Indiana’s sales tax has remained a consistent 7% since 2008, making it one of the highest in the United States. However, its simplicity sets it apart: there are no additional local sales taxes. This means that no matter where you are in Indiana, the sales tax rate remains the same.

While Indiana’s sales tax system may seem straightforward, understanding the specifics—like taxable goods and services, exemption applications, and audit preparation—is crucial for both businesses and consumers. This guide provides comprehensive information on Indiana’s sales tax, ensuring you can accurately manage your tax obligations.

Section 1: Determining Sales Tax Nexus in Indiana

This section explains how to determine if your business needs to collect sales tax in Illinois. We outline the criteria for establishing sales tax nexus, including economic and physical presence thresholds. Additionally, we provide guidance on complying with Illinois sales tax regulations once nexus is determined.

What is Indiana Sales Tax

Indiana imposes a state sales tax rate of 7%. This means that for every $100 of taxable purchases, you’ll pay $7 in sales tax.

Do You Need a Sales Tax Permit to Sell Online From or to Indiana?

Yes, you generally need a sales tax permit to sell online in or to Indiana. This is required if your annual sales volume in Indiana exceeds $100,000 or if you have more than 200 transactions in Indiana annually. If you have a physical location in Indiana, regardless of sales volume or transaction numbers, you must also collect, file, and pay sales tax.

Additionally, if you are a remote seller (i.e., you have no physical presence in Indiana) or you sell through online marketplaces facilitator like Amazon or eBay, you or the marketplace facilitator are responsible for collecting and remitting sales tax.

To determine if you need a sales tax permit, assess your business’s activity in Indiana and whether it meets the economic nexus thresholds or has a physical presence. If so, register for a permit and comply with Indiana’s sales tax laws.

What Triggers or Creates a Sales Tax Nexus in Indiana?

A sales tax nexus in Indiana is triggered or established when a business has a sufficient physical presence or economic activity within the state. This nexus obligation triggers the requirement to collect and remit sales tax on sales made to Indiana customers.

Key factors that can create a nexus include:

Physical Presence:

- Retail location: Operating a physical retail store within the state.

- Warehouse or storage facility: Maintaining a warehouse or storage facility for inventory.

- Employees: Having employees physically present in Indiana.

Economic Nexus:

- Sales threshold: Exceeding a certain annual sales threshold in Indiana. The specific threshold may vary, but it generally involves a significant amount of sales.

- Transactions threshold: Exceeding a specific number of transactions within the state.

Click-and-Mortar Nexus:

- Affiliated retailer: Having an affiliated retailer with a physical presence in Indiana.

Remote Sales Nexus:

- Sales threshold: Exceeding a certain annual sales threshold from Indiana residents.

Affiliate Nexus:

- Affiliated business: Having an affiliated business with a physical presence in Indiana.

What is Indiana Sales Tax Economic Nexus Threshold

Indiana’s economic nexus threshold for sales tax is $100,000. This means that if your gross revenue from sales into Indiana exceeds this amount in the current or previous calendar year, you must register for a sales tax permit and collect sales tax on all taxable sales made to Indiana customers.

Previously, Indiana had both a revenue and transaction threshold. However, as of 2024, the transaction threshold has been eliminated, simplifying compliance for online sellers

Indiana Sales Tax Nexus Calculator

To ensure compliance, you can use various online sales tax calculators provided by platforms like AtomicTax Sales Tax Calculator. These tools help you determine whether your sales exceed Indiana’s economic nexus threshold. By inputting your sales data, these calculators can quickly assess your obligation to collect and remit sales tax in Indiana.

Using a calculator is a practical way to stay on top of your sales tax obligations, especially as your business grows and potentially crosses into new states with different thresholds and requirements.

Section 2: Understanding Indiana Sales Taxability Exemptions and Resale Certificates

Illinois exemption certificates are required for businesses and non-profits to make tax-free purchases in the state. This guide explains the differences between resale and exemption certificates, outlines taxable and exempt items, and provides information on certificate validity, required details, and how to obtain one. We also address common misconceptions about out-of-state sellers and eligibility criteria for nonprofit tax exemptions.

Who Is Exempt from Sales Tax in Indiana?

In Indiana, certain entities and types of transactions are exempt from paying sales tax. These exemptions are typically granted to specific groups, such as nonprofits, government agencies, and manufacturers, as well as for specific types of purchases.

- Nonprofit Organizations: Nonprofits, such as religious institutions, educational organizations, and charitable entities, can be exempt from sales tax on purchases related to their exempt activities. However, they must apply for this exemption and receive an exemption certificate from the Indiana Department of Revenue.

- Government Agencies: Federal, state, and local government agencies are generally exempt from sales tax on purchases made for official use.

- Manufacturing and Agriculture: Purchases of certain machinery, raw materials, and utilities used directly in manufacturing or farming are exempt from sales tax in Indiana. This includes items like production machinery, agricultural equipment, and seeds.

What Is a Sales Tax Exemption Certificate in Indiana?

A sales tax exemption certificate, such as the Indiana General Sales Tax Exemption Certificate (Form ST-105), is a document that allows purchasers to buy goods without paying sales tax, provided those goods are intended for resale or meet other criteria for tax exemption. Businesses or individuals presenting this certificate to a seller do so to claim an exemption from sales tax on qualifying purchases.

To use an exemption certificate in Indiana:

- Obtain the Certificate: The buyer must fill out Form ST-105, which includes information about the business and the reason for the exemption.

- Present to Vendor: The completed certificate must be presented to the seller at the time of purchase.

- Maintain Records: Sellers are required to keep a copy of the exemption certificate on file for audit purposes.

How to Obtain an Indiana Sales Tax Exemption Certificate

Steps to Apply:

- Determine Eligibility:

- Identify qualifying activities: Determine if your business qualifies for sales tax exemptions based on Indiana’s laws. Common exemptions include non-profit organizations, government entities, and certain agricultural or manufacturing activities.

- Review specific requirements: Understand the specific criteria and documentation needed to support your exemption claim.

- Gather Required Documentation:

- Business information: Prepare your business name, address, and tax identification number (EIN).

- Supporting documents: Collect any necessary evidence to prove your eligibility, such as articles of incorporation, nonprofit status, or agricultural production records.

- Complete the Application Form:

- Obtain the form: Visit the Indiana Department of Revenue website or contact them directly to request the appropriate application form.

- Provide accurate information: Carefully fill out the form, ensuring all required fields are completed and accurate.

- Submit the Application:

- Mail or submit electronically: Submit the completed application form and supporting documentation to the Indiana Department of Revenue. Check their website for specific submission instructions.

- Await Approval:

- Processing time: The department will review your application and determine if you qualify for a sales tax exemption. The processing time may vary.

- Receive the Certificate:

- Notification: If approved, you will receive a sales tax exemption certificate from the Indiana Department of Revenue.

Indiana Sales Tax Exemption Rules

- Validity: The exemption certificate must be completed accurately and kept on file by the seller to be valid. Any incorrect or incomplete certificates can lead to the seller being liable for unpaid taxes.

- Resale Certificates: A resale certificate is used by a business when purchasing goods that will be resold to consumers. This allows the business to avoid paying sales tax on those purchases. However, the business must collect sales tax from its customers when the goods are sold at retail.

