Did you know that Kentucky is one of the few states that exempts groceries from sales tax? While many states impose taxes on essential items like food, Kentucky takes a more consumer-friendly approach, allowing its residents to stretch their dollars further when buying everyday necessities.

In this article, we’ll explore Kentucky’s simplified sales tax system, from understanding its flat rate to the exemptions and compliance requirements that affect both local businesses and online sellers. Whether you’re dealing with sales tax for the first time or looking for ways to optimize your process, this guide has got you covered.

Chapter 1: Determining Sales Tax Nexus in Kentucky

This chapter focuses on the fundamental concept of nexus, which is crucial for understanding sales tax obligations.

What is Sales Tax Nexus?

Nexus is a legal term that determines whether a business has a sufficient physical presence or economic activity within a state to be subject to that state’s sales tax laws. In simpler terms, it’s the connection between a business and a state that makes the business liable for collecting and remitting sales tax to that state.

Do You Need a Sales Tax Permit to Sell Online in and out of Kentucky?

If you have a sales tax nexus in Kentucky, you need to obtain a sales tax permit from the Kentucky Department of Revenue. This permit allows you to collect sales tax from Kentucky customers and file sales tax returns on your sales within the state.

Thus, whether you need a sales tax permit depends on whether you have a nexus in Kentucky.

What Triggers or Creates a Sales Tax Nexus in Kentucky?

There are two primary ways a business cantrigger or establish a nexus in Kentucky:

- Physical Nexus: This occurs when a business has a physical presence within the state, such as:

- Owning or leasing property

- Having employees or contractors

- Maintaining inventory or equipment

- Economic Nexus: Kentucky has an economic nexus law, which means a business can establish a nexus if it meets certain revenue or sales thresholds within the state.

- Inventory: Storing inventory in Kentucky.

- Affiliates: Having affiliates or subsidiaries based in Kentucky.

- Economic Nexus: Meeting Kentucky’s economic nexus threshold by exceeding a certain level of sales or revenue within the state.

What is Kentucky’s Sales Tax Economic Nexus Threshold?

The Kentucky economic nexus threshold is triggered when your sales into Kentucky exceed $100,000 or you have 200 or more separate transactions in the previous or current calendar year. This rule applies to both remote sellers and marketplace facilitators, ensuring that out-of-state businesses are compliant with Kentucky tax laws.

Kentucky’s economic nexus threshold is the amount of sales or revenue a business must generate from Kentucky customers to be considered to have a substantial economic presence in the state. The exact threshold may vary, but it is generally based on the total amount of sales or revenue generated from Kentucky customers within a specific period.

What is Kentucky’s Sales Tax Law on Remote Sellers and Online Sellers

If you’re an out-of-state seller (operating outside of Kentucky) selling online, and your online sales meet the economic nexus threshold, you are required to register for a Kentucky sales tax permit and collect and remit sales tax on your Kentucky sales. This is known as the nexus sales tax registration.

Key Points for Remote Sellers:

- Nexus Thresholds: Be aware of the specific economic nexus thresholds in Kentucky.

- Sales Tax Calculation: Use the correct sales tax rates for different Kentucky locations.

- Tax Returns: File your sales tax returns on time and accurately.

Kentucky Sales Tax Nexus Calculator

A Kentucky sales tax nexus calculator is an essential tool for businesses to determine whether they have established a nexus in the state. This calculator helps you assess whether your business activities have triggered the need to collect and remit sales tax in Kentucky.

By inputting key metrics such as total sales revenue and the number of transactions made in Kentucky, the calculator can help you quickly determine if you’ve crossed the economic nexus threshold of $100,000 in sales or 200 separate transactions within a year.

These calculators are particularly useful for remote sellers and e-commerce businesses that may not have a physical presence in the state but could still be liable for collecting Kentucky sales tax. They save time by automating the process of assessing compliance requirements and help businesses avoid costly penalties for failing to register for sales tax when required.

Many tax service providers and software platforms, such as AtomicTax, offer these calculators as part of their service packages. Using a reliable Kentucky sales tax nexus calculator ensures that your business remains compliant with Kentucky’s tax laws without the hassle of manual calculations.

Chapter 2: Sales Tax Exemptions and Resale Certificates

This chapter is divided into two sections. The first section covers sales tax exemptions, addressing who is exempt and the process of obtaining an exemption certificate. The second section focuses on resale certificates, explaining their purpose and how to obtain and verify them.

Section 1: Sales Tax Exemptions

Who Is Exempt From Sales Tax in Kentucky?

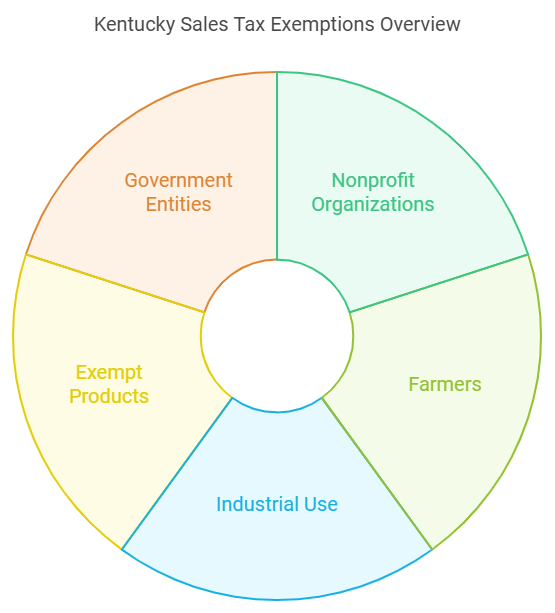

In Kentucky, various groups and types of transactions are exempt from sales tax. The most common exemptions include:

- Nonprofit Organizations: Educational, charitable, and religious institutions, along with Kentucky historical sites, are exempt from sales tax. These organizations must use the property or services exclusively for their exempt purposes, such as religious activities or educational functions.

- Farmers: Machinery used directly in farming, livestock feeds, seeds, and fertilizers are exempt from sales tax.

- Industrial Use: Machinery and equipment used in new and expanding industries, as well as oil and gas extraction equipment, are also exempt.

- Exempt Products: Certain goods like groceries, prescription medications, and security lighting are exempt from sales tax, ensuring that essential items remain untaxed for consumers.

- Government Entities: Sales made to federal, state, or local governments are generally exempt from sales tax in Kentucky.

To claim these exemptions, the buyer must present a valid Sales Tax Exemption Certificate to the seller at the time of purchase.

What Is a Sales Tax Exemption Certificate in Kentucky?

A Sales Tax Exemption Certificate in Kentucky is an official document that allows qualifying businesses or organizations to make purchases without paying sales tax. This certificate serves as proof that the purchase is for an exempt purpose, such as resale, nonprofit use, or industrial production.

