales Tax Nexus Requirements

Illinois has implemented economic nexus laws that determine when out-of-state businesses must collect and remit sales tax. Prior to the Wayfair decision, a physical presence was necessary. However, Illinois now requires businesses to collect sales tax if their sales within the state exceed $100,000 in gross revenue or 200 separate transactions in a 12-month period. This ensures a more equitable tax burden for all businesses, regardless of their physical location.

Illinois Sales Tax Nexus Calculator

To help businesses determine whether they meet the economic nexus thresholds, Illinois provides tools like sales tax calculators and nexus assessment tools. These calculators allow you to input your sales data and transaction count to see if you’ve crossed the threshold that requires you to collect sales tax.

Tools such as the Atomic Tax Calculator offer precise calculations based on the location-specific tax rates within Illinois, ensuring that you apply the correct rate when calculating sales tax. These calculators use geolocation technology to provide accurate rates by considering the specific address where a sale is made, which is crucial given that local tax rates can vary significantly within the state.

Section 2: Understanding Illinois Sales Taxability Exemptions and Resale Certificates in Illinois

Illinois exemption certificates are required for businesses and non-profits to make tax-free purchases in the state. This guide explains the differences between resale and exemption certificates, outlines taxable and exempt items, and provides information on certificate validity, required details, and how to obtain one. We also address common misconceptions about out-of-state sellers and eligibility criteria for nonprofit tax exemptions.

Who is Exempt from Sales Tax in Illinois?

In Illinois, certain organizations and transactions qualify for sales tax exemptions, allowing them to make purchases without paying the state’s standard sales tax.

- Charitable, Religious, and Educational Organizations: Organizations that are registered as non-profits and operate exclusively for charitable, religious, or educational purposes are generally exempt from sales tax. This includes churches, non-profit educational institutions, and recognized charities.

- Government Bodies: Federal, state, and local government entities are exempt from paying sales tax on purchases made for official use. This exemption helps reduce the operational costs of government activities.

- Certain Non-Profit Organizations: Specific non-profit organizations, such as licensed day care centers, senior citizen groups, and organizations dedicated to arts and culture, can also qualify for sales tax exemptions in Illinois.

- Hospitals and Medical Institutions: Non-profit hospitals and nursing homes that serve charitable purposes are exempt from sales tax when purchasing items necessary for patient care, such as food and medicine. However, these exemptions do not extend to items like candy, gum, and tobacco products, which are considered non-essential.

- Sales for Resale: Illinois also exempts sales of tangible personal property (TPP) when the item is purchased for resale, either in its current form or as part of a manufactured product. This exemption helps businesses avoid double taxation on goods that will ultimately be taxed when sold to the final consumer.

These exemptions are designed to ensure that certain critical services and organizations can operate without the additional financial burden of sales tax.

However, it’s important for qualifying organizations to apply for an exemption number (E-number) through the Illinois Department of Revenue to take advantage of these benefits.

What is an Illinois Sales Tax Exemption Certificate?

A sales tax exemption certificate in Illinois is a document that allows a purchaser to buy goods or services without paying sales tax, provided that the items are for resale or another exempt purpose.

The most commonly used certificate is the “Certificate of Resale” (Form CRT-61), which businesses use when purchasing goods intended for resale. When presenting this certificate to a vendor, the purchaser certifies that the items will be resold, thereby exempting the transaction from sales tax.

The Exemption validity: The vendor is responsible for keeping this certificate on file for their records, and it must be renewed every three years.

How to Obtain an Illinois Sales Tax Exemption Certificate?

The step-by-step application process to apply for and get an Illinois sales tax exemption certificate includes:

- Determine Eligibility:

- Identify qualifying activities: Determine if your business qualifies for sales tax exemptions based on Illinois’ laws. Common exemptions include non-profit organizations, government entities, and certain agricultural or manufacturing activities.

- Review specific requirements: Understand the specific criteria and documentation needed to support your exemption claim.

- Gather Required Documentation:

- Business information: Prepare your business name, address, and tax identification number (EIN).

- Supporting documents: Collect any necessary evidence to prove your eligibility, such as articles of incorporation, nonprofit status, or agricultural production records.

- Complete the Application Form:

- Obtain the form: Visit the Illinois Department of Revenue website or contact them directly to request the appropriate application form.

- Provide accurate information: Carefully fill out the form, ensuring all required fields are completed and accurate.

- Submit the Application:

- Mail or submit electronically: Submit the completed application form and supporting documentation to the Illinois Department of Revenue. Check their website for specific submission instructions.

- Await Approval:

- Processing time: The department will review your application and determine if you qualify for a sales tax exemption. The processing time may vary.

- Receive the Certificate:

- Notification: If approved, you will receive a sales tax exemption certificate from the Illinois Department of Revenue.

Illinois Sales Tax Exemption Rules

Illinois has specific rules governing who can claim sales tax exemptions and how they must document these claims:

- Eligibility: Sales tax exemptions are available to non-profits (charitable, religious, educational), government bodies, and certain medical institutions. These organizations must operate exclusively for their stated purpose and be officially recognized by the state.

- Documentation: Eligible organizations must apply for an exemption number (E-number) through the Illinois Department of Revenue. This number is required to make tax-free purchases.

- Use of Exemptions: Exemptions apply only to purchases made directly for the organization’s exempt activities. Improper use, such as for personal benefit, is prohibited.

- Resale Exemption: Sales of goods intended for resale are exempt from sales tax. Vendors must keep a valid resale certificate on file.

- Compliance: Organizations must renew their exemption status as required and ensure accurate record-keeping to maintain their tax-exempt status.

What Goods Are Taxable in Illinois?

In Illinois, most tangible personal property is subject to the state’s base sales tax rate of 6.25%. This category includes a wide range of products that consumers commonly purchase, such as:

List of Taxable Goods in Illinois:

- Clothing and Apparel: All types of clothing, including shoes and accessories, are taxable at the standard rate.

- Electronics: Items like computers, smartphones, TVs, and other electronic devices are taxed at the full rate.

- Furniture and Home Goods: Furniture, appliances, and home decor items are also subject to sales tax.

- Automobiles: The purchase of cars, trucks, and motorcycles is subject to both the state sales tax and, in many cases, additional local taxes, which can significantly increase the overall tax rate.

List of Non-Taxable Goods in Illinois:

There are also specific goods that are taxed at reduced rates or have exemptions:

- Groceries: While most tangible goods are taxed at 6.25%, groceries are taxed at a reduced rate of 1%. This lower rate applies to food items meant for home consumption but excludes prepared foods, alcohol, and candy.

- Prescription and Over-the-Counter Drugs: Both prescription and over-the-counter medications are taxed at a reduced rate of 1%, making healthcare more affordable for Illinois residents.

- Prepared Food: Any food sold in a ready-to-eat state, such as at restaurants or food trucks, is taxed at a higher rate, typically around 8%, depending on the local tax rate.

What Services Are Taxable in Illinois? (List of Taxable Services in Illinois)

Illinois imposes sales tax on a wide range of services. While the specific list can vary, here are some common services that are typically subject to sales tax:

- Professional Services:

- Accounting

- Legal

- Architectural

- Engineering

- Medical

- Dental

- Veterinary

- Personal training

- Business Services:

- Advertising

- Cleaning

- Printing

- Security

- Storage

- Telecommunications

- Personal Services:

- Hairdressing

- Manicures

- Pedicures

- Massage therapy

- Dry cleaning

- Entertainment Services:

- Movie theaters

- Amusement parks

- Bowling alleys

- Golf courses

- Fitness centers

- Other Services:

- Repair services (e.g., auto, appliance)

- Towing services

- Utility services (e.g., electricity, gas, water)

- Hotel and lodging accommodations

What Is Excluded from Sales Tax in Illinois? (List of Common Non Taxable Items in Illinois)

Certain items and transactions in Illinois are specifically exempt from sales tax, often for reasons related to public policy, health, or economic development:

- Medical Equipment and Supplies: Medical equipment such as wheelchairs, prosthetic devices, and other prescribed medical devices are exempt from sales tax. This exemption helps reduce healthcare costs for individuals who require these essential items.