- Expiration: In Indiana, resale certificates do not have a standard expiration date, but businesses must ensure that they remain accurate and up-to-date to avoid issues during audits.

These rules ensure that sales tax is collected and remitted properly while allowing for legitimate exemptions under Indiana law. It’s important for both sellers and buyers to understand and correctly apply these exemptions to avoid penalties during state audits.

What Goods Are Taxable in Indiana?

In Indiana, the majority of tangible personal property is subject to sales tax. This includes physical items such as:

List of Taxable Goods in Indiana

- Clothing: Regular clothing items are taxed at the standard state sales tax rate of 7%.

- Prepared Food: Any food that has been prepared or heated, such as meals from restaurants, is taxable at a higher rate of 9%.

- Electronics: Items like smartphones, computers, and household appliances are all taxable.

- Furniture: Purchases of furniture and home decor are subject to the 7% sales tax.

- Motor Vehicles: Cars, trucks, and other motor vehicles are taxed when purchased.

What Services Are Taxable in Indiana? (List of Taxable Services in Indiana)

While services are generally not subject to sales tax in Indiana, there are some exceptions where services are taxable:

- Lodging: The rental of hotel rooms or other accommodations is subject to sales tax.

- Rental of Tangible Personal Property: Leasing or renting items such as vehicles, equipment, or furniture is taxable.

- Installation Services: Services related to the installation of tangible personal property, such as installing home appliances or flooring, are taxable.

- Repair and Maintenance Services: Repairs and maintenance on physical goods like cars or electronics are also taxable.

- Admission Fees: Entry fees for amusement parks, athletic events, and entertainment venues are taxable.

What Is Excluded from Sales Tax in Indiana?

Certain items are specifically exempt from sales tax in Indiana, including:

- Unprepared Food: Groceries, which include unprocessed and uncooked food items like fruits, vegetables, and bread, are not subject to sales tax.

- Prescription Drugs and Medical Supplies: Most prescription medications and necessary medical devices are exempt from sales tax.

- Farm Equipment: Machinery and tools used directly in agricultural production are not taxed.

- Sales to Nonprofits and Government Agencies: Purchases made by qualifying nonprofits and government entities are often exempt from sales tax when used for exempt purposes.

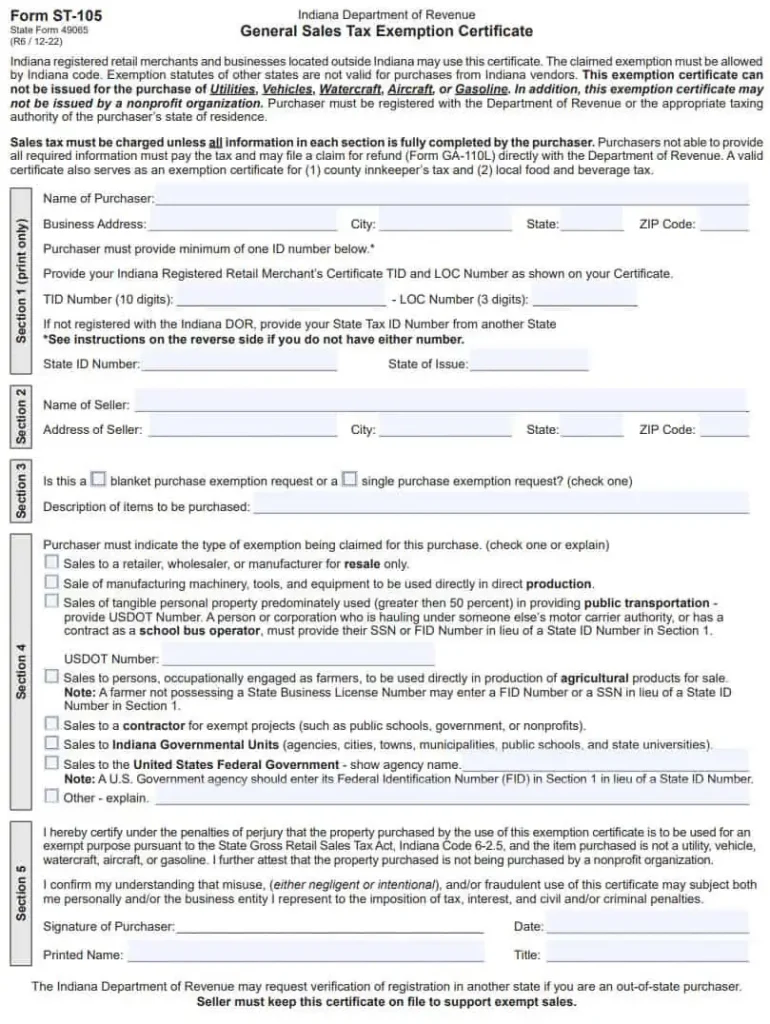

How Does an Indiana Sales Tax Exemption Form Look?

The Indiana Sales Tax Exemption Certificate, known as Form ST-105, is a critical document for businesses and individuals who wish to make tax-exempt purchases in Indiana. The form is divided into several sections that need to be completed to validate the exemption:

- Section 1: This section requires the purchaser’s identification information, such as the Indiana Taxpayer Identification Number (TID) or a State Tax ID Number if the purchaser is from another state.

- Section 2: The seller’s information, including name and address, is recorded here.

- Section 3: The purchaser must specify whether the exemption is for a single purchase or a blanket exemption and provide a description of the items being purchased.

- Section 4: This section is where the type of exemption being claimed is indicated, such as resale, manufacturing, or farming.

- Section 5: The form must be signed and dated by the purchaser, with their printed name and title also required.

The completed form must be kept on file by the seller to support the tax-exempt sale in case of an audit.

Here’s a sample image of how an Indiana sales tax exemption certificate looks like

Indiana Sales Tax Exemption Chart PDF

For those who need a quick reference, Indiana provides a Sales Tax Exemption Chart in PDF format, detailing the types of transactions and entities that are exempt from sales tax.

This chart is particularly useful for businesses to ensure they are correctly applying exemptions and for buyers to understand what purchases qualify for tax exemption. To find or download the Indiana Sales Tax Exemption Chart PDF, you can visit the Indiana Department of Revenue’s website or search for “Indiana Sales Tax Exemption Chart PDF” online.

Out-of-State Sales Tax Exemption in Indiana

Indiana generally allows out-of-state businesses to use their own state’s tax exemption certificates when making tax-exempt purchases within the state, provided they are registered with their own state’s tax authority.

However, it’s important to note that Indiana does not automatically honor exemption certificates from other states unless the purchasing entity is registered with the Indiana Department of Revenue or another appropriate taxing authority.

To avoid complications, businesses purchasing from out-of-state vendors should ensure they have the correct documentation on file, and sellers should verify the validity of the exemption certificates presented to them.

Indiana Sales Tax Exemption Certificate for Nonprofits

Nonprofit organizations in Indiana can qualify for sales tax exemptions on purchases used for their exempt purposes. To claim this exemption, nonprofits must use the Indiana Nonprofit Sales Tax Exemption Certificate (Form NP-1), which is different from the general sales tax exemption form (Form ST-105).

This specific form must be presented to vendors at the time of purchase to avoid paying sales tax on eligible items.

Is Indiana Seller’s Permit the Same as a Tax-Exempt Certificate?