To use an exemption certificate:

- Blanket vs. Single Purchase: Buyers can issue a blanket certificate for ongoing purchases from a specific vendor or a single purchase certificate for one-time transactions.

- Required Information: The certificate must include the buyer’s exemption status, vendor details, and a description of the items purchased. The certificate must be signed and affirmed as accurate to avoid penalties.

Once presented, it is the responsibility of the seller to verify the legitimacy of the certificate. Any misuse of exemption certificates by the buyer can result in penalties, including back taxes and fines.

Kentucky offers several exemption certificates, including ones for farmers, nonprofits, and manufacturers. These forms are downloadable from the Kentucky Department of Revenue‘s website and can be used for transactions where sales tax exemptions apply.

Kentucky Sales Tax Exemption Rules

The Kentucky sales tax exemption rules dictate how specific transactions or entities can avoid paying sales tax on qualifying purchases.

- Eligibility: Exemptions apply to certain groups like nonprofits, farmers, and businesses purchasing for resale. Purchases must be used directly for the exempt purpose (e.g., charitable work, farming).

- Documentation: Buyers must provide a completed Sales Tax Exemption Certificate at the time of purchase. The vendor must retain this for audits.

- Certificate Types: Blanket Certificates cover ongoing purchases; Single Purchase Certificates are for one-time use.

- Vendor Responsibility: Vendors must verify certificates. Improper documentation can result in the vendor being liable for taxes.

- Misuse Penalties: Misusing exemption certificates leads to penalties, including back taxes and fines.

What Goods Are Taxable in Kentucky?

In Kentucky, most tangible goods are subject to the state’s 6% sales tax, including:

- Furniture and Appliances: Household items like chairs, tables, refrigerators, and washing machines are taxable.

- Clothing: Regular clothing, footwear, and accessories are taxable, except for prescription eyewear.

- Electronics: Items such as computers, phones, and TVs are subject to sales tax.

- Prepared Food: Meals purchased from restaurants, fast food, and vending machines are taxable.

What Services Are Taxable in Kentucky?

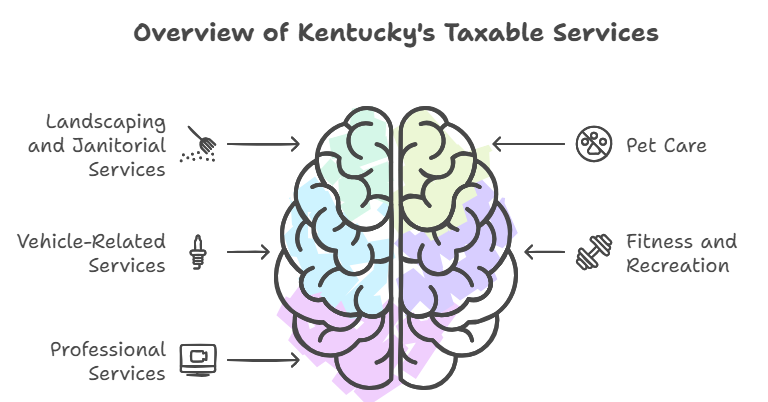

Kentucky has expanded the scope of taxable services in recent years. The following services are now subject to sales tax:

- Landscaping and Janitorial Services: Lawn care, tree trimming, snow removal, and cleaning services are all taxable.

- Pet Care: Grooming, boarding, and training services for small animals are subject to sales tax.

- Vehicle-Related Services: Car repairs, labor charges for modifications, and extended warranties are taxed.

- Fitness and Recreation: Memberships and fees at gyms, fitness centers, golf courses, and bowling alleys are taxable.

- Professional Services: Services such as photography, prewritten computer software access, and website design now fall under Kentucky’s taxable services.

These changes reflect a growing trend toward taxing services that were previously untaxed, bringing additional revenue into the state’s tax system.

What Is Excluded From Sales Tax in Kentucky?

In Kentucky, certain items are excluded from sales tax. These exemptions typically apply to essential goods and specific industries. Here’s a breakdown of commonly exempted items:

- Groceries: Essential grocery items are exempt from Kentucky’s 6% sales tax. This includes basic food products but excludes prepared food.

- Prescription Drugs: Both prescription medications and certain medical devices are exempt from sales tax.

- Agricultural Equipment: Machinery and equipment used directly in farming, such as tractors and livestock feed, are exempt.

- Manufacturing Exemptions: Machinery used for new and expanded industrial processes, as well as energy used in manufacturing, is exempt.

- Nonprofit Organizations: Sales made to qualifying nonprofit organizations, when used for charitable or educational purposes, are also exempt.

How Does a Kentucky Sales Tax Exemption Form Look Like?

The Kentucky Sales Tax Exemption Certificate is a straightforward document used to certify that a purchase is tax-exempt. It typically includes:

- Name of the exempt organization or buyer

- Type of exemption (e.g., nonprofit, resale, manufacturing)

- Description of the goods or services being purchased

- Vendor information

- Signature of the authorized representative

Form 51A126 is the standard exemption certificate and must be presented at the time of purchase.

Kentucky Sales Tax Exemption Chart PDF

Kentucky provides detailed charts that outline which items are exempt from sales tax. These charts cover a wide range of exemptions, from agricultural products to specific medical items and nonprofit purchases.

The Kentucky Department of Revenue regularly updates these charts, which can be found on their website in PDF format. These documents serve as a valuable resource for businesses and organizations to ensure compliance with state tax laws while taking full advantage of available exemptions.

Out-of-State Sales Tax Exemption in Kentucky

In Kentucky, out-of-state sales tax exemptions apply to businesses that purchase goods for resale outside the state. If you’re a retailer making purchases to sell out of state, you can avoid paying Kentucky sales tax on those goods by presenting a valid resale certificate.

The exemption applies as long as the goods are not intended for use within Kentucky and will be sold or used exclusively outside of the state. You will need to provide the vendor with documentation proving that the sale is destined for out-of-state purposes, ensuring compliance with Kentucky tax laws.

Kentucky Sales Tax Exemption Certificate for Nonprofits

If you represent a nonprofit organization in Kentucky, you can obtain a sales tax exemption certificate to make tax-free purchases. Nonprofits such as educational institutions, religious organizations, and charities are eligible to apply for this certificate. To qualify, your nonprofit must use the purchased goods or services solely for activities that align with your organization’s exempt purpose. This might include supplies for educational programs, charity events, or church operations.

The certificate itself must be provided to the vendor at the time of purchase, ensuring that no sales tax is charged. It’s essential to keep your certificate updated and ready for audits to maintain compliance.