- Newspapers and Magazines: Publications like newspapers and magazines are exempt from sales tax in Illinois. This exemption is intended to support the free dissemination of information.

- Manufacturing Machinery and Equipment: Machinery and equipment used in manufacturing and assembling goods for resale are often exempt from sales tax. This exemption applies provided that the machinery is directly involved in the production process and meets other specific criteria outlined by Illinois law.

- Transportation: Items like fuel, motor vehicles, and public transportation fares are often exempt.

- Agricultural products: Raw agricultural products used in farming are typically exempt.

- Charitable donations: Donations to qualified charitable organizations are exempt.

- Clothing: Clothing and footwear priced below a certain threshold are generally exempt.

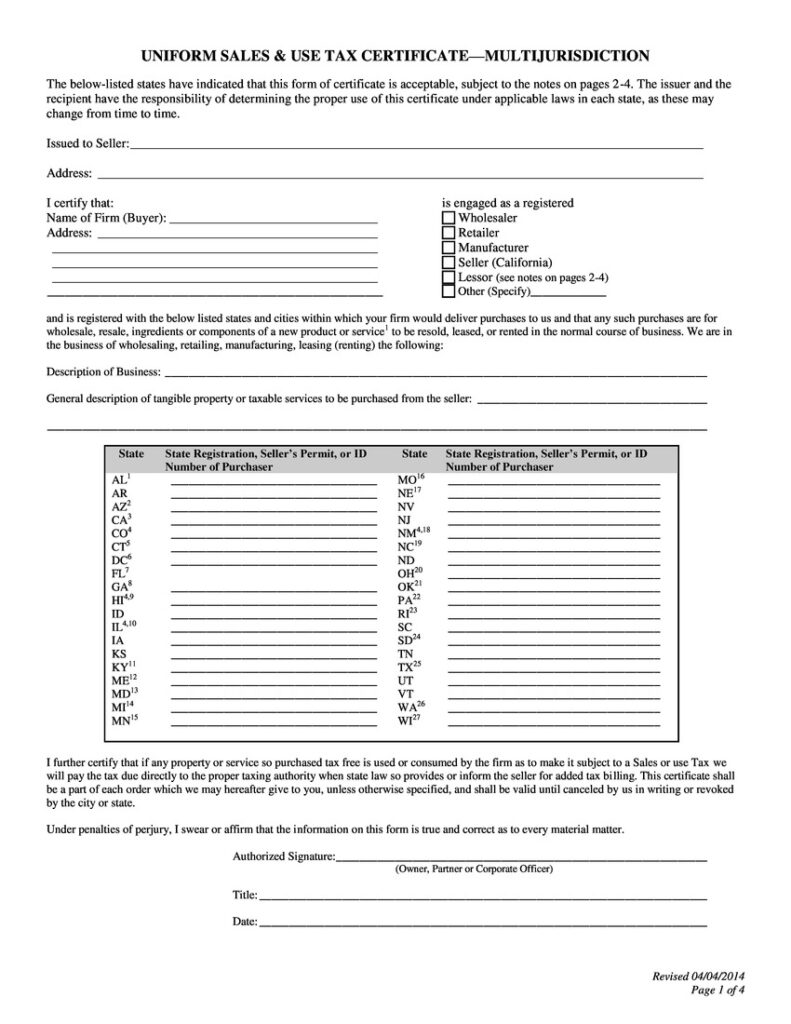

How Does an Illinois Sales Tax Exemption Form Look Like?

In Illinois, the Certificate of Resale (Form CRT-61) is a common sales tax exemption form used by businesses to purchase items tax-free when those items are intended for resale. This form is straightforward and includes several key sections:

- Buyer and Seller Information: The form requires the full legal names, addresses, and contact details of both the buyer and seller. This ensures that both parties are clearly identified for tax records.

- Resale Information: The buyer must include their Illinois resale number, or, if they are an out-of-state purchaser, a comparable number from their home state. This resale number certifies that the buyer is authorized to make tax-exempt purchases for resale purposes.

- Description of Goods: The form requires a description of the items being purchased for resale. This could include product categories or specific items, depending on the nature of the purchase.

- Certification Statement: The buyer must sign a statement certifying that the goods will be resold in the normal course of business and that they understand the legal implications of using the certificate for non-exempt purchases.

- Signature and Date: The form concludes with the buyer’s signature and the date of signing. This finalizes the buyer’s legal commitment to the terms of the certificate.

Here’s an image of how an Illinois Sales Tax Exemption Form looks like

Illinois Sales Tax Exemption Chart PDF

The Illinois Department of Revenue offers various charts and guides that detail which transactions are exempt from sales tax. These charts are particularly useful for businesses and organizations that need to quickly determine whether specific items or services qualify for an exemption.

- Detailed Breakdown: The exemption charts typically categorize items based on their tax status. For example, they may list medical equipment, manufacturing machinery, and certain types of agricultural products that are exempt from sales tax. Each category includes specific criteria that the items must meet to qualify for the exemption.

- Reduced Rates: Some goods, like groceries or prescription medications, are not fully exempt but are taxed at a reduced rate. These charts clearly outline these categories, helping businesses apply the correct tax rate.

- Access and Use: These charts are available as PDFs, making them easy to download and reference. They are updated periodically to reflect changes in tax law, so it’s important for businesses to ensure they are using the most current version.

These charts are accessible through the Illinois Department of Revenue’s website and can be a critical tool in ensuring compliance with state tax regulations.

Out-of-State Sales Tax Exemption in Illinois

If you’re an out-of-state business purchasing goods in Illinois for resale, you can claim an exemption from Illinois sales tax using a Certificate of Resale or a similar form. The process and documentation requirements are similar to those for in-state buyers but with a few additional considerations:

- Out-of-State Certification: An out-of-state purchaser must provide a resale certificate that includes their registration number from their home state. This certificate must demonstrate that the buyer is registered to collect sales tax in another state, thereby allowing them to purchase goods in Illinois without paying sales tax.

- Uniform Sales Tax Exemption Certificates: Illinois is a member of the Streamlined Sales and Use Tax Agreement, which allows the use of uniform sales tax exemption certificates across multiple states. This is particularly useful for businesses operating in several states, as it simplifies the documentation process.

- Renewal and Compliance: Just like in-state buyers, out-of-state businesses must ensure their exemption certificates are up-to-date. Certificates are typically valid for three years, after which they must be renewed. Failure to maintain proper documentation can result in penalties if audited by the Illinois Department of Revenue.

Out-of-state buyers using these certificates must also ensure that the items purchased are indeed for resale and that they comply with both Illinois and their home state’s tax laws.

Illinois Sales Tax Exemption Certificate for Nonprofits

In Illinois, nonprofit organizations that qualify under specific criteria, such as those operating exclusively for charitable, religious, or educational purposes, can apply for a sales tax exemption certificate. This certificate allows them to make purchases without paying sales tax, which can significantly reduce operational costs.

To obtain this exemption, a nonprofit must apply for an E-number (Exemption Number) by submitting Form STAX-1 to the Illinois Department of Revenue. This application process requires supporting documentation, including:

- Articles of Incorporation: These are the official documents that establish the nonprofit’s existence.

- Bylaws: The nonprofit’s bylaws, which outline its operational structure.

- IRS Determination Letter: This letter confirms the organization’s federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

- Financial Statements: The most recent audited financial statement showing the organization’s income and expenses. Religious organizations are typically exempt from submitting financial statements with their initial application.

- Narrative Description: A brief narrative that explains the purposes, functions, and activities of the organization.