No, an Indiana Seller’s Permit, also known as the Registered Retail Merchant Certificate (RRMC), is not the same as a tax-exempt certificate.

The RRMC allows a business to legally sell goods and collect sales tax from customers within Indiana.

Conversely, a tax-exempt certificate (such as Form NP-1 or ST-105) allows certain entities, such as nonprofits or resellers, to purchase goods without paying sales tax, provided those goods are used in a manner that qualifies for the exemption. It is essential for businesses and nonprofits to understand the difference to ensure compliance with Indiana’s tax laws.

Indiana Sales Tax Exemption for Manufacturing

In Indiana, manufacturing businesses can benefit from significant sales tax exemptions on specific items that are directly used in the production process. This includes machinery, tools, equipment, and other materials that have a direct and immediate effect on the tangible personal property being produced.

For example, equipment like drills, grinders, and material handling machinery, as well as consumables like grease, welding gases, and safety equipment, are typically exempt from sales tax if they are integral to the production process.

To claim these exemptions, manufacturers must fill out and submit Form ST-105 to their vendors, ensuring they are not charged sales tax on qualifying purchases.

Indiana Sales Tax Exemption Certificate Verification (Do You Have to Renew Your Seller’s Permit in Indiana?)

In Indiana, the Registered Retail Merchant Certificate (commonly referred to as a seller’s permit) does not need to be renewed regularly, as it remains valid as long as the business continues to meet its tax obligations. However, the tax exemption certificates, such as Form ST-105, should be kept updated and accurate to avoid issues during audits.

The Indiana Department of Revenue may request verification of the exemption certificate, especially if the business is purchasing from out-of-state vendors. It’s important to maintain accurate records of all exemption certificates used in transactions to ensure compliance.

Sales Tax Exemption for Farming in Indiana

Indiana provides specific sales tax exemptions for items used directly in farming. This includes agricultural machinery, tools, and equipment that are used in the production of crops, livestock, or other agricultural products. Items such as tractors, plows, and fertilizers that are directly involved in farming activities are exempt from sales tax.

To take advantage of these exemptions, farmers must use Form ST-105, specifically indicating the exemption for agricultural use. It’s important for farmers to ensure that all exempt items are directly related to production activities to qualify for these tax benefits.

These exemptions are critical for reducing the operational costs of manufacturing and farming businesses in Indiana, allowing them to reinvest in their operations more effectively.

What Is an Indiana Resale Certificate?

An Indiana resale certificate is a document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. When you present a valid resale certificate to your supplier, the supplier does not charge you sales tax on those items. Instead, you collect the sales tax from your customers when the items are resold.

This certificate is essential for any business in Indiana that regularly purchases inventory for resale.

How Much Does an Indiana Resale Permit Cost?

The cost of an Indiana resale permit is $25. However, before you can obtain a resale permit, you must first apply for a Registered Retail Merchant Certificate (RRMC), which serves as the sales tax permit in Indiana. The RRMC costs $25, and there is an additional $1 fee if you apply online to cover processing fees.

How Long Does It Take to Get an Indiana Resale License?

It typically takes 10-17 business days to get an Indiana resale license. The first step is to apply for a Registered Retail Merchant Certificate. This can be done online through Indiana’s INBiz portal portal. Once you submit your application, you should receive confirmation within 3-5 business days. The actual certificate is then mailed out and typically arrives within 7-10 business days.

If you need to expedite the process, you can contact the Indiana Department of Revenue.

How Do I Get a Resale License Number in Indiana?

To obtain a resale license number in Indiana, you must first apply for a Registered Retail Merchant Certificate (RRMC). This certificate serves as your sales tax permit and is necessary for conducting retail business in the state. Here’s how to get it:

- Register Your Business: Begin by registering your business with the Indiana Department of Revenue through the INBiz portal. This involves providing essential business information such as your federal tax ID (EIN), legal business name, and contact details.

- Apply for the RRMC: Once registered, apply for the Registered Retail Merchant Certificate. This certificate provides you with an Indiana Tax ID number, which is necessary for obtaining a resale certificate.

- Complete the Resale Certificate (Form ST-105): After receiving your RRMC, you can fill out the Indiana General Sales Tax Exemption Certificate (Form ST-105) to use as your resale certificate. This form allows you to purchase goods without paying sales tax, provided they are intended for resale.

The process is straightforward, and you typically receive your certificate within 7-10 business days after application.

How to Verify an Indiana Sales Tax Resale Certificate?

To verify an Indiana sales tax resale certificate, follow these steps:

- Obtain the certificate number: Get the nine-digit number from the seller.

- Contact or Visit the Indiana Department of Revenue website: Go to https://www.in.gov/dor/ or call them at 1-800-968-6448

- Access the resale certificate verification tool: Look for a tool labeled “Sales Tax Resale Certificate Verification”.

- Enter the certificate number: Input the nine-digit number into the designated field.

- Review the verification results: The tool will display whether the certificate is valid or invalid. If valid, it will show the seller’s name and business address.

Section 3: Understanding Indiana Sales Tax Rates

Illinois imposes a state sales tax of 2.9%. However, local jurisdictions often add additional taxes, resulting in varying rates across the state. To calculate the total sales tax for a specific item or location, you can use online tax calculators or consult local government websites.

This guide provides detailed information on Illinois’s sales tax, including county-by-county breakdowns, exemptions, and other important considerations. Whether you’re a business owner or a consumer, understanding sales tax is essential for accurate financial planning and compliance.

What is Indiana Sales Tax Rate?

Indiana has a flat statewide sales tax rate of 7%. This means that no matter where you make a purchase in the state, you’ll pay the same sales tax rate. There are no additional local sales taxes in Indiana. This makes it easy to calculate your total cost when shopping.

How to Find or Lookup Your Indiana Sales Tax Rate?

Finding the sales tax rate in Indiana is straightforward since it is a flat rate of 7% across the state. You don’t need to worry about different rates in different localities because Indiana does not impose local sales taxes.

However, if you want to confirm this rate or see it applied in practice, you can use various online tools, such as sales tax calculators available from resources like AtomicTax. These tools allow you to input your purchase details to see the exact tax amount.

How to Calculate Indiana Sales Tax Rate?

To calculate the Indiana sales tax rate for a specific item or transaction, follow these steps:

- Determine the item’s taxable status: Not all items are subject to sales tax in Indiana. Generally, tangible personal property sold at retail is taxable, while services are not. Certain items, such as groceries and prescription medications, may be exempt from sales tax.

- Identify the applicable tax rate: The sales tax rate in Indiana varies by county and municipality. You can find the tax rate for your location on the Indiana Department of Revenue website or by contacting your local tax office.

- Calculate the tax amount: Multiply the taxable price of the item by the applicable sales tax rate to determine the tax amount. For example, if the taxable price of an item is $100 and the sales tax rate is 7%, the tax amount would be $7.

- Add the tax to the price: Add the tax amount to the taxable price to determine the total price of the item, including sales tax.

Example:

If you purchase a $50 shirt in a county with a 7% sales tax rate, the total price would be calculated as follows:

- Tax amount = $50 x 0.07 = $3.50

- Total price = $50 + $3.50 = $53.50

Therefore, the total price of the shirt, including sales tax, would be $53.50..

What City Has the Highest Sales Tax Rate in Indiana?