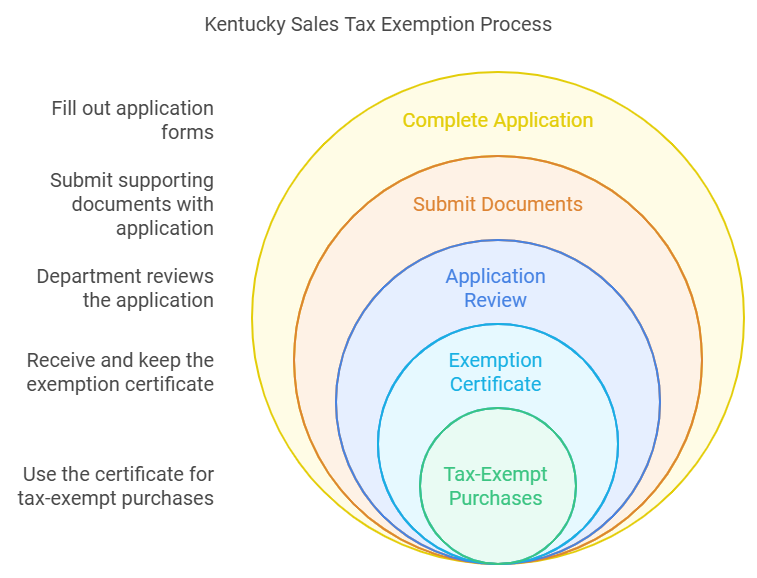

How to Apply and Get a Kentucky Sales Tax Exemption Certificate

Applying for a Kentucky sales tax exemption certificate is a straightforward process. Here’s what you need to do:

- Determine Eligibility: First, confirm that your organization qualifies for an exemption, such as a nonprofit, agricultural, or manufacturing entity.

- Complete the Application: You can fill out the required forms online or download them from the Kentucky Department of Revenue’s website. For nonprofits, Form 51A126 is commonly used.

- Submit Supporting Documents: Along with the application, you may need to submit proof of your nonprofit status (such as your 501(c)(3) determination letter), or other documentation that supports your claim for an exemption.

- Review and Approval: Once submitted, the Department of Revenue will review your application. If everything is in order, you’ll receive your exemption certificate.

- Present the Certificate: Once approved, use this certificate to make tax-exempt purchases. Keep records of all transactions and exemption certificates, as these are subject to audits by the state.

By following these steps, you can ensure that your organization remains compliant while benefiting from sales tax exemptions.

Is a Kentucky Seller’s Permit the Same as a Tax Exempt Certificate?

No, a Kentucky seller’s permit is not the same as a tax-exempt certificate. A seller’s permit is required for businesses that sell tangible goods or taxable services within Kentucky. It authorizes the business to collect sales tax from customers and remit it to the state. All businesses engaging in retail sales within Kentucky must have a seller’s permit.

On the other hand, a tax-exempt certificate is used by eligible organizations, such as nonprofits, or for specific purposes, like reselling goods, to make purchases without paying sales tax. This certificate is presented to vendors when making tax-exempt purchases. While the seller’s permit allows you to collect sales tax, the tax-exempt certificate allows you to avoid paying it on qualifying purchases.

Kentucky Sales Tax Exemption for Manufacturing

Kentucky offers a sales tax exemption for manufacturing to businesses engaged in the production of tangible goods. This exemption applies to machinery, equipment, and materials that are used directly in the manufacturing process. To qualify, the machinery must be integral to the production of goods for sale. For example, a machine used to assemble products or a conveyor system in a factory could be eligible for this exemption.

Additionally, energy used in the manufacturing process, such as electricity or gas, may also be exempt from sales tax. Manufacturers must present a sales tax exemption certificate (usually Form 51A111) to vendors when purchasing qualifying equipment or energy. This helps lower the operational costs of manufacturing businesses by eliminating the sales tax on crucial items used in production.

Kentucky Sales Tax Exemption Certificate Verification and Renewal

For businesses and organizations that hold a Kentucky sales tax exemption certificate, it is important to keep the certificate valid and up to date. Kentucky does not require you to renew your seller’s permit; once you’ve obtained it, it remains active as long as your business is operational. However, you are required to file regular sales tax returns to maintain compliance.

As for the tax-exempt certificate, there is typically no automatic expiration date. However, if the nature of your organization or business changes, or if the state has reason to believe that your eligibility may no longer be valid, they may request a re-verification or audit. Nonprofits, for instance, may need to periodically confirm their status with the state, especially if they make changes to their operations.

To verify a sales tax exemption certificate, vendors can check the validity through Kentucky’s Department of Revenue. This ensures that businesses claiming an exemption are still eligible and operating under current regulations. Maintaining accurate and up-to-date documentation is crucial to avoid potential penalties during audits.

What Is the Sales Tax Exemption for Farming in Kentucky?

In Kentucky, farmers can benefit from a sales tax exemption on certain purchases used directly in agricultural production.

To qualify, farmers must apply for an Agriculture Exemption Number. This exemption covers items such as livestock feed, fertilizers, machinery, fuel used in farming operations, and other agricultural inputs. The goal is to reduce the operational costs for farmers by excluding these essential goods from Kentucky’s 6% sales tax. Once a farmer has their exemption number, they must present it to vendors when making qualified purchases to avoid paying sales tax.

Section 2: Resale Certificates

What Is a Kentucky Resale Certificate?

A Kentucky resale certificate allows businesses to purchase goods without paying sales tax when those goods are intended for resale. This certificate is presented to wholesalers or suppliers, and it confirms that the buyer will resell the purchased items and collect sales tax from the end consumer.

The resale certificate must include key details such as the business’s sales tax ID number, the name and address of both the buyer and seller, and a description of the items being purchased for resale. Businesses must ensure that they use the certificate only for legitimate resale purposes to avoid penalties.

How Much Does a Kentucky Resale Permit Cost?

Obtaining a resale permit in Kentucky, also known as a sales tax permit, does not come with a direct fee. However, you must first apply for a sales tax permit through the Kentucky Department of Revenue to receive your Tax ID number.

Once you have the permit, you can issue resale certificates to vendors for tax-exempt purchases. Although the permit itself is free, businesses should be mindful of the compliance and filing obligations that come with holding the permit, such as regular sales tax filings and audits.

How Long Does It Take to Get a Kentucky Resale License?

The process of obtaining a Kentucky resale license generally takes 2 to 3 weeks after you submit your application. You can apply online through the Kentucky Business One Stop Portal or submit a paper form.

Once your application is processed, you’ll receive your resale certificate, allowing you to make tax-exempt purchases of goods for resale. While there is no cost to apply, timely filing ensures your resale license is processed efficiently.