- Promotional Materials: Any brochures, pamphlets, or other printed material that describe the organization’s mission and activities.

Once the application is approved, the nonprofit will receive an E-number, which they can use to purchase goods without paying sales tax.

Is an Illinois Seller’s Permit the Same as a Tax-Exempt Certificate?

No, an Illinois seller’s permit is not the same as a tax-exempt certificate. A seller’s permit allows businesses to collect sales tax from customers on taxable sales and remit it to the state. In contrast, a tax-exempt certificate allows eligible organizations, such as nonprofits, to make purchases without paying sales tax.

A business with a seller’s permit is responsible for collecting and remitting sales tax, whereas a nonprofit with a tax-exempt certificate is exempt from paying sales tax on purchases made for their exempt activities. It’s important for nonprofits to understand this distinction to ensure they are properly managing their tax obligations and benefits.

Illinois Sales Tax Exemption for Manufacturing

In Illinois, the sales tax exemption for manufacturing covers a wide range of tangible personal property used in the production process. This includes machinery, equipment, and tools that are primarily used in manufacturing activities.

The exemption also extends to production-related tangible personal property, such as supplies and consumables like fuels, lubricants, and safety equipment. The key criterion is that the property must be used primarily in the manufacturing process within a manufacturing facility. Illinois expanded this exemption in 2019, simplifying the process by eliminating the need for a separate exemption certificate for each qualifying transaction.

Now, manufacturers can complete a single exemption certificate (Form ST-587) to document their eligibility, which must be available for inspection by the Illinois Department of Revenue.

Illinois Sales Tax Exemption Certificate Verification and Renewal

In Illinois, sales tax exemption certificates, including those for manufacturing, must be properly maintained and available for audit by the Illinois Department of Revenue.

For most businesses, including manufacturers, these certificates do not have a fixed expiration date but must be updated if any relevant information changes. It’s essential to review and renew your seller’s permit periodically to ensure ongoing compliance.

Although Illinois does not require sellers to renew their permits annually, keeping your records current and verifying the accuracy of your exemption certificates is crucial to avoid penalties.

Sales Tax Exemption for Farming in Illinois

Illinois provides a sales tax exemption for farming equipment used primarily in production agriculture. This exemption applies to machinery and equipment directly involved in farming activities, such as tractors, combines, and other agricultural implements.

The exemption is meant to reduce the financial burden on farmers, allowing them to purchase essential equipment without incurring sales tax.

To qualify, the equipment must be used primarily (more than 50% of the time) in farming activities. Farmers can use Form ST-587 to claim this exemption, which must be provided to the seller at the time of purchase.

What is an Illinois Resale Certificate?

An Illinois resale certificate, officially known as Form CRT-61, allows businesses to purchase goods tax-free if those goods are intended for resale. When you buy products that you plan to resell, this certificate enables you to avoid paying sales tax at the time of purchase.

Instead, sales tax is collected from the end customer when the product is sold. It’s important to note that a resale certificate should only be used for inventory items meant for resale and not for items used in your business operations, like office supplies.

How Much Does an Illinois Resale Permit Cost?

Obtaining an Illinois resale certificate is free. Once you have registered your business with the Illinois Department of Revenue and received a sales tax account number, you can use this number to complete the resale certificate without any additional cost.

How Long Does It Take to Get an Illinois Resale License?

Generally, it may take anywhere from a few days to a few weeks to receive your resale license. If there are no issues with your application, you can expect a relatively quick turnaround.

The processing time for an Illinois resale license can vary depending on several factors, including the completeness of your application and any additional information required.

To expedite the process, ensure that your application is accurate and complete. Provide all necessary documentation as requested and double-check for any errors.

How Do I Get a Resale License Number in Illinois?

To obtain a resale license number in Illinois, you first need to register your business with the Illinois Department of Revenue (IDOR). Here’s a step-by-step guide:

- Register Your Business: Start by registering your business through the MyTax Illinois portal, which is the state’s online system for managing tax accounts. If you prefer, you can also complete and mail Form REG-1, Illinois Business Registration Application, to the IDOR.

- Receive Your Sales Tax Account Number: After registering, IDOR will issue you a sales tax account number, also known as a tax ID or reseller number. This number is crucial for obtaining your resale certificate.

- Fill Out the Resale Certificate: With your sales tax account number, you can complete the Illinois Certificate of Resale (Form CRT-61). This certificate allows you to purchase goods without paying sales tax, as long as the items are intended for resale.

- Use the Resale Certificate: Once you have your resale certificate, you can present it to suppliers when making tax-exempt purchases. Make sure to keep a copy for your records.

The entire process of registering your business and obtaining a resale license number can take one to two days if done online, or up to 6-8 weeks if you mail your application.

How to Verify an Illinois Sales Tax Resale Certificate?

Verifying an Illinois resale certificate is crucial for ensuring that the buyer’s exemption claim is legitimate. Here’s how you can do it:

- Access MyTax Illinois: Go to the MyTax Illinois website, which provides a tool to verify registered businesses and their resale numbers.

- Enter the Required Information: Input the purchaser’s Illinois account ID or resale number into the verification tool. The system will check the validity of the certificate and confirm whether it is active.

- Review the Certificate Details: Ensure that the information provided on the certificate, such as the purchaser’s business name and address, matches the records.

- Maintain Proper Records: As a seller, it’s your responsibility to keep a copy of the verified resale certificate in your records. This documentation is essential in case of an audit by the IDOR.

This process helps protect your business from liability if the certificate is later found to be invalid.

Section 3: Understanding Sales Tax Rates in Illinois

Illinois imposes a state sales tax of 2.9%. However, local jurisdictions often add additional taxes, resulting in varying rates across the state. To calculate the total sales tax for a specific item or location, you can use online tax calculators or consult local government websites.

This guide provides detailed information on Illinois’s sales tax, including county-by-county breakdowns, exemptions, and other important considerations. Whether you’re a business owner or a consumer, understanding sales tax is essential for accurate financial planning and compliance.

What is the Illinois Sales Tax Rate?

Illinois has a base state sales tax rate of 6.25%, while the combined sales tax rate in Illinois can range from 6.25% to as high as 11.5%. Dpending on where you are in the state, this rate can increase significantly due to additional local taxes imposed by counties, cities, and special districts. For instance, in Chicago, the combined state and local sales tax rate is typically around 10.25%.

How to Find or Look Up Your Illinois Sales Tax Rate?

To determine the exact sales tax rate for a specific location in Illinois, you can use the following methods:

1. Online Tax Calculators:

- Reliable websites: Utilize reputable online tax calculators that provide accurate and up-to-date information.

- Enter location: Input your city, county, or ZIP code to get the combined state and local sales tax rate.

2. Illinois Department of Revenue:

- Website: Visit the official website of the Illinois Department of Revenue.

- Tax rate lookup tool: Look for a specific tool or resource designed to help you find sales tax rates.

- Contact information: If unable to find the tool online, contact the department directly for assistance.

3. Local Government Websites:

- County or city websites: Check the websites of your local county or city government.

- Tax information: They may provide information on sales tax rates and any additional local taxes.

How to Calculate Illinois Sales Tax Rate

Calculating the sales tax for a transaction in Illinois involves applying the combined state and local tax rate to the purchase amount. Here’s a step-by-step guide:

Steps to Calculate Illinois Sales Tax:

- Determine the base rate: The state’s base sales tax rate is 6.25%.

- Identify local taxes: Many counties and municipalities impose additional sales taxes. To find the local rate for your specific location, use online tax calculators or contact the Illinois Department of Revenue.

- Calculate combined rate: Add the state and local rates to determine the total sales tax rate.

- Apply to purchase price: Multiply the total sales tax rate by the purchase price to calculate the sales tax amount.