The sales tax rate in Indiana is a flat 7% statewide. There are no additional local sales taxes, so this rate applies equally in all cities and counties, including major ones like Indianapolis, Fort Wayne, Evansville, and Lafayette.

Indiana Sales Tax by County and Zip Codes

There are 92 counties in Indiana. Since Indiana has a flat sales tax rate of 7% that applies uniformly across all counties and zip codes, there is no variation in sales tax rates by location. Whether you’re in Marion County (home to Indianapolis) or any other county in the state, the sales tax remains consistent at 7%.

Following is the table that shows the uniform sales tax rate for each county and their respective zip codes:

| County Name | Tax Rate | Primary ZIP Codes |

| Adams County | 7% | 46733, 46740, 46772 |

| Allen County | 7% | 46802, 46804, 46805 |

| Bartholomew County | 7% | 47201, 47203, 47232 |

| Benton County | 7% | 47922, 47944, 47948 |

| Blackford County | 7% | 47348, 47359 |

| Boone County | 7% | 46052, 46075, 46112 |

| Brown County | 7% | 46160, 47448, 47471 |

| Carroll County | 7% | 46917, 46920, 46923 |

| Cass County | 7% | 46947, 46950, 46994 |

| Clark County | 7% | 47111, 47119, 47130 |

| Clay County | 7% | 47834, 47841, 47853 |

| Clinton County | 7% | 46041, 46050, 46058 |

| Crawford County | 7% | 47118, 47123, 47140 |

| Daviess County | 7% | 47501, 47553, 47558 |

| De Kalb County | 7% | 46706, 46721, 46730 |

| Dearborn County | 7% | 47001, 47025, 47040 |

| Decatur County | 7% | 47240, 47261, 47283 |

| Delaware County | 7% | 47302, 47304, 47305 |

| Dubois County | 7% | 47546, 47547, 47549 |

| Elkhart County | 7% | 46514, 46516, 46526 |

| Fayette County | 7% | 47331, 47357, 47362 |

| Floyd County | 7% | 47119, 47122, 47129 |

| Fountain County | 7% | 47918, 47952, 47987 |

| Franklin County | 7% | 47012, 47024, 47030 |

| Fulton County | 7% | 46910, 46931, 46975 |

| Gibson County | 7% | 47601, 47615, 47616 |

| Grant County | 7% | 46952, 46953, 46986 |

| Greene County | 7% | 47424, 47438, 47457 |

| Hamilton County | 7% | 46032, 46033, 46038 |

| Hancock County | 7% | 46140, 46154, 46186 |

| Harrison County | 7% | 47112, 47160, 47164 |

| Hendricks County | 7% | 46112, 46123, 46167 |

| Henry County | 7% | 47362, 47344, 47352 |

| Howard County | 7% | 46901, 46902, 46903 |

| Huntington County | 7% | 46750, 46792, 46783 |

| Jackson County | 7% | 47220, 47274, 47281 |

| Jasper County | 7% | 46310, 46374, 47943 |

| Jay County | 7% | 47326, 47369, 47371 |

| Jefferson County | 7% | 47250, 47270, 47243 |

| Jennings County | 7% | 47265, 47273, 47232 |

| Johnson County | 7% | 46106, 46131, 46142 |

| Knox County | 7% | 47591, 47512, 47516 |

| Kosciusko County | 7% | 46580, 46582, 46555 |

| La Porte County | 7% | 46350, 46360, 46391 |

| Lagrange County | 7% | 46761, 46767, 46795 |

| Lake County | 7% | 46307, 46308, 46319 |

| Lawrence County | 7% | 47421, 47446, 47470 |

| Madison County | 7% | 46011, 46012, 46064 |

| Marion County | 7% | 46201, 46202, 46203 |

| Marshall County | 7% | 46563, 46501, 46537 |

| Martin County | 7% | 47581, 47522, 47553 |

| Miami County | 7% | 46970, 46926, 46951 |

| Monroe County | 7% | 47401, 47404, 47408 |

| Montgomery County | 7% | 47933, 47989, 47940 |

| Morgan County | 7% | 46151, 46158, 46166 |

| Newton County | 7% | 46310, 46349, 47922 |

| Noble County | 7% | 46755, 46767, 46784 |

| Ohio County | 7% | 47018, 47040, 47043 |

| Orange County | 7% | 47454, 47469, 47432 |

| Owen County | 7% | 47431, 47460, 47427 |

| Parke County | 7% | 47872, 47862, 47868 |

| Perry County | 7% | 47520, 47525, 47576 |

| Pike County | 7% | 47598, 47564, 47585 |

| Porter County | 7% | 46304, 46383, 46385 |

| Posey County | 7% | 47620, 47633, 47616 |

| Pulaski County | 7% | 46996, 46985, 46978 |

| Putnam County | 7% | 46135, 46120, 46121 |

| Randolph County | 7% | 47394, 47373, 47340 |

| Ripley County | 7% | 47006, 47037, 47263 |

| Rush County | 7% | 46173, 46176, 47331 |

| Scott County | 7% | 47170, 47102, 47138 |

| Shelby County | 7% | 46176, 46126, 46182 |

| Spencer County | 7% | 47579, 47611, 47635 |

| St. Joseph County | 7% | 46601, 46613, 46530 |

| Starke County | 7% | 46534, 46366, 46374 |

| Steuben County | 7% | 46703, 46737, 46779 |

| Sullivan County | 7% | 47882, 47879, 47855 |

| Switzerland County | 7% | 47043, 47040, 47038 |

| Tippecanoe County | 7% | 47906, 47909, 47901 |

| Tipton County | 7% | 46072, 46069, 46031 |

| Union County | 7% | 47353, 47003, 47394 |

| Vanderburgh County | 7% | 47708, 47711, 47715 |

| Vermillion County | 7% | 47842, 47854, 47885 |

| Vigo County | 7% | 47802, 47803, 47805 |

| Wabash County | 7% | 46992, 46940, 46943 |

| Warren County | 7% | 47918, 47993, 47975 |

| Warrick County | 7% | 47601, 47610, 47637 |

| Washington County | 7% | 47167, 47108, 47125 |

| Wayne County | 7% | 47374, 47392, 47330 |

| Wells County | 7% | 46714, 46777, 46791 |

| White County | 7% | 47960, 47995, 47926 |

| Whitley County | 7% | 46725, 46787, 46764 |

Section 4: Registering for Sales Tax Permits in Indiana

This section provides a step-by-step guide to obtaining a Illinois Sales Tax Permit. We cover who needs one, how to apply online or in person, and the necessary information. You’ll also learn about the permit process, the difference between a sales tax ID and permit, and when out-of-state businesses must collect Illinois sales tax. While the permit itself is free, there may be associated costs.

Do You Need to Register for Sales Tax in Indiana?

Yes, you need to register for sales tax in Indiana if you meet any of the following criteria:

You have a physical presence in Indiana, such as a store, office, or warehouse. You sell tangible personal property to Indiana residents, even if you don’t have a physical presence in the state. You solicit sales in Indiana, such as through advertising, catalogs, or websites. You have an affiliate program in Indiana.

Once registered, you will be issued a Registered Retail Merchant Certificate (RRMC), which allows you to legally collect and remit sales tax in the state.

How Much Does It Cost to Get an Indiana Seller’s Permit?