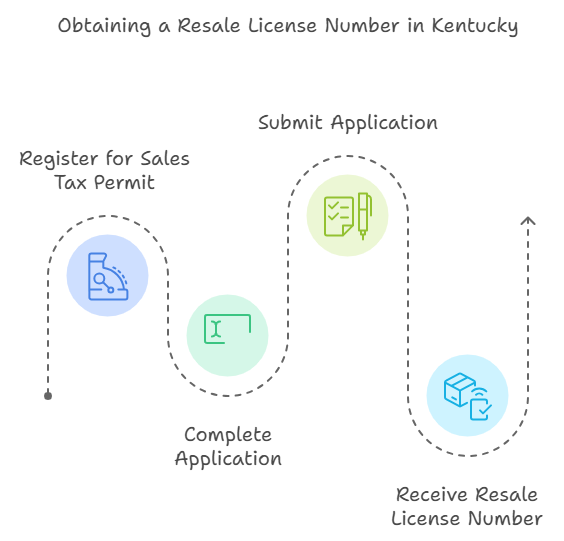

How Do I Get a Resale License Number in Kentucky? (Application)

To get a resale license number in Kentucky, you need to follow these steps:

- Register for a Sales Tax Permit: Visit the Kentucky Department of Revenue website or the Kentucky Business One Stop Portal to register your business and apply for a sales tax permit.

- Complete the Application: You’ll need details like your business name, address, legal entity type, NAICS code, and Social Security number.

- Submit Your Application: Applications can be submitted online or by paper form. Once approved, you’ll be issued a sales tax number, which you’ll use on your resale certificate when purchasing goods for resale.

After completing these steps, you’ll receive your resale license number to begin making tax-exempt purchases for your business.

How to Verify a Kentucky Sales Tax Resale Certificate

Verifying a Kentucky sales tax resale certificate is essential to ensure compliance and avoid penalties. As a seller, you are responsible for confirming that the buyer’s resale certificate is valid and accurately filled out. Here’s how you can verify a resale certificate:

- Check Completeness: Ensure that all required fields on the resale certificate, such as the buyer’s name, address, sales tax ID, and description of goods being purchased, are properly completed.

- Assess Consistency: The goods being purchased should align with the buyer’s line of business. For instance, if a buyer operating a car dealership purchases office supplies tax-free, this might warrant further investigation.

- Contact the Kentucky Department of Revenue: Use their resources or call to verify the validity of the resale certificate, ensuring that the buyer is still an active registered business.

Chapter 3: Understanding Kentucky Sales Tax Rates

This chapter focuses on the fundamental concept of sales tax rates, including how to find and calculate them.

What is Kentucky Sales Tax Rate? (How Much is Kentucky Sales Tax?)

In Kentucky, the sales tax rate is a flat 6%. This rate applies consistently across the state because Kentucky does not allow local jurisdictions, like cities or counties, to impose additional sales taxes. Therefore, wherever you are in Kentucky—whether Louisville, Lexington, or a rural area—you will always pay 6% on taxable goods and services. This makes Kentucky’s system simpler compared to states with varying local tax rates.

Essential items, such as groceries and prescription medications, are exempt from this sales tax. Additionally, sales of alcohol and tobacco products are subject to the 6% sales tax, plus additional excise taxes.

How to Find or Lookup Your Kentucky Sales Tax Rate

To find your Kentucky sales tax rate, you can use online tools provided by the Kentucky Department of Revenue or third-party services like AtomicTax Sales Tax Calculator. These tools allow you to input a street address or ZIP code, ensuring that you are charged the correct tax rate for your specific location.

Since the state tax is uniform, the lookup tools mainly help determine which goods or services are subject to tax or exempt under Kentucky law. For example, if you are purchasing specific goods, such as groceries or machinery for agriculture, these tools help you understand if you’re eligible for exemptions.

How to Calculate Kentucky Sales Tax Rate

Calculating Kentucky sales tax is simple due to the flat rate of 6%. To calculate the tax, you multiply the price of the taxable item by 0.06 (6%).

For example, if you purchase an item for $200:

- Sales Tax = $200 x 0.06 = $12 This means you would pay $12 in sales tax, and the total cost would be $212.

If you’re dealing with multiple items or more complex transactions, using an online sales tax calculator can automate the process. These tools help you calculate the correct tax based on the total amount, ensuring accuracy.

Moreover, if you’re selling taxable goods in Kentucky, AtomicTax sales tax software can integrate directly into your point-of-sale system to automatically calculate and apply the appropriate tax. This ensures compliance and prevents mistakes during the checkout process.

What City Has the Highest Sales Tax Rate in Kentucky?

While Kentucky’s statewide sales tax rate is 6%, some cities may have additional local taxes. For instance, Albany, Kentucky has a combined sales tax rate of 9.75%, which includes both the state and local tax rates. This makes Albany the city with the highest sales tax rate in Kentucky.

Kentucky Sales Tax by County and ZIP Codes

There are 120 counties in Kentucky. Kentucky applies a flat 6% sales tax across all counties, making it easy for businesses and consumers to calculate taxes without worrying about varying rates across different regions. Local jurisdictions can add their own taxes in certain areas.

Thus, ZIP codes are essential for accurate record-keeping, and local jurisdictions may sometimes require ZIP-specific information for tax compliance and filings.

Following is the table showing tax rates for each county and their zip codes respectively.