For example, if you make a purchase of $100 in a location with a local tax rate of 2.5% and a state tax rate of 6.25%, the combined sales tax rate would be 8.75%. The sales tax on the $100 purchase would be $8.75, making the total cost $108.75.

What City Has the Highest Sales Tax Rate in Illinois?

The cities of Harvey, Harwood Heights, Matteson, and Richton Park currently hold the highest sales tax rate in Illinois, with a combined rate of 11.5%. This rate includes the state base rate of 6.25% and additional local taxes imposed by the respective municipalities.

Illinois Sales Tax by County and Zip Codes

There are 102 counties in Illinois. Sales tax rates in Illinois can vary significantly depending on the county and even within different zip codes in the same county. The state has a base sales tax rate of 6.25%, but local jurisdictions can add their own taxes, leading to a combined rate that ranges from 6.25% to 11.5% across the state.

The table below shows the sales tax rate for each county along with their respective zip codes:

| County Name | Tax Rate | ZIP Codes |

| Adams County | 9% | 62301, 62305, 62306 |

| Alexander County | 8.50% | 62914, 62926, 62957 |

| Bond County | 8.75% | 62246, 62249, 62275 |

| Boone County | 8.75% | 61008, 61065, 61073 |

| Brown County | 8.25% | 62353, 62301, 62374 |

| Bureau County | 8% | 61356, 61314, 61368 |

| Calhoun County | 8% | 62006, 62047, 62036 |

| Carroll County | 7.50% | 61053, 61074, 61085 |

| Cass County | 8.25% | 62618, 62627, 62673 |

| Champaign County | 9% | 61820, 61821, 61822 |

| Christian County | 9% | 62568, 62567, 62531 |

| Clark County | 8.25% | 62441, 62442, 62420 |

| Clay County | 7.75% | 62839, 62858, 62824 |

| Clinton County | 8.85% | 62231, 62218, 62230 |

| Coles County | 8.75% | 61920, 61938, 61951 |

| Cook County | 11.50% | 60007, 60018, 60016, 60601-60661 |

| Crawford County | 7.25% | 62454, 62451, 62433 |

| Cumberland County | 7.75% | 62428, 62445, 62468 |

| De Witt County | 8.25% | 61727, 61735, 61750 |

| Dekalb County | 8.25% | 60115, 60178, 60112 |

| Douglas County | 8.75% | 61919, 61920, 61943 |

| Dupage County | 10.50% | 60101, 60103, 60106 |

| Edgar County | 8.75% | 61944, 61924, 61917 |

| Edwards County | 7.75% | 62837, 62844 |

| Effingham County | 7.50% | 62401, 62411, 62424 |

| Fayette County | 8.25% | 62471, 62262, 62422 |

| Ford County | 7.50% | 60936, 60933, 60952 |

| Franklin County | 9.50% | 62812, 62896, 62822 |

| Fulton County | 9.75% | 61520, 61427, 61432 |

| Gallatin County | 8.25% | 62954, 62935, 62979 |

| Greene County | 8% | 62016, 62092, 62044 |

| Grundy County | 9% | 60450, 60444, 60437 |

| Hamilton County | 8.25% | 62859, 62828, 62841 |

| Hancock County | 8.25% | 62373, 62358, 62321 |

| Hardin County | 8.25% | 62931, 62943, 62985 |

| Henderson County | 8% | 61442, 61469, 61425 |

| Henry County | 8.25% | 61254, 61434, 61490 |

| Iroquois County | 7.25% | 60955, 60970, 60953 |

| Jackson County | 9.75% | 62901, 62966, 62918 |

| Jasper County | 7.75% | 62448, 62479, 62434 |

| Jefferson County | 9.50% | 62864, 62816, 62888 |

| Jersey County | 10.50% | 62052, 62063, 62036 |

| Jo Daviess County | 8.25% | 61036, 61028, 61041 |

| Johnson County | 8.50% | 62952, 62985, 62987 |

| Kane County | 11% | 60120, 60123, 60174 |

| Kankakee County | 8.25% | 60901, 60914, 60915 |

| Kendall County | 9.25% | 60543, 60560, 60538 |

| Knox County | 10% | 61401, 61448, 61412 |

| La Salle County | 8.50% | 61350, 61301, 61341 |

| Lake County | 10% | 60030, 60035, 60048 |

| Lawrence County | 7.75% | 62417, 62439, 62460 |

| Lee County | 8.25% | 61021, 61031, 61032 |

| Livingston County | 8.25% | 61764, 61739, 61726 |

| Logan County | 9.25% | 62656, 62634, 62635 |

| Macon County | 9.25% | 62521, 62526, 62522 |

| Macoupin County | 9.25% | 62088, 62640, 62063 |

| Madison County | 9.60% | 62040, 62034, 62025 |

| Marion County | 9.50% | 62881, 62801, 62854 |

| Marshall County | 7.25% | 61548, 61570, 61559 |

| Mason County | 8.75% | 62664, 62677, 62639 |

| Massac County | 7.75% | 62960, 62962, 62942 |

| Mcdonough County | 9% | 61455, 61470, 61475 |

| Mchenry County | 9% | 60050, 60098, 60152 |

| Mclean County | 8.75% | 61701, 61704, 61705 |

| Menard County | 8.75% | 62675, 62629, 62613 |

| Mercer County | 8.25% | 61231, 61234, 61272 |

| Monroe County | 8.50% | 62298, 62236, 62295 |

| Montgomery County | 8.25% | 62049, 62094, 62051 |

| Morgan County | 8.25% | 62650, 62644, 62639 |

| Moultrie County | 7.75% | 61951, 61944, 61931 |

| Ogle County | 8.75% | 61068, 61081, 61062 |

| Peoria County | 10% | 61604, 61614, 61615 |

| Perry County | 9.75% | 62274, 62888, 62820 |

| Piatt County | 8.25% | 61856, 61851, 61818 |

| Pike County | 8% | 62353, 62366, 62374 |

| Pope County | 8.25% | 62928, 62910, 62984 |

| Pulaski County | 7.75% | 62963, 62996, 62964 |

| Putnam County | 7.25% | 61360, 61340, 61344 |

| Randolph County | 8.25% | 62233, 62278, 62257 |

| Richland County | 8.75% | 62401, 62421, 62452 |

| Rock Island County | 9.50% | 61201, 61244, 61265 |

| Saline County | 8.75% | 62930, 62946, 62987 |

| Sangamon County | 9.75% | 62701, 62702, 62703 |

| Schuyler County | 8.25% | 62326, 62624, 62681 |

| Scott County | 7.75% | 62650, 62050, 62080 |

| Shelby County | 8.25% | 62565, 62422, 62557 |

| St. Clair County | 9.85% | 62220, 62221, 62223 |

| Stark County | 7.75% | 61424, 61483, 61474 |

| Stephenson County | 9% | 61032, 61062, 61067 |

| Tazewell County | 9.50% | 61554, 61611, 61610 |

| Union County | 9.50% | 62906, 62908, 62920 |

| Vermilion County | 9.25% | 61832, 61833, 61858 |

| Wabash County | 7.25% | 62849, 62867, 62863 |

| Warren County | 11% | 61462, 61483, 61453 |

| Washington County | 7.75% | 62263, 62801, 62808 |

| Wayne County | 8.25% | 62895, 62899, 62830 |

| White County | 8.25% | 62821, 62827, 62869 |

| Whiteside County | 9.25% | 61081, 61270, 61283 |

| Will County | 10.25% | 60431, 60435, 60440 |

| Williamson County | 10% | 62948, 62959, 62966 |

| Winnebago County | 9.75% | 61101, 61104, 61108 |

| Woodford County | 9.25% | 61760, 61771, 61774 |

Section 4: Registering for Illinois Sales Tax Permits

This section provides a step-by-step guide to obtaining a Illinois Sales Tax Permit. We cover who needs one, how to apply online or in person, and the necessary information. You’ll also learn about the permit process, the difference between a sales tax ID and permit, and when out-of-state businesses must collect Illinois sales tax. While the permit itself is free, there may be associated costs.