The cost to obtain a sales tax permit in Indiana is $25. If you register online, there is an additional $1 fee for processing, making it $26 in total. The good news is that this registration fee is a one-time cost, and the RRMC will automatically renew every two years at no additional charge, provided your account remains in good standing.

How to Register for Sales Tax in Indiana?

To register for a sales tax permit in Indiana, you can either apply online through the INBiz portal or submit a paper application (Form BT-1). The online application process is generally faster, with confirmation typically provided within 48 hours, and your certificate arriving within 7-10 business days. Once you receive your RRMC, you can set up your account on Indiana’s INtax system for easy management of your sales tax filings.

If you need assistance during the registration process, you can contact the Indiana Department of Revenue or use a professional service like TaxValet to handle the registration on your behalf.

How to Get a Sales Tax ID in Indiana?

To obtain a sales tax ID in Indiana, you’ll need to apply for a Registered Retail Merchant Certificate (RRMC). This certificate is necessary for any business selling taxable goods or services in the state.

You can register for the RRMC through the INBiz portal, which is Indiana’s online resource for business registration and tax filings. The process involves providing essential business details, including your business name, address, and Federal Employer Identification Number (EIN). The registration fee is $25, and you’ll typically receive your certificate within 7-10 business days.

Does Indiana Sales Tax Apply to Out-of-State Purchases?

Yes, Indiana sales tax applies to out-of-state purchases if the seller is located in Indiana or if the item is delivered to an Indiana address. This is because Indiana has a destination-based sales tax system, which means that the tax is based on the location where the item is delivered or used.

If you are an Indiana resident and you make a purchase from an out-of-state seller, you are generally responsible for paying the Indiana sales tax on the purchase. However, there are some exceptions to this rule, such as when the item is purchased for resale or for use in a business.

It is important to note that the sales tax rate in Indiana varies depending on the location where the item is delivered or used. You can find the sales tax rate for your location on the Indiana Department of Revenue website.

Additionally, if you are an Indiana resident and you make a purchase from an out-of-state seller that does not collect Indiana sales tax, you may be required to file an Indiana sales tax return and pay the tax yourself.

Section 5: Setting Up Your Online Store, Recordkeeping, and Calculating Sales Tax in Indiana

This section covers how to calculate sales tax, including state and local rates. We’ll also discuss sales tax for eBay sellers and how the platform handles these calculations. Finally, we’ll guide you through calculating sales tax for car purchases in Illinois, explaining the specific tax rates and steps involved.

How do I Calculate Sales Tax in Indiana?

Calculating sales tax in Indiana is straightforward due to the state’s uniform tax rate. Indiana has a flat statewide sales tax rate of 7%, which applies to most goods and services sold within the state.

To calculate the sales tax, you simply multiply the purchase price of the taxable item by 7%. For example, if you’re purchasing an item that costs $100, the sales tax would be $7, making the total amount $107.

For businesses selling online, it’s important to apply this rate to all taxable sales made to Indiana customers. Tools like the Atomic Sales Tax Calculator can help you quickly determine the correct tax amount for each sale.

eBay Sales Tax Indiana Calculator

If you’re selling on eBay and need to calculate sales tax for Indiana buyers, eBay automatically handles sales tax calculation and collection for you. eBay uses the same 7% sales tax rate for all purchases shipped to Indiana addresses. The sales tax is automatically added to the total sale amount during the checkout process, ensuring that both you and the buyer are compliant with Indiana sales tax laws.

How to Calculate Sales Tax on a Car in Indiana?

In Indiana, the sales tax on vehicles is set at a flat rate of 7% of the purchase price. This applies to both new and used cars. When calculating the sales tax for a vehicle, the process involves several steps:

- Determine the Purchase Price: Start with the total selling price of the vehicle. This price should include any additional costs like dealer-installed options but exclude dealer rebates. However, if there is a trade-in involved, you can subtract the value of the trade-in from the purchase price before calculating the tax.

- Apply the Sales Tax Rate: Multiply the final purchase price (after subtracting the trade-in value, if applicable) by 7%.

For example, if you’re buying a car priced at $20,000 and have a trade-in valued at $5,000, the taxable amount would be $15,000.

The sales tax would then be $15,000 × 7% = $1,050.

- Include Additional Fees: Remember that when purchasing a vehicle, you’ll also need to account for additional fees like registration, title, and license plate fees, which are separate from the sales tax but will affect your total cost.

Reverse Sales Tax Calculator for Indiana

A reverse sales tax calculator is useful when you know the total amount paid for an item (including tax) and need to determine the original price before tax. This can be particularly handy when you want to break down a total cost to see how much of it was sales tax.

To calculate the original price before tax using a reverse sales tax method in Indiana:

- Determine the Total Price: Start with the total amount paid, including sales tax.

- Calculate the Pre-Tax Price: Divide the total price by 1 plus the tax rate in decimal form. In Indiana, this would be dividing by 1.07.

For example, if the total price (including tax) was $1,070, you would calculate the pre-tax price as follows: $1,070 ÷ 1.07 = $1,000.

- Calculate the Sales Tax: Subtract the pre-tax price from the total price to find out how much of the total was tax: $1,070 – $1,000 = $70.

These steps allow you to accurately determine both the pre-tax price and the amount of sales tax included in a transaction.

Section 6: Charging & Collecting Sales Tax in Indiana

What Does It Mean to Charge Sales Tax vs. Collect Sales Tax?

Charging sales tax refers to the process of adding the applicable sales tax amount to the purchase price of a taxable item or service at the point of sale. In Indiana, this typically involves adding the state’s 7% sales tax rate to the sales price of most tangible goods and certain services.

Collecting sales tax, on the other hand, involves gathering this tax from the customer during the sale. Once collected, the business is responsible for holding this tax and remitting it to the Indiana Department of Revenue. Failure to correctly charge or collect sales tax can lead to penalties, so it’s important to understand your obligations as a seller.

When to Charge Sales Tax in Indiana

In Indiana, you are required to charge sales tax on all taxable goods and services sold to customers within the state. This includes most tangible personal property, certain services like installation and repairs, and digital products delivered electronically. You should charge sales tax when:

- The Item or Service is Taxable: Most physical goods are taxable in Indiana, but some services and specific goods, like groceries or prescription drugs, are exempt.

- The Sale Occurs in Indiana: If the sale is made to a customer in Indiana, you must charge the state’s 7% sales tax.

- The Sale Meets Nexus Requirements: If you have a physical presence (such as a store or warehouse) or meet the economic nexus threshold in Indiana (e.g., over $100,000 in sales in the state), you must charge sales tax.

How to Charge and Collect Sales Tax in Indiana

To properly charge and collect sales tax in Indiana, follow these steps:

- Register for a Sales Tax Permit: Before you can start collecting sales tax, you must register with the Indiana Department of Revenue and obtain a Registered Retail Merchant Certificate (RRMC). This certificate authorizes your business to collect sales tax.

- Determine Taxable Sales: Identify which of your products or services are taxable under Indiana law. This generally includes tangible personal property and some services.

- Apply the Correct Rate: Add the 7% sales tax to the total sales price of taxable items. If you offer discounts, only the discounted price is subject to tax.

- Collect the Tax from Customers: At the point of sale, ensure that the correct amount of sales tax is collected from the customer. This tax should be clearly listed on the receipt.