| County Name | Tax Rate | ZIP Codes |

| Adair County | 6% | 42728 |

| Allen County | 6% | 42164 |

| Anderson County | 6% | 40342 |

| Ballard County | 6% | 42056, 42067 |

| Barren County | 6% | 42141, 42142 |

| Bath County | 6% | 40360 |

| Bell County | 6% | 40977, 40813 |

| Boone County | 6% | 41005, 41042 |

| Bourbon County | 6% | 40361 |

| Boyd County | 6% | 41101, 41102 |

| Boyle County | 6% | 40422 |

| Bracken County | 6% | 41002, 41004 |

| Breathitt County | 6% | 41339, 41390 |

| Breckinridge County | 6% | 40143, 40145 |

| Bullitt County | 6% | 40165, 40109 |

| Butler County | 6% | 42261 |

| Caldwell County | 6% | 42445 |

| Calloway County | 6% | 42071 |

| Campbell County | 6% | 41071, 41076 |

| Carlisle County | 6% | 42024 |

| Carroll County | 6% | 41008 |

| Carter County | 6% | 41143, 41164 |

| Casey County | 6% | 42539, 42528 |

| Christian County | 9.50% | 42240, 42241 |

| Clark County | 6% | 40391, 40392 |

| Clay County | 6% | 40914 |

| Clinton County | 9.75% | 42602 |

| Crittenden County | 6% | 42064 |

| Cumberland County | 6% | 42717 |

| Daviess County | 6% | 42301, 42303 |

| Edmonson County | 6% | 42210 |

| Elliott County | 6% | 41171 |

| Estill County | 6% | 40336 |

| Fayette County | 6% | 40502, 40503 |

| Fleming County | 6% | 41041 |

| Floyd County | 6% | 41653, 41601 |

| Franklin County | 6% | 40601 |

| Fulton County | 6% | 42041 |

| Gallatin County | 6% | 41095 |

| Garrard County | 6% | 40444 |

| Grant County | 6% | 41035 |

| Graves County | 6% | 42066 |

| Grayson County | 6% | 42754 |

| Green County | 6% | 42743 |

| Greenup County | 6% | 41144, 41175 |

| Hancock County | 6% | 42348, 40111 |

| Hardin County | 6% | 40160, 40162 |

| Harlan County | 6% | 40831, 40843 |

| Harrison County | 6% | 41031 |

| Hart County | 6% | 42749, 42765 |

| Henderson County | 6% | 42420, 42451 |

| Henry County | 6% | 40068, 40070 |

| Hickman County | 6% | 42050 |

| Hopkins County | 6% | 42431, 42441 |

| Jackson County | 6% | 40402, 40447 |

| Jefferson County | 6% | 40201, 40299 |

| Jessamine County | 6% | 40356, 40390 |

| Johnson County | 6% | 41222, 41230 |

| Kenton County | 6% | 41015, 41017 |

| Knott County | 6% | 41731, 41754 |

| Knox County | 6% | 40906, 40962 |

| Larue County | 6% | 42748, 42716 |

| Laurel County | 6% | 40741, 40744 |

| Lawrence County | 6% | 41144, 41166 |

| Lee County | 6% | 41301, 41310 |

| Leslie County | 6% | 41731, 41749 |

| Letcher County | 6% | 41832, 41840 |

| Lewis County | 6% | 41135, 41179 |

| Lincoln County | 6% | 40484, 40489 |

| Livingston County | 6% | 42045, 42081 |

| Logan County | 6% | 42206, 42276 |

| Lyon County | 6% | 42038, 42055 |

| Madison County | 6% | 40403, 40475 |

| Magoffin County | 6% | 41465, 41472 |

| Marion County | 6% | 40033, 40037 |

| Marshall County | 6% | 42025, 42048 |

| Martin County | 6% | 41224, 41256 |

| Mason County | 6% | 41056, 41041 |

| Mccracken County | 6% | 42001, 42003 |

| Mccreary County | 6% | 42647, 42653 |

| Mclean County | 6% | 42330, 42354 |

| Meade County | 6% | 40108, 40175 |

| Menifee County | 6% | 40322, 40346 |

| Mercer County | 6% | 40330, 40310 |

| Metcalfe County | 6% | 42129, 42154 |

| Monroe County | 6% | 42167, 42140 |

| Montgomery County | 6% | 40353, 40337 |

| Morgan County | 6% | 41413, 41472 |

| Muhlenberg County | 6% | 42330, 42344 |

| Nelson County | 6% | 40004, 40012 |

| Nicholas County | 6% | 40311, 40350 |

| Ohio County | 6% | 42320, 42347 |

| Oldham County | 6% | 40031, 40077 |

| Owen County | 6% | 40359, 40363 |

| Owsley County | 6% | 41314, 41364 |

| Pendleton County | 6% | 41040, 41043 |

| Perry County | 6% | 41701, 41775 |

| Pike County | 6% | 41501, 41503 |

| Powell County | 6% | 40312, 40380 |

| Pulaski County | 6% | 42501, 42503 |

| Robertson County | 6% | 41064 |

| Rockcastle County | 6% | 40456, 40460 |

| Rowan County | 6% | 40351, 40319 |

| Russell County | 6% | 42642, 42629 |

| Scott County | 6% | 40324, 40379 |

| Shelby County | 6% | 40065, 40076 |

| Simpson County | 6% | 42134 |

| Spencer County | 6% | 40071 |

| Taylor County | 6% | 42718, 42728 |

| Todd County | 6% | 42234, 42261 |

| Trigg County | 6% | 42211, 42236 |

| Trimble County | 6% | 40006, 40045 |

| Union County | 6% | 42461, 42437 |

| Warren County | 6% | 42101, 42104 |

| Washington County | 6% | 40069, 40078 |

| Wayne County | 6% | 42633 |

| Webster County | 6% | 42404, 42413 |

| Whitley County | 6% | 40701, 40763 |

| Wolfe County | 6% | 41360, 41367 |

| Woodford County | 6% | 40383, 40347 |

Chapter 4: Registration for Kentucky Sales Tax Permits

Chapter 4 addresses the process of registering for a sales tax permit, a crucial step for businesses operating in Kentucky.

Do You Need to Register for Sales Tax in Kentucky?

Yes, if you are engaging in any activities such as selling tangible personal property, digital property, or taxable services in Kentucky, you must register for a sales tax permit. This applies whether you have a physical presence (e.g., an office, warehouse, or employees in Kentucky) or if you meet the economic nexus threshold—making over $100,000 in sales or conducting 200 or more transactions in the state within a 12-month period.

Even if you are a remote seller with no physical presence, you are required to register once you meet these thresholds.

How Much Does It Cost to Get a Kentucky Seller’s Permit?

There is no cost to obtain a sales tax permit in Kentucky. However, you will need to submit the required business information during registration, such as your business name, address, and NAICS code. While the sales tax permit itself is free, other business registration fees might apply depending on the nature of your business.

How to Register for Sales Tax in Kentucky?

You can register for a sales tax permit in Kentucky either online or by paper application. Most businesses opt for the online registration process via the Kentucky Business One Stop Portal, which is faster and more convenient.

Alternatively, you can complete Form 10A100 and mail it to the Kentucky Department of Revenue. The application requires information about your business, such as your legal business name, primary location, ownership type, and NAICS code. Typically, it takes 2-3 weeks to receive your sales tax permit.

How to Get a Sales Tax ID in Kentucky

To obtain a Sales Tax ID in Kentucky, you must register for a sales tax permit through the Kentucky Business One Stop Portal or by submitting Form 10A100 by mail. The online process is the quickest option, usually taking about 2-3 weeks to receive your tax ID.

The information you’ll need includes your business name, Federal Employer Identification Number (FEIN) or Social Security Number, physical business location, and a description of the products or services you plan to sell. Once registered, you will receive your sales tax ID, allowing you to legally collect and remit sales tax on taxable sales.

Does Kentucky Sales Tax Apply to Out-of-State Purchases?

If you are a Kentucky resident or business purchasing goods from out of state, use tax applies if no sales tax was collected by the seller. The use tax is the same rate as the sales tax (6%) and applies to items brought into Kentucky for use or consumption.