Do You Need to Register for Sales Tax in Illinois?

Yes, if your business engages in sales of taxable goods or services in Illinois, you must register for a sales tax permit. This requirement applies to both in-state businesses and remote sellers who meet Illinois’ economic nexus thresholds—$100,000 in sales or 200 transactions annually. Additionally, if you operate at events like craft shows or fairs in Illinois, you will also need to register.

How Much Does It Cost to Get an Illinois Seller’s Permit?

Registering for an Illinois sales tax permit is free. There are no fees associated with obtaining this permit, but you will need to complete the registration process through the Illinois Department of Revenue.

How to Register for Sales Tax and Obtain a Permit in Illinois?

To register for a sales tax permit in Illinois, follow these steps:

Determine Eligibility:

- Business type: Assess if your business is subject to Illinois sales tax based on its nature and operations.

- Gross sales: Determine if your annual gross sales exceed the state’s registration threshold.

Gather Required Information:

- Business details: Prepare your business name, address, federal tax identification number (EIN), and principal place of business.

- Owner information: Provide details about the business owners or partners.

Complete the Registration Form:

- Obtain the form: Visit the Illinois Department of Revenue website or contact them directly to request the registration form.

- Provide accurate information: Carefully fill out the form, ensuring all required fields are completed correctly.

Submit the Registration:

- Online or by mail: Submit the completed registration form and any supporting documentation to the Illinois Department of Revenue. Check their website for specific instructions.

Payment of Fees:

- Registration fee: Pay the required registration fee, if applicable.

Await Approval:

- Processing time: The Department of Revenue will review your application and process your registration. The processing time may vary.

Receive Permit:

- Notification: Once approved, you will receive your sales tax permit.

What are the different methods for applying for an Illinois sales tax permit?

- Online Registration: The quickest and easiest way to register is through the MyTax Illinois portal. Here, you will need to complete Form REG-1, the Illinois Business Registration Application.

The form requires detailed information about your business, such as its legal name, address, type of entity (e.g., LLC, corporation), Federal Employer Identification Number (EIN), and details about the products or services you intend to sell.

- Mail Registration: If you prefer, you can fill out the REG-1 form manually and mail it to the Illinois Department of Revenue. However, this method takes significantly longer—expect processing times of 6-8 weeks compared to just a few days for online registration.

How to Get a Sales Tax ID in Illinois

To obtain a sales tax ID in Illinois, you need to register your business with the Illinois Department of Revenue (IDOR). This can be done online through the MyTax Illinois portal or by submitting the Illinois Business Registration Application (Form REG-1) by mail as explained above.

After your application is processed, you will receive a unique sales tax ID number that you must use to collect and remit sales tax in Illinois. Be sure to display your registration certificate prominently at your business location.

Does Sales Tax Apply to Shipping in Illinois?

In Illinois, whether sales tax applies to shipping charges depends on the nature of the transaction:

- Taxable Shipping: If the shipping charge is part of the sale (i.e., the customer is required to pay shipping to receive the goods), then the shipping charge is generally taxable. This is common in online sales where shipping is a mandatory part of the transaction.

- Non-Taxable Shipping: If the shipping charge is separately stated and the customer has the option to pick up the item without incurring a shipping fee, the shipping charge may not be taxable. Additionally, shipping charges that exceed the actual cost of shipping may also be taxable.

It’s important to clearly itemize shipping costs on invoices to ensure proper tax treatment.

Does Illinois Sales Tax Apply to Out-of-State Purchases?

Yes, Illinois sales tax can apply to out-of-state purchases if the seller has a physical presence or economic nexus in Illinois. Under the economic nexus rule, out-of-state sellers must collect Illinois sales tax if they exceed $100,000 in sales or 200 transactions with Illinois customers in the previous 12 months.

For Illinois residents purchasing from out-of-state sellers who do not collect Illinois sales tax, they are generally required to pay use tax on the purchase. Use tax is the same rate as sales tax and is applied to purchases made from out-of-state sellers when Illinois sales tax is not collected at the point of sale.

Section 5: Setting Up Your Online Store, Recordkeeping, and Calculating Sales Tax in Illinois

This section covers how to calculate sales tax, including state and local rates. We’ll also discuss sales tax for eBay sellers and how the platform handles these calculations. Finally, we’ll guide you through calculating sales tax for car purchases in Illinois, explaining the specific tax rates and steps involved.

How Do I Calculate Sales Tax in Illinois?

To calculate sales tax in Illinois, you need to consider both the state base rate and any applicable local taxes. Illinois has a statewide base sales tax rate of 6.25%.

However, local jurisdictions (such as counties, cities, and special districts) can add additional taxes, which means the total sales tax rate can range from 6.25% to 11% depending on the location.

Here’s how you can calculate sales tax for your transactions:

- Determine the Total Sales Tax Rate: Identify the applicable sales tax rate by combining the state base rate with any local taxes. You can use online tools like the AtomicTax sales tax calculator to look up the precise rate based on your business location or your customer’s shipping address.

- Calculate the Tax: Multiply the sales tax rate by the price of the taxable goods or services.

For example, if the total tax rate is 8.75% and the item costs $100, the sales tax would be $8.75, making the total price $108.75.

- Use Automated Tools: For ease and accuracy, especially if your business operates in multiple jurisdictions, consider using sales tax software, which can automatically calculate the correct sales tax rate and amount for each transaction.

eBay Sales Tax Illinois Calculator

If you sell on eBay and are based in Illinois or have a nexus in Illinois, you need to collect sales tax on applicable sales. Fortunately, eBay automatically calculates and collects sales tax on behalf of sellers for most states, including Illinois.

However, to ensure compliance and accuracy:

- Verify the Tax Rates: eBay uses the appropriate tax rates based on the buyer’s location and adds it to the total sale amount at checkout.

You don’t need to manually calculate it, but it’s wise to double-check the rates using the Atomic Tax sales tax calculator to understand what’s being charged.

- Recordkeeping: Keep records of all sales transactions, including the tax collected. eBay provides detailed transaction reports that include the sales tax collected, which you can use for your own bookkeeping and tax filing purposes.

How to Calculate Sales Tax on a Car in Illinois?

When purchasing a car in Illinois, you need to consider the state and local sales tax rates that apply to vehicle purchases. The base state sales tax rate in Illinois is 6.25%. However, depending on where you purchase the vehicle, additional local taxes may apply, leading to a higher overall tax rate.

Steps to Calculate Sales Tax on a Car in Illinois:

- Determine the Vehicle’s Purchase Price: Start with the total purchase price of the vehicle. This price includes any dealer fees but excludes rebates or trade-in allowances.

- Subtract Trade-In Allowance: Illinois allows you to subtract the value of your trade-in from the purchase price before calculating the sales tax.

For instance, if you purchase a car for $30,000 and trade in your old car for $5,000, you would calculate the sales tax on $25,000.

- Apply the Combined Tax Rate: Multiply the taxable amount (after trade-ins) by the combined state and local tax rate.

For example, if the combined tax rate is 8% and the taxable amount is $25,000, the sales tax would be:

$25000 x 0.08 = $2000.

- Additional Local Taxes: Check for any additional local taxes that might apply based on your location. Cities like Chicago have higher tax rates, which can increase the total amount of tax you’ll pay.

This method gives you a straightforward way to calculate the amount of sales tax you’ll owe when purchasing a car in Illinois.

Reverse Sales Tax Calculator Illinois

A reverse sales tax calculator is a useful tool if you know the total amount paid (including tax) and want to find out the pre-tax amount. This is particularly helpful in determining how much of a car’s purchase price was actual cost versus tax.