- Remit the Collected Tax: Periodically (usually monthly or annually, depending on your filing frequency), you must remit the collected sales tax to the Indiana Department of Revenue using the INTIME portal or another authorized payment method.

- Maintain Accurate Records: Keep detailed records of all sales, the amount of tax collected, and any exemptions claimed by customers. This is crucial for filing accurate tax returns and for potential audits.

Does Indiana Collect Sales Tax on Out-of-State Sales?

Indiana follows the principle of “destination-based” sales tax, meaning that sales tax is collected based on the location of the buyer. For businesses that are located in Indiana but sell products to customers in other states, Indiana does not collect sales tax on those out-of-state sales.

Instead, the business may be required to collect sales tax for the state where the product is delivered, depending on whether the business has a sales tax nexus in that state.

A nexus could be established through physical presence, economic activity, or participation in a marketplace that meets the other state’s thresholds.

Do Contractors Charge Sales Tax on Labor in Indiana?

In Indiana, the sales tax rules for contractors are specific. Generally, contractors are considered the final consumers of materials used in construction, meaning they pay sales tax when purchasing those materials, but do not charge sales tax on the labor associated with their services.

However, if a contractor also sells tangible personal property as part of their service (e.g., installing a new appliance), the contractor must charge sales tax on the sale of the item itself, but not on the installation labor.

Does Indiana Charge Sales Tax on Shipping?

Yes, Indiana requires that sales tax be applied to shipping and handling charges if the goods being shipped are taxable. If the items sold are subject to sales tax, then any related shipping charges must also be taxed.

Conversely, if the goods being shipped are exempt from sales tax, then the shipping charges would also be exempt. This rule applies regardless of whether the shipping costs are separately stated or included in the price of the goods.

Does Indiana Charge Sales Tax on Services?

In Indiana, most services are not subject to sales tax. The state’s tax laws primarily focus on the sale of tangible personal property. However, there are exceptions. Certain services that are closely tied to the sale of taxable goods, such as installation or repair services, can be taxable if they are included in the final price of a product.

For example, if a contractor charges for installing a product they’ve sold, the installation service might be taxable along with the product. On the other hand, standalone labor or services that do not involve the transfer of tangible property are generally exempt from sales tax in Indiana.

Does Indiana Charge Sales Tax on Food?

Indiana has a specific approach to taxing food items. Generally, unprepared food and grocery items are exempt from sales tax, which includes items like fresh produce, dairy products, and bread. However, prepared foods, such as those sold in restaurants or ready-to-eat items from grocery stores, are subject to sales tax at the standard rate of 7%.

Additionally, beverages, candy, and dietary supplements are also taxable. It’s essential for businesses that sell both taxable and non-taxable food items to accurately categorize these products to comply with state tax laws.

Do Photographers Charge Sales Tax in Indiana?

Yes, photographers in Indiana are required to charge sales tax on the tangible products they sell, such as prints, albums, and framed photos. This is because these items are considered tangible personal property.

However, the services involved in creating these products, such as the photography session itself, are generally not taxable unless the charges for the tangible goods are bundled together with the service charges and the tangible goods portion exceeds 10% of the total bill. If a photographer sells digital images delivered electronically without any physical media, these sales may not be subject to sales tax.

Photographers must carefully itemize their invoices to distinguish between taxable goods and non-taxable services.

Does Amazon Charge Sales Tax in Indiana?

Yes, Amazon charges sales tax on purchases made by Indiana residents. Since 2014, Amazon has been collecting and remitting sales tax in Indiana due to the company’s physical presence in the state, including several distribution centers.

This means that when you purchase an item on Amazon and have it shipped to an address in Indiana, the state’s 7% sales tax is automatically added to your purchase.

Does eBay Charge Sales Tax in Indiana?

eBay also collects and remits sales tax for purchases made in Indiana. This is due to marketplace facilitator laws, which require large online marketplaces like eBay to collect sales tax on behalf of sellers for transactions where the buyer is located in a state with such laws.

Indiana is one of these states, so if you buy something on eBay and it’s shipped to an Indiana address, eBay will add the appropriate 7% sales tax to your purchase during checkout.

Does Wayfair Charge Sales Tax in Indiana?

Similarly, Wayfair, following the Supreme Court’s decision in the South Dakota v. Wayfair case, collects and remits sales tax for purchases made by Indiana residents.

This is because Indiana, like many other states, implemented economic nexus laws after the Wayfair decision, requiring remote sellers to collect sales tax if they exceed certain thresholds. Since Wayfair is a major online retailer with significant sales into Indiana, it automatically charges the state’s 7% sales tax on orders shipped to Indiana.

Do You Charge Sales Tax on Rental Equipment in Indiana?

Yes, rental equipment in Indiana is generally subject to sales tax. The tax applies to most types of tangible personal property rentals, including tools, machinery, and other equipment.

When you rent out equipment, you must collect the standard 7% sales tax from your customers. Additionally, if the rental is for certain types of heavy equipment, it might also be subject to an excise tax, depending on the specific type of equipment and rental terms.

Can You Charge Sales Tax on Delivery in Indiana?

In Indiana, sales tax also applies to delivery charges if the goods being delivered are taxable. This means that if you sell a taxable item and charge for its delivery, you must include the delivery fee when calculating the total sales tax. However, if the items being shipped are not subject to sales tax (e.g., exempt items like certain groceries), then the delivery charge would also be exempt from sales tax.

These regulations are important for ensuring compliance with Indiana’s tax laws, whether you’re renting equipment or selling and delivering goods to customers. Always make sure to include these taxes in your billing to avoid any legal complications.

Do I Charge Sales Tax to Non-Profits in Indiana?

In Indiana, nonprofit organizations may be exempt from collecting sales tax, but this depends on their classification and the amount of sales they generate.

As of July 1, 2023, Indiana law exempts certain nonprofits—such as churches, monasteries, and public schools—from collecting sales tax on sales of tangible personal property, regardless of the amount sold. However, other types of nonprofits, like charities and educational organizations, must collect and remit sales tax if their annual sales exceed $100,000.

If a nonprofit exceeds the $100,000 threshold in a given year, it must register with the Indiana Department of Revenue and begin collecting sales tax on subsequent sales. This threshold applies to cumulative sales across all fundraising activities within a calendar year. For nonprofits that fall below this threshold, no sales tax collection is required.

Do Restaurants Charge Sales Tax in Indiana?

Yes, restaurants in Indiana are required to charge sales tax on the sale of prepared food and beverages. The state sales tax rate is 7%, which is applied to the total bill. This includes all food items, beverages (including alcoholic drinks), and any other taxable goods sold by the restaurant.

Additionally, some local jurisdictions in Indiana may impose an additional food and beverage tax on top of the state sales tax, which could increase the overall tax rate for customers dining out.

Section 7: Reporting, Paying, Filing & Indiana Remitting Sales Tax Returns

This section clarified the key distinctions between reporting, paying, filing, and remitting sales tax. We outlined who owes sales tax, how and when to pay it, and the deadlines for filing tax returns. Common misconceptions about sales tax, such as whether wholesalers or individuals buying homes are subject to it, were also addressed.

What is Sales Tax Reporting vs. Payment vs. Filing vs. Remittance?