Out-of-state sellers meeting economic nexus thresholds (over $100,000 in sales or 200 transactions annually) are required to collect Kentucky sales tax on purchases made by Kentucky customers, even if they do not have a physical presence in the state.

Chapter 5: Charging and Collecting Sales Tax

Chapter 5 delves into the practical aspects of charging and collecting sales tax, covering various scenarios and specific exemptions.

What Does It Mean to Charge Sales Tax vs. Collect Sales Tax?

Charging sales tax means that as a business, you add a percentage of the sale to the customer’s total bill. This extra amount represents the sales tax, which is required by state law.

Collecting sales tax refers to the process of receiving this tax from the customer at the point of sale. Once collected, it’s your responsibility as a business owner to remit the tax to the state. Essentially, charging is the act of adding sales tax to the price, while collecting is the act of gathering the tax from the customer.

When to Charge Sales Tax in Kentucky?

You need to charge sales tax in Kentucky whenever you sell taxable goods or services and have established nexus in the state. Nexus can be created through either physical presence, like having a store or warehouse in Kentucky, or economic activity, such as exceeding the state’s threshold of $100,000 in sales or 200 transactions within a year. Sales tax is applied to most tangible personal property and certain services unless specifically exempt.

How to Charge and Collect Sales Tax in Kentucky?

To charge and collect sales tax in Kentucky, follow these steps:

- Register for a Sales Tax Permit: Before you can legally charge sales tax, you must obtain a sales tax permit from the Kentucky Department of Revenue. This allows you to collect sales tax and ensures compliance with state regulations.

- Set Up Sales Tax in Your Point of Sale System: If you operate an online or physical store, ensure that your system is set up to automatically apply the correct 6% Kentucky sales tax to all taxable items.

For e-commerce platforms like Shopify, Amazon, or eBay, you can activate sales tax collection through their settings, ensuring that the correct rate is charged at checkout.

- Collect the Sales Tax: At the time of sale, your system should add the sales tax to the customer’s total bill. Ensure that this tax is clearly itemized on the receipt.

- Remit the Tax: After collecting the tax, you are required to file regular sales tax returns with the Kentucky Department of Revenue. Depending on the volume of sales, this may be monthly, quarterly, or annually. The state will inform you of your specific filing requirements when you register for the permit.

Does Kentucky Collect Sales Tax on Out-of-State Sales?

Yes, Kentucky collects sales tax on out-of-state sales if you meet the state’s economic nexus thresholds. This means that if your business makes more than $100,000 in gross receipts or conducts 200 or more transactions into Kentucky within a calendar year, you are required to collect and remit Kentucky sales tax on those sales, even if your business has no physical presence in the state.

This rule applies to both remote and online sellers, ensuring that out-of-state businesses contribute to the state’s tax base if they engage in significant economic activity in Kentucky.

Do Contractors Charge Sales Tax on Labor in Kentucky?

In Kentucky, contractors generally do not charge sales tax on labor for repairs, installations, or maintenance services related to real property (e.g., construction work on homes and buildings).

However, if the labor is associated with the sale of tangible personal property, such as installing new equipment or performing repairs involving taxable materials, the labor charges may be taxable. It is important to differentiate between labor that modifies real property and labor that affects tangible personal property, as this distinction determines the taxability.

Does Kentucky Charge Sales Tax on Shipping?

Yes, Kentucky charges sales tax on shipping costs when the shipping charges are part of a taxable sale. If you are selling taxable goods and charge your customer for shipping, the 6% sales tax is applied to both the cost of the goods and the shipping fees. However, if the sale is exempt from sales tax (e.g., groceries), the shipping costs are also exempt. This rule applies to both in-state and out-of-state shipments as long as the goods sold are taxable under Kentucky law.

Does Kentucky Charge Sales Tax on Services?

Yes, Kentucky charges sales tax on certain services. Over recent years, the state has expanded its taxable services base. Services that are now subject to sales tax include landscaping, janitorial services, pet care, fitness and recreational sports services, personal care services, repair and maintenance services, and more.

The expansion also includes digital services, such as SaaS (Software as a Service) and certain telecommunication services. It’s important to check whether the service you offer falls under the taxable category to ensure compliance.

Does Kentucky Charge Sales Tax on Food?

No, Kentucky does not charge sales tax on groceries. Essential grocery items are exempt from the state’s 6% sales tax. However, prepared foods, such as meals bought at restaurants or catered services, are subject to the sales tax. This distinction ensures that basic necessities are tax-free while non-essential prepared foods are taxable.

Do Photographers Charge Sales Tax in Kentucky?

Yes, as of January 1, 2023, photographers in Kentucky are required to charge sales tax on their services. This includes charges for photography sessions, sitting fees, and the development and printing of photographs.

The expansion of the sales tax base under Kentucky House Bill 8 means that photography services are now treated as taxable under the state’s sales tax law. Photographers need to ensure they are collecting the 6% tax from their clients on all taxable services.

Does Amazon Charge Sales Tax in Kentucky?

Yes, Amazon charges sales tax in Kentucky. As a marketplace facilitator, Amazon is required by Kentucky law to collect and remit sales tax on behalf of third-party sellers for all taxable items sold to customers in Kentucky.

This applies whether the items are sold by Amazon directly or by a third-party seller using Amazon’s platform. The tax rate applied is the standard Kentucky state sales tax of 6%, which Amazon automatically calculates and adds to the buyer’s total during checkout. Amazon then remits this tax directly to the Kentucky Department of Revenue, ensuring that sellers on the platform comply with state tax laws .

Does eBay Charge Sales Tax in Kentucky?

Yes, eBay also charges sales tax in Kentucky. Like Amazon, eBay is classified as a marketplace facilitator under Kentucky law. This means that eBay is responsible for collecting and remitting sales tax on behalf of its sellers for all taxable sales made to Kentucky customers.

eBay applies the 6% Kentucky state sales tax to the total sales amount during the checkout process. Sellers on eBay do not need to manually calculate or remit sales tax for transactions with Kentucky buyers, as eBay handles this automatically.

Does Wayfair Charge Sales Tax in Kentucky?

Yes, Wayfair charges sales tax in Kentucky. Following the Supreme Court’s decision in South Dakota v. Wayfair, Inc., states like Kentucky have implemented economic nexus laws requiring out-of-state sellers to collect sales tax if they exceed certain thresholds.

As a major online retailer, Wayfair collects Kentucky’s 6% sales tax on all applicable sales made to customers in the state. This tax is automatically added during the purchase process, and Wayfair handles the remittance of the collected tax to the Kentucky Department of Revenue.

Do You Charge Sales Tax on Rental Equipment in Kentucky?

Yes, Kentucky charges sales tax on rental equipment. Rentals and leases of tangible personal property are treated similarly to retail sales, meaning that you are required to collect 6% sales tax on rental equipment transactions.