How to Use a Reverse Sales Tax Calculator:

- Identify the Total Paid Amount: Start with the total amount you paid, which includes both the vehicle’s price and the sales tax.

- Know the Sales Tax Rate: Determine the combined sales tax rate that applies to your location in Illinois.

- Use the Reverse Calculation Formula: Divide the total paid amount by (1 + the sales tax rate).

For example, if you paid $32,000 and the tax rate was 8%, divide $32,000 by 1.08 to get the pre-tax amount, which would be approximately $29,629.63.

- Calculate the Sales Tax: Subtract the pre-tax amount from the total paid amount to find out how much you paid in sales tax.

Using these steps, you can determine both the pre-tax price of your vehicle and the amount of sales tax included in your payment.

Section 6: Charging & Collecting Sales Tax in Illinois

This section provides a comprehensive overview of Illinois sales tax, covering when and how to charge and collect it. It outlines which goods and services are taxable, explains the difference between charging and collecting tax, and details the specific conditions for taxation. Additionally, it offers step-by-step guidance on tax calculation, collection, and remittance, and addresses common taxability questions for various products and service

What Does It Mean to Charge Sales Tax vs. Collect Sales Tax in Illinois?

When you charge sales tax, you are adding the applicable tax rate to the sale of taxable goods or services at the point of purchase. This tax is then passed on to the customer as part of their total payment.

On the other hand, collecting sales tax refers to the process of receiving the sales tax from the customer as part of the transaction. After collecting the tax, you are responsible for remitting it to the Illinois Department of Revenue according to the schedule set by the state (monthly, quarterly, or annually).

The primary responsibility of businesses is to ensure they charge the correct tax rate based on the location of the sale and then remit the collected taxes in a timely manner to the state.

When to Charge Sales Tax in Illinois?

Businesses must charge Illinois sales tax if they sell tangible goods to customers located in the state. This applies regardless of where the goods are shipped from or where the business is located. If your business has a physical presence in Illinois, such as a store, office, or warehouse, you must collect sales tax on all sales made within the state. Additionally, if your business drop-ships products to Illinois customers, or you’re temporarily conducting business in the state, you are required to charge sales tax.

How to Charge and Collect Sales Tax in Illinois?

To correctly charge and collect sales tax in Illinois, follow these steps:

- Determine the Applicable Sales Tax Rate: Illinois is an origin-based sales tax state. This means that if your business is located in Illinois and you are making sales within the state, you charge the sales tax rate based on the location of your business. If you have multiple locations, you must apply the tax rate of the location where the sale originates.

- Include Sales Tax in the Transaction: When you make a sale, add the sales tax to the price of the taxable item. For example, if the total tax rate is 8% and the item costs $100, the customer will pay $108.

- Record and Report: Keep accurate records of all sales and the amount of sales tax collected. You will need this information when filing your sales tax returns with the Illinois Department of Revenue.

- Remit the Collected Tax: Depending on the amount of sales tax you collect, you will be required to file and remit the tax monthly, quarterly, or annually. This can be done through the MyTax Illinois portal.

Does Illinois Collect Sales Tax on Out-of-State Sales?

Yes, Illinois does collect sales tax on out-of-state sales, but this applies primarily to businesses that have established nexus in Illinois.

If you’re an out-of-state seller and you either generate $100,000 in sales or conduct 200 or more transactions with Illinois customers in a 12-month period, you must collect Illinois sales tax. This is due to Illinois’ economic nexus laws, which require remote sellers to register, collect, and remit sales tax if they meet these thresholds.

Additionally, if you operate through a marketplace facilitator (like Amazon or eBay), the platform is responsible for collecting and remitting the sales tax on your behalf, according to Illinois law.

Do Contractors Charge Sales Tax on Labor in Illinois?

In Illinois, contractors generally do not charge sales tax on labor. However, if the contractor is also selling tangible personal property as part of their service (such as materials used in a construction project), those materials are taxable.

The contractor is considered the end-user of the materials, meaning they must pay sales tax on the purchase of those materials unless they are working on a project for a tax-exempt organization, in which case an exemption certificate would be used.

Does Illinois Charge Sales Tax on Services?

In Illinois, the general rule is that services are not subject to sales tax. However, there are exceptions, particularly when the service is tied to the sale of tangible personal property. For example, if a service includes providing goods (like a repair service that also supplies parts), the cost of the parts is taxable, even if the service itself is not.

Additionally, certain specific services, such as hotel accommodations, parking services, and some telecommunications services, are taxable in Illinois.

Does Illinois Charge Sales Tax on Food?

Illinois imposes a reduced sales tax rate of 1% on most food items that are intended for human consumption off the premises where they are sold, such as groceries. However, prepared foods, soft drinks, and alcoholic beverages are taxed at the higher general merchandise rate, which is 6.25% plus any applicable local taxes.

This means that if you’re purchasing ready-to-eat meals or soda, you’ll be paying a higher tax rate compared to unprepared grocery items.

Do Photographers Charge Sales Tax in Illinois?

Photographers in Illinois are required to charge sales tax on the sale of tangible goods, such as prints, photo albums, and other physical items.

If you provide a digital product delivered electronically and it does not involve a physical component, it typically isn’t subject to sales tax. However, if you deliver digital files on a physical medium like a USB drive or CD, the sale becomes taxable because the item is now considered tangible personal property.

Additionally, any charges for services that are necessary to produce a tangible product (like editing) are also subject to sales tax.

Does Amazon Charge Sales Tax in Illinois?

Yes, Amazon does charge sales tax in Illinois. Since January 1, 2020, Amazon, as a marketplace facilitator, is required to collect and remit sales tax on behalf of its third-party sellers.

This applies to all sales made to Illinois customers, regardless of whether the seller is located in Illinois or out-of-state. This requirement was part of Illinois’ broader effort to level the playing field between online and brick-and-mortar retailers following the Supreme Court’s Wayfair decision.

Does eBay Charge Sales Tax in Illinois?

Similar to Amazon, eBay also charges sales tax on sales made to Illinois customers. Since the implementation of the marketplace facilitator laws in 2020, eBay has been required to collect and remit sales tax on behalf of its sellers.

This means that if you purchase an item on eBay and have it shipped to Illinois, you will see the applicable sales tax added to your order.

Does Wayfair Charge Sales Tax in Illinois?

Wayfair, like Amazon and eBay, is required to collect sales tax on all sales made to customers in Illinois. This requirement has been in place since the state’s marketplace facilitator laws were enacted in 2020. As a result, when you purchase goods through Wayfair and have them delivered to Illinois, the appropriate sales tax will be automatically applied at checkout.

These changes in sales tax collection practices ensure that both in-state and out-of-state sellers are subject to the same tax rules, thereby promoting fair competition.

Does Illinois Charge Sales Tax on Rental Equipment?

Yes, Illinois does charge sales tax on rental equipment. When you rent tangible personal property, such as construction equipment or vehicles, the rental fee is subject to the same sales tax rate as the purchase of the equipment.

The applicable tax rate includes the state base rate of 6.25% plus any local taxes, which can bring the total rate up to 11% depending on the location. Recent changes in Illinois tax law have streamlined the tax treatment of leased and rented equipment, aligning it more closely with other states.

Can You Charge Sales Tax on Delivery in Illinois?

In Illinois, whether sales tax applies to delivery charges depends on how those charges are presented. If the delivery charge is not separately stated on the invoice or if the customer has no option but to pay for delivery to receive the goods, then the delivery charge is considered part of the taxable sale and is subject to sales tax.

However, if the delivery charge is separately stated and the customer can choose to pick up the item without a delivery fee, the delivery charge may not be subject to sales tax. This distinction is based on Illinois Supreme Court rulings and subsequent amendments to the state’s tax regulations.

Do I Charge Sales Tax to Nonprofits in Illinois?