When managing sales tax in Indiana, it’s important to understand the differences between reporting, payment, filing, and remittance:

- Sales Tax Reporting: This refers to the process of documenting and summarizing the sales transactions that have taken place during a specific period. Businesses must report the total sales, taxable sales, and the amount of tax collected to the Indiana Department of Revenue (DOR).

- Sales Tax Payment: Payment involves transferring the collected sales tax from the business to the state. After collecting sales tax from customers, businesses hold these funds until it’s time to remit them to the DOR.

- Sales Tax Filing: Filing is the submission of a sales tax return, which details your sales, the amount of tax collected, and any deductions or exemptions. In Indiana, sales tax returns must be filed either monthly or annually, depending on the volume of sales.

- Sales Tax Remittance: Remittance is the final step where you actually send the collected sales tax to the state. Filing and remittance are often done simultaneously through the DOR’s online portal.

Who Pays Sales Tax in Indiana?

In Indiana, the sales tax is ultimately paid by the consumer. However, the responsibility for collecting and remitting this tax lies with the retailer or service provider.

Businesses with a physical or economic presence (nexus) in Indiana must collect sales tax on all taxable sales and submit it to the state. This includes both in-state businesses and out-of-state businesses that meet Indiana’s economic nexus threshold.

When to Pay Sales Tax in Indiana?

The timing for paying sales tax in Indiana depends on your assigned filing frequency, which is determined by the volume of tax you collect:

- Monthly Filers: Businesses that average more than $1,000 in sales tax liability per month must file and pay their sales tax by the 20th of the following month.

- Annual Filers: Businesses with a smaller tax liability may file and pay sales tax annually, with the deadline typically being the 30th of the month following the end of the calendar year.

If a due date falls on a weekend or holiday, the deadline is extended to the next business day. Failure to file and remit sales tax on time can result in penalties and interest charges.

Where Do I Pay Indiana Sales Tax?

In Indiana, sales tax is paid through the Indiana Department of Revenue’s (DOR) online portal known as INTIME. This portal allows businesses to file their sales tax returns and make payments electronically. If you prefer, you can also mail a check to the DOR, but using INTIME is the most efficient method for ensuring timely payment and filing.

How to Pay Sales Tax in Indiana?

To pay your sales tax in Indiana, follow these steps:

- Log into the INTIME Portal: Access the INTIME portal and log in using your credentials. If you haven’t created an account yet, you’ll need to do so using your Registered Retail Merchant Certificate (RRMC) details.

- File Your Sales Tax Return: After logging in, navigate to the “File Form ST-103” section to submit your sales tax return. You’ll need to enter your total sales, any deductions, and the sales tax amount you owe.

- Make the Payment: Once your return is submitted, you can proceed to make the payment. The portal allows you to pay via electronic funds transfer (EFT), credit card, or debit card. Ensure that the payment is scheduled to be processed on or before the due date to avoid penalties.

How to File Sales and Use Tax in Indiana?

In Indiana, sales tax is applied to the retail sale of most goods and certain services. Businesses that sell taxable goods or services in the state are required to collect sales tax from their customers and remit it to the Indiana Department of Revenue (DOR).

Use tax complements sales tax by applying to purchases made outside of Indiana where sales tax was not collected but the item is used, stored, or consumed within the state. This ensures that all goods consumed in Indiana are taxed equally, whether purchased in-state or out-of-state.

For example, if an Indiana business buys equipment from another state without paying sales tax, they must pay use tax on that purchase when bringing it into Indiana.

What is the Deadline to Pay Sales Taxes in Indiana?

Indiana requires businesses to pay sales tax based on their assigned filing frequency, which can be monthly, quarterly, or annually. The sales tax due dates are as follows:

- Monthly Filers: Sales tax must be paid by the 20th of the following month. For example, sales tax for January is due by February 20th.

- Quarterly Filers: Payments are due by the 20th of the month following the end of the quarter. For example, sales tax for Q1 (January – March) is due by April 20th.

- Annual Filers: For those filing annually, the sales tax deadline is generally January 30th of the following year.

If a due date falls on a weekend or holiday, the deadline is extended to the next business day. Ensuring you meet these deadlines is crucial to avoid penalties and interest.

Do Nonprofits Pay Sales Tax on Purchases in Indiana?

In Indiana, qualified nonprofit organizations can be exempt from paying sales tax on purchases, but only if they meet certain conditions:

- Obtain a Sales Tax Exemption Certificate: Nonprofits must apply for and receive a sales tax exemption certificate (Form NP-1) from the Indiana Department of Revenue. This certificate must be provided to vendors to avoid paying sales tax on qualifying purchases.

- Qualified Purchases: The items purchased must be used directly for the nonprofit’s exempt purpose. Additionally, the purchases must be invoiced directly to and paid for by the nonprofit entity.

However, not all nonprofits are automatically exempt. Those that exceed certain sales thresholds (e.g., $100,000 in taxable sales) may need to collect and remit sales tax on their own sales, though their purchases may remain exempt.

Do Wholesalers Pay Sales Tax in Indiana?

In Indiana, wholesalers do not pay sales tax on items they purchase for resale. This is because wholesalers typically buy products in bulk to sell to retailers or directly to consumers. To avoid paying sales tax, wholesalers must present a valid resale certificate (Form ST-105) to their suppliers at the time of purchase. This certificate indicates that the goods are being purchased for resale, not for personal or business use, and therefore are exempt from sales tax.

Do You Pay Sales Tax on a Leased Car in Indiana?

Yes, in Indiana, sales tax is charged on leased vehicles. The tax is applied to the lease payments rather than the full value of the vehicle. Indiana’s sales tax rate of 7% is applied to the monthly lease payment amount.

Additionally, the initial down payment or any trade-in credit that reduces the lease cost is also subject to sales tax. The sales tax must be collected by the leasing company and remitted to the Indiana Department of Revenue.

Do You Pay Sales Tax When You Buy a House in Indiana?

In Indiana, purchasing a house is not subject to sales tax. Real estate transactions, including the sale of residential and commercial properties, are exempt from sales tax.

However, other fees, such as property taxes, recording fees, and possibly a real estate transfer tax, may apply when buying a house. These fees are handled separately from sales tax and are paid as part of the closing process when purchasing real estate.

Section 8: Understanding Indiana Sales Tax Holidays and Refunds in Indiana

This section provides information on Illinois’s sales tax refunds and annual sales tax holiday. We cover who is eligible for sales tax refunds, including foreigners, and outline the refund process. Additionally, we explain the purpose of the sales tax holiday and detail the types of items typically exempt from tax during this event.

Does Indiana Do Sales Tax Refunds?

Yes, Indiana does offer sales tax refunds. If you’ve overpaid sales tax on a purchase, you may be eligible for a refund. This can occur for various reasons, such as purchasing an exempt item or returning a product.

To claim a refund, you’ll need to submit a claim to the Indiana Department of Revenue. Make sure to provide all necessary documentation, including receipts and a completed refund form. The department will review your claim and process the refund if it’s valid and can be verified.

Does Indiana Refund Sales Tax to Foreigners?

Indiana does not offer sales tax refunds to international visitors. This means that international travelers cannot claim back the sales tax they pay on purchases made within the state. Unlike some states like Texas and Louisiana. that provide refunds to tourists, Indiana’s sales tax policies are generally non-refundable unless specific conditions are met, such as a return of the purchased item or a billing error.