This includes rentals of construction equipment, vehicles, tools, and other tangible goods. The tax is applied to the total rental price, and as the rental provider, you are responsible for remitting the collected tax to the Kentucky Department of Revenue. Both short-term and long-term rentals are subject to this tax unless a specific exemption applies.

Can You Charge Sales Tax on Delivery in Kentucky?

Yes, sales tax applies to delivery charges in Kentucky if the underlying sale is taxable. When delivery or shipping charges are part of a taxable transaction, the 6% sales tax is applied to the total amount, which includes the cost of delivery.

However, if the sale itself is tax-exempt (for example, if you are shipping groceries or other tax-exempt items), the delivery charge is also exempt from sales tax. It’s important to ensure that your point-of-sale system is configured to correctly apply sales tax to both the product and the delivery fee when applicable.

Do I Charge Sales Tax to Nonprofits in Kentucky?

In Kentucky, nonprofits are not automatically exempt from sales tax. While certain nonprofit organizations may qualify for tax-exempt status, this exemption is typically limited to purchases directly related to the nonprofit’s charitable mission.

Nonprofits must apply for and present a valid sales tax exemption certificate to avoid paying sales tax on qualifying purchases. If the nonprofit engages in taxable activities, such as selling goods or services, they may still be required to collect and remit sales tax just like any other business. Nonprofits need to maintain proper documentation and ensure that their sales tax exemption certificate is accurate and up to date.

Do Restaurants Charge Sales Tax in Kentucky?

Yes, restaurants in Kentucky are required to charge sales tax on the sale of prepared foods. This includes meals served in restaurants, fast food, and catered events. The 6% state sales tax is applied to the total cost of the food and beverages sold.

Additionally, any delivery fees charged by the restaurant for bringing the food to the customer may also be subject to sales tax if the sale itself is taxable.

Chapter 6: Reporting, Paying, Filing, and Remitting Sales Tax Returns

Chapter 6 focuses on the core aspects of sales tax compliance, including reporting, payment, filing, and remittance.

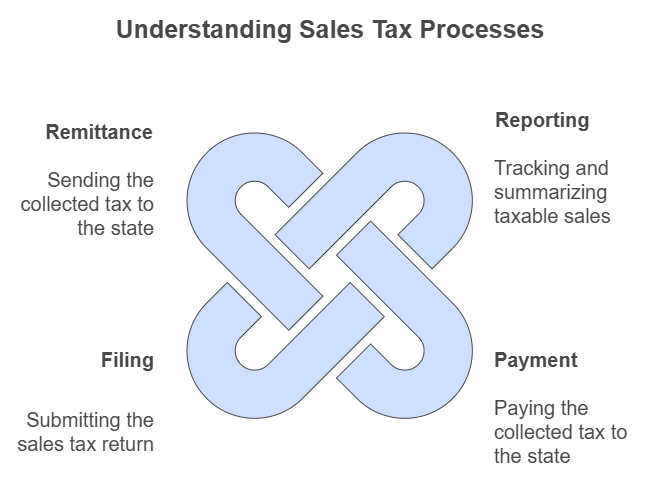

What is Sales Tax Reporting vs. Payment vs. Filing vs. Remittance?

Understanding the difference between reporting, paying, filing, and remitting sales tax is essential for maintaining compliance in Kentucky:

- Sales Tax Reporting: This involves keeping track of all taxable sales, exempt sales, and the sales tax collected during a specific reporting period. You summarize this information on your sales tax return, detailing the total sales and the amount of tax collected.

- Sales Tax Payment: After reporting, you must pay the state the tax amount you collected from customers during the reporting period. Sales tax payments can be made via check, electronic transfer, or through an online tax payment system.

- Sales Tax Filing: Filing refers to submitting your completed sales tax return to the Kentucky Department of Revenue. You must file your return even if no sales tax was collected during the reporting period, as failure to do so could result in penalties.

- Sales Tax Remittance: Remittance is the act of sending the collected sales tax to the state. Once you’ve filed your return, you remit the payment to the Kentucky Department of Revenue, ensuring the state receives the money owed.

Who Pays Sales Tax in Kentucky?

In Kentucky, the consumer ultimately pays the sales tax, as the tax is added to the price of goods or services at the time of purchase. However, the seller is responsible for collecting the tax from the customer and remitting it to the state. This means businesses need to add the appropriate sales tax to each transaction, collect it from their customers, and then submit that money to the Kentucky Department of Revenue.

When to Pay Sales Tax in Kentucky?

Sales tax in Kentucky must be paid according to your designated filing schedule, which could be monthly, quarterly, or annually, depending on your sales volume. The Kentucky Department of Revenue determines your filing frequency based on your business size and taxable sales.

For example, businesses with higher sales volumes are generally required to file and pay monthly, while smaller businesses may file quarterly or annually. Payments are due by the 20th of the month following the reporting period. For quarterly filers, this usually means filing for periods ending in March, June, September, and December.

Where Do I Pay Kentucky Sales Tax?

You can pay Kentucky sales tax either online or by mailing a check or money order. The most efficient way to pay is through the Kentucky Business One Stop Portal, where businesses are required to file and pay their sales tax electronically. This method is quick and allows for timely payments to avoid penalties.

Alternatively, if you prefer to mail in your payment, you can send it to the Kentucky Department of Revenue. Ensure that all checks or money orders are made payable to the Kentucky State Treasurer.

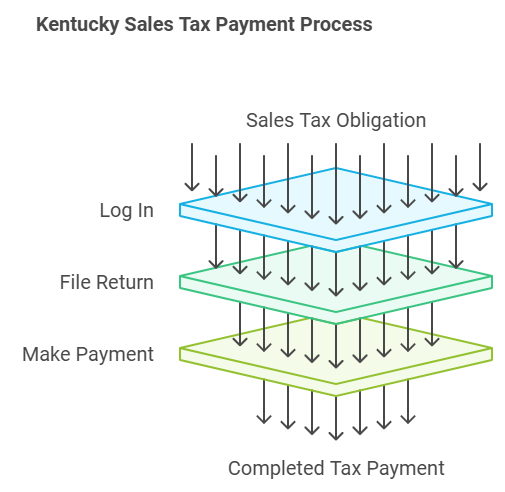

How to Pay Sales Tax in Kentucky

To pay your sales tax in Kentucky, follow these steps:

- Log in to your account on the Kentucky Business One Stop Portal.

- File your sales tax return: Once your gross sales and deductions are entered, you will be prompted to file your return.

- Make a payment: After filing, choose to pay the balance directly through the portal using either a bank account or a credit card. Ensure that your payment is made by the due date to avoid penalties. You can also schedule future payments if needed.