In Illinois, nonprofits that have obtained a tax-exempt status from the Illinois Department of Revenue (IDOR) are generally exempt from paying sales tax on purchases made for their charitable, religious, or educational activities. These organizations are issued a sales tax exemption number, known as an E-number, which they can present to vendors to make tax-free purchases.

However, if your nonprofit organization sells goods or services, you may still be required to collect and remit sales tax on those sales unless they fall under specific exemptions. For instance, sales made only to the organization’s members, or occasional sales like fundraising dinners that are not in direct competition with for-profit businesses, may be exempt from sales tax.

Do Restaurants Charge Sales Tax in Illinois?

Yes, restaurants in Illinois are required to charge sales tax on food and beverages sold for immediate consumption. The state imposes a base sales tax rate of 6.25%, but when local taxes are added, the total rate can be much higher, depending on the location of the restaurant. For example, in Chicago, the combined sales tax rate for restaurants can be as high as 11.5%.

This sales tax applies to all prepared food and beverages, whether consumed on the premises or taken out, but does not typically apply to unprepared grocery items. Restaurant owners must ensure they collect the correct amount of tax and remit it to the state according to the required filing schedule.

Section 7: Reporting, Paying, Filing & Remitting Sales Tax Returns

This section clarified the key distinctions between reporting, paying, filing, and remitting sales tax. We outlined who owes sales tax, how and when to pay it, and the deadlines for filing tax returns. Common misconceptions about sales tax, such as whether wholesalers or individuals buying homes are subject to it, were also addressed.

What is Sales Tax Reporting vs. Payment vs. Filing vs. Remittance?

In Illinois, managing your sales tax involves several distinct processes:

- Reporting: This involves detailing all taxable sales made during the reporting period. You will report gross sales, taxable sales, and any applicable deductions to the Illinois Department of Revenue.

- Payment: After reporting, you must calculate the amount of sales tax owed and make the necessary payment to the state. This payment covers the tax you collected from customers.

- Filing: Filing refers to submitting your sales tax return, which includes all the reporting details and the payment information. In Illinois, this is typically done using Form ST-1 through the MyTax Illinois portal.

- Remittance: Remittance is the actual transfer of funds to the Illinois Department of Revenue. This happens after you’ve calculated the tax due and filed your return.

Who Pays Sales Tax in Illinois?

In Illinois, the responsibility for paying sales tax generally falls on the consumer. However, businesses are required to collect this tax at the point of sale and then remit it to the state.

Whether you’re an in-state business or a remote seller meeting Illinois’ economic nexus thresholds (over $100,000 in sales or 200 transactions annually), you must collect sales tax from your Illinois customers.

When to Pay Sales Tax in Illinois?

The frequency with which you must file and pay sales tax in Illinois depends on the amount of sales tax your business collects:

- Monthly: If your business collects a significant amount of sales tax, you will likely be required to file and pay monthly. These filings are due by the 20th of the month following the reporting period.

- Quarterly: Businesses with moderate sales tax collections may file quarterly. These returns are also due by the 20th day following the end of the quarter.

- Annually: Small businesses with minimal tax collections may be allowed to file annually, with returns typically due by January 20th of the following year.

It’s important to adhere to these deadlines to avoid penalties and interest.

Where Do I Pay Illinois Sales Tax?

You can pay your Illinois sales tax through the MyTax Illinois portal, which is the official online platform provided by the Illinois Department of Revenue (IDOR).

MyTax Illinois allows you to file your sales tax returns and make payments electronically, which is the preferred method for most businesses. If your annual tax liability exceeds $20,000, you are required to use electronic funds transfer (EFT) to make your payments.

Alternatively, for smaller businesses, you can pay via check or money order, but electronic payment is generally faster and more secure.

How to Pay Sales Tax in Illinois?

To pay your sales tax in Illinois, follow these steps:

- Log in to MyTax Illinois: If you don’t already have an account, you’ll need to create one using the credentials you received when you registered for your Illinois sales tax permit.

- File Your Return: Use the ST-1 form on the portal to report your sales and calculate the tax owed. Once you’ve completed the form, you can submit it directly through the portal.

- Make Your Payment: After filing your return, proceed to payment. You can pay via bank account debit (EFT), which requires you to enter your bank details. Ensure that the payment is scheduled at least by the return due date to avoid any penalties.

- Save Your Confirmation: After submitting your payment, save or print the confirmation for your records. This step is crucial for audit purposes and to confirm that your payment has been processed.

How to File Sales and Use Tax in Illinois?

In Illinois, sales tax is a tax imposed on the sale of tangible personal property and certain services, collected by the seller at the point of sale and remitted to the state.

Use tax, on the other hand, applies to tangible personal property purchased out-of-state and used within Illinois when Illinois sales tax has not been paid. Use tax ensures that out-of-state purchases are taxed similarly to in-state purchases, leveling the playing field between in-state and out-of-state sellers.

For most businesses, sales tax is collected from customers and then paid to the state, while use tax is often self-assessed on items bought out-of-state and used in Illinois.

What is the Deadline to Pay Sales Taxes in Illinois?

In Illinois, the deadline to pay sales tax varies depending on your filing frequency:

- Monthly Filers: Sales tax returns are due by the 20th of each month for the previous month’s sales.

- Quarterly Filers: Returns are due by the 20th of the month following the end of the quarter (e.g., April 20 for Q1).

- Annual Filers: If you file annually, the return is due by January 20 of the following year.

Make sure to adhere to these sales tax due dates to avoid penalties and interest charges. It’s important to remember that even if you file on time, the payment must also be received by the sales tax deadline to be considered timely.

Do Nonprofits Pay Sales Tax on Purchases in Illinois?

In Illinois, nonprofits can be exempt from paying sales tax on purchases if they have obtained a valid tax-exempt status from the Illinois Department of Revenue. Nonprofits must use an exemption certificate, known as an E-number, to make tax-free purchases for items used in their charitable, religious, or educational activities. However, not all purchases are automatically exempt; the exemption only applies to purchases directly related to the nonprofit’s mission.

If a nonprofit organization does not have this exemption or uses it improperly, they may be required to pay sales tax like any other entity.

Do Wholesalers Pay Sales Tax in Illinois?

In Illinois, wholesalers generally do not pay sales tax on the goods they purchase for resale. When a wholesaler buys goods intended for resale, they can provide a resale certificate to the seller, allowing them to purchase the items without paying sales tax.

The sales tax is then collected when the goods are sold to the end consumer. However, if the wholesaler uses the goods for purposes other than resale, they would need to pay use tax on those items.

Do You Pay Sales Tax on a Leased Car in Illinois?

Yes, in Illinois, sales tax is charged on the lease of a car. The tax is applied to both the down payment and the monthly lease payments.

For example, if your down payment is $2,000, the sales tax would be calculated on that amount, and you would also pay sales tax on each monthly payment. Illinois law requires the lessor to collect the sales tax and remit it to the state.

The sales tax rate for vehicles is 6.25% at the state level, with additional local taxes that can increase the total rate.

Do You Pay Sales Tax When You Buy a House in Illinois?

No, you do not pay sales tax when buying a house in Illinois. However, Illinois imposes a real estate transfer tax on the transfer of property, which is typically split between the buyer and the seller. This tax is separate from sales tax and is calculated based on the sale price of the property.

The state transfer tax rate is $0.50 per $500 of the property’s value, and local governments may impose additional transfer taxes.

Section 8: Understanding Illinois Sales Tax Holidays and Refunds

This section provides information on Illinois’s sales tax refunds and annual sales tax holiday. We cover who is eligible for sales tax refunds, including foreigners, and outline the refund process. Additionally, we explain the purpose of the sales tax holiday and detail the types of items typically exempt from tax during this event.

Does Illinois Do Sales Tax Refunds?