Once you’ve paid sales tax in Indiana, it’s generally not refundable unless the item is returned or there’s a billing mistake. So, if you’re a tourist or foreign national shopping in Indiana, you won’t be able to claim back the sales tax you’ve paid.

Is It Illegal Not to Refund Sales Tax in Indiana?

No, it is not illegal for businesses in Indiana to refuse a sales tax refund unless the refund request meets specific legal criteria. Generally, if a refund is requested for a returned item, the merchant is required to refund both the purchase price and the sales tax. However, if the sale was final or the item is ineligible for a refund, the sales tax may not be refunded.

How to Claim a Sales Tax Refund in Indiana?

To claim a sales tax refund in Indiana, you must file a Claim for Refund (Form GA-110L) with the Indiana Department of Revenue (DOR). This form requires detailed information, including the amount of tax paid, the reason for the refund request, and supporting documentation like receipts or invoices. Refunds are typically processed within 60 to 90 days after the DOR receives a complete and accurate claim.

Here are some additional tips for claiming a sales tax refund in Indiana:

- File your claim as soon as possible after you discover that you have overpaid or mistakenly paid sales tax.

- Make sure that all of the information on your claim is accurate and complete.

- Keep copies of all of the documentation that you submit with your claim.

- If your claim is denied, you may be able to appeal the decision.

Does Indiana Give Sales Tax Holidays?

No, Indiana does not currently offer sales tax holidays. Unlike some other states that temporarily waive sales tax on certain items like school supplies or emergency preparedness products, Indiana does not have any scheduled tax-free weekends or holidays in 2024.

Sales tax holidays are periods during which specific items can be purchased without paying the usual sales tax, and they are often used by states to encourage spending in certain sectors or to provide financial relief to consumers.

However, this incentive is not available in Indiana, so residents and businesses should plan for the standard 7% sales tax on all eligible purchases throughout the year.

Section 9: Understanding Indiana Sales Tax Audits and Penalties in Indiana

This section explores the potential consequences of delaying sales tax payments and the risks associated with sales tax audits. We discussed penalties for late payments, factors that trigger audits, and options for potential relief. By understanding these risks, you can take steps to ensure your business remains compliant and protected.

What is the Penalty for Paying Sales Tax Late in Indiana?

The penalty for late payment of sales tax in Indiana is 10% of the unpaid tax liability or a minimum of $5, whichever is greater. If the failure to file or pay is determined to be fraudulent, the penalty can be as high as 100% of the unpaid tax amount. Additionally, interest is charged on any overdue taxes from the due date until the tax is paid in full.

Does Indiana Do Sales Tax Audits?

Yes, Indiana conducts sales tax audits. The Indiana Department of Revenue (DOR) regularly audits businesses that collect and remit sales tax to verify the accuracy of their tax filings. These audits are a routine part of the DOR’s efforts to maintain compliance and are typically triggered by discrepancies or patterns that suggest underreporting or misreporting of sales tax.

If you are a business owner in Indiana, it is important to be aware of the state’s sales tax audit procedures. This will help you ensure that your business is compliant with tax laws and avoid any potential penalties.

What Triggers a Sales Tax Audit in Indiana?

Several factors can trigger a sales tax audit in Indiana:

- High Volume of Exempt Sales: If a business reports a high percentage of sales as tax-exempt, this can raise red flags for the DOR, especially if the exemptions are not adequately documented.

- Consistent Late Payments: Regularly paying sales tax late or failing to file returns on time can increase the likelihood of an audit.

- Large Discrepancies: Significant discrepancies between reported sales and income on other tax forms, such as income tax returns, can also trigger an audit.

- Random Selection: Sometimes, businesses are selected for audits randomly as part of the DOR’s regular compliance checks.

What is the Penalty for an Audit After the Due Date in Indiana?

The penalty for an audit after the due date in Indiana can be severe. If the audit reveals additional tax liabilities, the standard penalty for late payment of sales tax is 10% of the unpaid tax due or $5, whichever is greater. However, if the audit reveals negligence, such as failing to report the correct amount of tax or not keeping adequate records, the penalties can increase substantially. Negligence penalties may range from 20% to 50% of the additional tax due, and in cases of fraud, the penalty can be up to 100% of the unpaid tax.

What is Indiana Sales Tax Penalty Waiver?

An Indiana Sales Tax Penalty Waiver allows businesses to potentially avoid paying penalties for late filing or non-payment of sales taxes. To qualify, businesses must demonstrate “reasonable cause” for their failure to comply with tax laws. This could include factors such as natural disasters, unexpected staffing shortages, or sudden illness.

To request a waiver, businesses must submit a written request to the Indiana Department of Revenue, explaining the circumstances and providing supporting documentation. The department may grant a full or partial waiver based on the merits of the case and the taxpayer’s compliance history.

Section 10: Indiana Sales Tax Software – AtomicTax

Imagine handling your Indiana sales tax obligations with zero stress—no more manual calculations, missed deadlines, or compliance worries. With AtomicTax, your sales tax management becomes a breeze, even in a state like Indiana, where there are no local taxes to complicate things.

Why Consider AtomicTax Ecommerce Sales Tax Software?

Automated Tax Calculation: AtomicTax automatically calculates the correct sales tax for every transaction based on Indiana’s 7% rate, eliminating manual errors and ensuring compliance.

Real-Time Tax Updates: Stay compliant with the latest tax laws. AtomicTax updates tax rates and regulations in real-time, so you’re always applying the most current rates without needing to track changes manually.

Comprehensive Reporting: Generate detailed reports on your sales tax liabilities, giving you clear insights into your tax obligations and simplifying the filing process. These reports are customizable to suit your business needs.

Seamless Integration: AtomicTax integrates effortlessly with your existing eCommerce platform, accounting software, or ERP system, ensuring a smooth workflow and reducing the need for manual data entry.

Automated Filing and Remittance: Save time and reduce stress with automated filing and remittance. AtomicTax handles the submission of your sales tax returns and payments, making sure you never miss a deadline.

User-Friendly Dashboard: The intuitive dashboard provides at-a-glance insights into your tax status, making it easy to monitor and manage your sales tax obligations without needing specialized tax knowledge.

Scalability: Whether you’re a small business or a large enterprise, AtomicTax scales with your business, offering flexible solutions that grow as your needs evolve.

Dedicated Support: Get access to a team of tax professionals ready to assist you with any questions or issues, ensuring that you’re never alone in managing your sales tax responsibilities.

Ready to simplify your sales tax process and ensure compliance effortlessly? Explore AtomicTax e-commerce sales tax software and discover how easy sales tax management can be!

Conclusion

This guide has taken you through every crucial aspect of managing sales tax in Indiana, empowering you to make informed decisions. But knowledge alone isn’t enough—it’s the application of this knowledge that will truly set your business apart.

As you implement the practices outlined here, take a moment to consider the broader impact: the trust you’ll build with your customers, the peace of mind you’ll gain from knowing your compliance is solid, and the time you’ll save that can be reinvested into growing your business.

Indiana’s tax landscape may be straightforward, but the true advantage lies in how you leverage this simplicity to your benefit. As you move forward, keep refining your approach, stay informed of any changes in regulations, and continue to prioritize accuracy in your tax practices. This proactive mindset will not only keep you compliant but also drive your business toward sustained success.