In Illinois, sales tax refunds are generally not available to consumers who have paid sales tax on purchases within the state. However, businesses may qualify for a sales tax refund if they overpay taxes, return purchased items, or if specific exemptions apply retroactively.

A sales tax refund in Illinois typically occurs when there’s an excess payment of sales tax that needs to be returned to the taxpayer. Businesses seeking a refund must file a claim with the Illinois Department of Revenue and provide appropriate documentation to support their claim.

Does Illinois Refund Sales Tax to Foreigners?

Illinois does not provide sales tax refunds to international visitors. Unlike some other states or countries with VAT systems, where foreign visitors can claim a refund on taxes paid for goods they take out of the country, Illinois requires that sales tax be paid on all taxable goods purchased within the state, regardless of the buyer’s residency.

The only exception is if the goods are shipped directly out of the United States by the retailer without the customer taking possession within Illinois. In such cases, sales tax may not be applied.

Is It Illegal Not to Refund Sales Tax in Illinois?

Yes, it is illegal not to refund sales tax in Illinois when a customer returns an item. If a consumer pays sales tax on a purchase and later returns the item, they are entitled to a refund of the sales tax along with the refund of the purchase price.

Retailers must comply with this requirement, and failure to do so can be considered a violation of consumer protection laws. If a retailer refuses to refund the sales tax, the consumer may have grounds to file a complaint or even pursue legal action for a refund.

How to Claim a Sales Tax Refund in Illinois?

To claim a sales tax refund in Illinois, you must file a claim with the Illinois Department of Revenue. This process typically involves submitting Form ST-6, which is used to report overpayments or errors in sales tax payments.

You will need to provide detailed documentation, such as receipts and invoices, to support your claim. The processing time for these refunds can vary, so it’s important to ensure all your documentation is accurate and complete before submission.

Does Illinois Give Sales Tax Holidays?

Illinois does not currently offer sales tax holidays.

A sales tax holiday is a temporary period during which specific items are exempt from sales tax, typically aimed at providing tax relief on back-to-school items or emergency preparedness supplies.

While some states in the U.S. offer these holidays to boost retail sales or provide relief to consumers, Illinois has not enacted such a provision as part of its sales tax policy. Therefore, all applicable sales taxes must be paid on purchases in Illinois throughout the year.

Section 9: Understanding Illinois Sales Tax Audits and Penalties

This section explores the potential consequences of delaying sales tax payments and the risks associated with sales tax audits. We discussed penalties for late payments, factors that trigger audits, and options for potential relief. By understanding these risks, you can take steps to ensure your business remains compliant and protected.

What is the Penalty for Paying Sales Tax Late in Illinois?

In Illinois, if you pay your sales tax late, the state imposes a penalty that increases the longer the payment is overdue. Specifically:

- 2% penalty if the payment is made within 30 days of the due date.

- 10% penalty if paid between 31 and 90 days late.

- 15% penalty if paid between 91 and 180 days late.

- 20% penalty if the tax is unpaid for more than 180 days.

These penalties are cumulative, meaning the longer you wait to pay, the higher the penalty percentage applied to the unpaid tax amount. Additionally, interest will accrue on the unpaid balance from the day after the tax was due until it is paid.

Does Illinois Conduct Sales Tax Audits?

Yes, Illinois does conduct sales tax audits. The Illinois Department of Revenue (IDOR) selects businesses for audits based on various factors, including random selection, the nature of the business, audit history, and specific tax issues.

During an audit, the IDOR reviews your records to ensure that the correct amount of sales tax has been reported and paid. The audit process may involve a detailed examination of your sales records, invoices, and other documentation.

The goal of these audits is to promote compliance with tax laws, deter tax evasion, and correct any errors in tax reporting. If an audit reveals that additional tax is owed, penalties and interest may be assessed on the underpaid amounts.

What Triggers a Sales Tax Audit in Illinois?

A sales tax audit in Illinois can be triggered by several factors, including:

- Inconsistent or Inaccurate Reporting: If your business’s sales tax filings show inconsistencies or significant discrepancies compared to industry norms, it may raise a red flag for the Illinois Department of Revenue (IDOR).

- Large Deductions or Exemptions: Claiming large or unusual deductions or exemptions on your sales tax returns can trigger an audit, as the IDOR may want to verify their validity.

- Industry Type: Certain industries, such as cash-intensive businesses (like restaurants) or those that frequently deal with exempt sales (like wholesalers), are more likely to be audited due to the higher risk of errors or non-compliance.

- Previous Audit History: If your business has been audited before and discrepancies were found, the IDOR may choose to audit you again to ensure continued compliance.

- Third-Party Information: The IDOR may initiate an audit if they receive information from third parties, such as customers, suppliers, or former employees, suggesting that your business is not complying with sales tax laws.

What is the Penalty for an Audit After the Due Date in Illinois?

If an audit reveals that you owe additional sales tax after the due date, Illinois imposes significant penalties:

- Standard Late-Payment Penalty: If the payment is made within 30 days after the due date, a penalty of 2% of the unpaid tax is imposed. If the payment is between 31 and 90 days late, the penalty increases to 10%.

- Post-Audit Penalty: If the audit uncovers unpaid taxes, and the payment is not made within 30 days after the audit’s conclusion, a penalty of 20% is imposed on the unpaid amount. This penalty reflects the state’s efforts to encourage timely tax payment and compliance.

What is Illinois Sales Tax Penalty Waiver?

Illinois allows for a penalty waiver in certain situations where the taxpayer can demonstrate reasonable cause for failing to file or pay taxes on time.

Examples of reasonable cause include severe illness, natural disasters, or errors made by the Illinois Department of Revenue itself.

To request a waiver, you must file a petition with the Board of Appeals and provide evidence supporting your claim. The decision to grant a waiver is at the discretion of the Illinois Department of Revenue, and each case is reviewed on its merits.

Section 10: Illinois Sales Tax Software – AtomicTax

If you’re focused on expanding your Illinois-based business, but the complexity of sales tax management is holding you back. Go for AtomicTax Ecommerce Sales Tax Software—the solution that takes the guesswork out of Illinois sales tax.

How AtomicTax Ecommerce Sales Tax Software Benefits You?

- Automated Tax Calculation: AtomicTax automatically calculates the correct sales tax for every transaction based on the latest Illinois tax rates and local jurisdiction rules. This ensures accurate tax collection without manual effort, reducing the risk of errors.

- Real-Time Updates: Tax rates and regulations are constantly changing. AtomicTax keeps your business compliant by updating tax rates in real-time, so you never have to worry about outdated information.

- Seamless Integration: The software integrates easily with your ecommerce platform, ensuring that sales tax is calculated and applied at checkout without disrupting your current systems.

- Detailed Reporting and Filing Assistance: AtomicTax provides comprehensive reports that simplify the filing process. The software helps prepare your sales tax returns, making it easier to file accurately and on time, thus avoiding penalties.

- Audit Support: If your business is selected for an audit, AtomicTax helps by organizing and providing all necessary documentation, ensuring a smooth audit process.

With AtomicTax, you can reduce the administrative burden of managing sales tax and focus on growing your business. The software’s automation and accuracy help protect your business from costly mistakes and ensure that you are always compliant with Illinois sales tax laws.

Ready to simplify your sales tax process? Visit AtomicTax to learn more and get started today.

Conclusion

Mastering Illinois sales tax isn’t just about compliance—it’s about gaining confidence in your business operations. This guide has armed you with the knowledge to handle sales tax efficiently, from determining rates to filing returns. But beyond the technicalities, it’s also given you the clarity to see sales tax not as a burden, but as a manageable aspect of your business.

By staying informed and proactive, you’re positioning your business to thrive in an environment where tax laws are constantly evolving.

So, as you move forward, consider this guide your roadmap—a tool to keep you on course as you deal with the challenges of Illinois sales tax. The decisions you make now will echo in the success of your business tomorrow.