How to Report Sales Tax in Kentucky

Reporting sales tax in Kentucky involves filing regular sales tax returns with the Kentucky Department of Revenue. You will need to report your gross sales, any exemptions, and the sales tax collected. Kentucky businesses are required to file and remit taxes online. The filing frequency—monthly, quarterly, or annually—depends on the amount of sales tax you collect.

For monthly filers, the tax must be reported and paid by the 20th of the month following the reporting period. Quarterly filers must report by the 20th of the month following each quarter, and annual filers must file by January 20th.

How to File Sales and Use Tax in Kentucky

Sales tax is a tax imposed on the sale of goods and certain services. In Kentucky, the standard sales tax rate is 6%, and it applies to most tangible personal property and some services. Sales tax is typically added to the purchase price of an item, and the customer bears the responsibility for paying it.

Use tax, on the other hand, is a complementary tax to sales tax. It applies when goods are purchased outside of Kentucky (or online) but are used, stored, or consumed within the state.

To file sales and use tax in Kentucky, you must first have a sales tax permit. Once registered, you’ll need to file a sales tax return based on the filing frequency assigned to you—this could be monthly, quarterly, or annually, depending on your sales volume. The easiest way to file is through the Kentucky Business One Stop Portal, which allows you to submit your returns and payments electronically.

You will report your gross sales, exempt sales, and the amount of sales tax collected during the period. The portal simplifies the process by calculating the total tax due based on your inputs. Once filed, you must remit the tax owed directly through the portal or by mailing a check.

What is the Deadline to Pay Sales Taxes in Kentucky?

Kentucky sales tax returns and payments are due by the 20th of the month following the close of the filing period. This is known as the sales tax due date or sales tax deadline.

For example, if you are filing for the month of January, your sales tax return and payment must be submitted by February 20th. If the due date falls on a weekend or holiday, you can file by the next business day without incurring penalties.

If you are a quarterly filer, deadlines typically fall on April 20th, July 20th, October 20th, and January 20th of the following year.

Do Nonprofits Pay Sales Tax on Purchases in Kentucky?

Yes, nonprofits in Kentucky are required to pay sales tax on purchases unless they have applied for and received a sales tax exemption certificate.

Simply being a nonprofit does not automatically exempt the organization from sales tax; they must provide proof of their tax-exempt status by presenting the certificate to vendors at the time of purchase. If the certificate is valid and the purchase qualifies under the exemption rules, the nonprofit can make tax-free purchases.

However, if the nonprofit engages in activities outside of their exempt purpose (e.g., retail sales), they may still be responsible for collecting and remitting sales tax.

Do Wholesalers Pay Sales Tax in Kentucky?

No, wholesalers in Kentucky do not pay sales tax on goods they purchase for resale. When buying products for resale, wholesalers must present a resale certificate to the seller, which allows them to make tax-free purchases. This certificate certifies that the items will be sold to end customers, at which point sales tax will be collected by the retailer. It’s important to maintain proper documentation and ensure that the goods are indeed for resale to avoid any compliance issues.

Do You Pay Sales Tax on a Leased Car in Kentucky?

Yes, you do pay sales tax on a leased car in Kentucky. The state imposes a 6% sales tax on the monthly lease payments of the vehicle.

This sales tax is calculated based on the gross lease price and must be collected by the lessor (leasing company) and remitted to the state. The tax is not applied to the upfront price of the car but rather to the recurring payments throughout the lease term.

Do You Pay Sales Tax When You Buy a House in Kentucky?

No, you do not pay sales tax when you buy a house in Kentucky. Real estate transactions, including the purchase of homes, are exempt from sales tax. Kentucky applies sales tax to tangible personal property and certain services, but real property transactions like home purchases fall outside the scope of sales tax. However, other taxes, such as property taxes, will apply after the home purchase.

Chapter 7: Sales Tax Audits, Penalties and Refunds

Chapter 7 addresses potential issues that businesses may encounter, such as audits, penalties, and refunds.

What Is the Penalty for Paying Sales Tax Late in Kentucky?

If you pay your sales tax late in Kentucky, you will incur penalties and interest. Kentucky imposes a 2% penalty of the total tax due for each 30-day period (or fraction thereof) that the tax payment is late, with a maximum penalty of 20%. The minimum penalty for late filing is $10, or $100 if a jeopardy assessment has been issued. In addition to the penalty, interest accrues on unpaid balances, and the rate is set annually. For 2023, the interest rate is 8%.

Does Kentucky Do Sales Tax Audits?

Yes, Kentucky conducts sales tax audits to ensure compliance with the state’s tax laws. The Kentucky Department of Revenue (DOR) performs these audits to verify that businesses are accurately collecting and remitting sales taxes. The audit process begins with a notification letter to the business, outlining the audit period and the documents required.

Auditors review a range of financial records, including invoices, receipts, exemption certificates, and tax returns. If discrepancies are found, the business may be assessed additional tax, penalties, and interest. Businesses have the right to appeal the audit findings if they disagree.

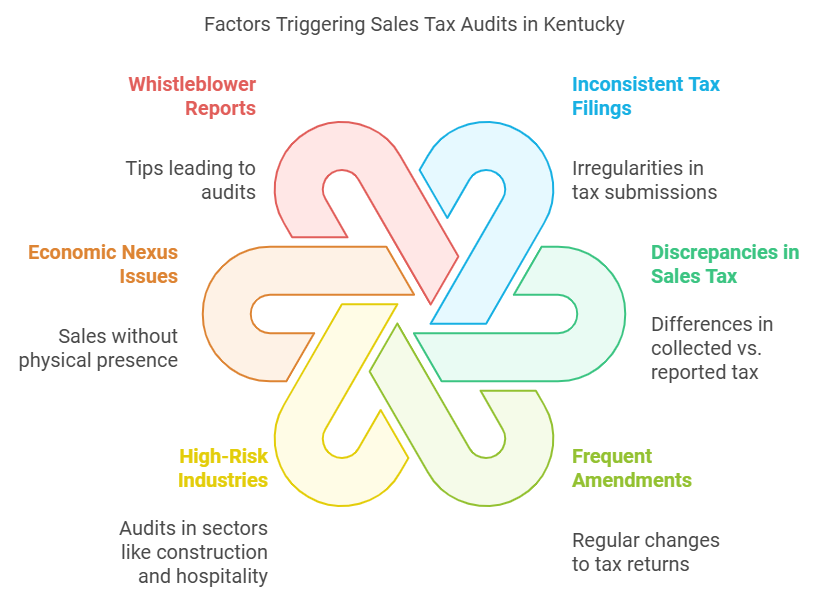

What Triggers a Sales Tax Audit in Kentucky?

Sales tax audits in Kentucky can be triggered by several factors. Some common triggers include; inconsistent tax filings, large discrepancies between sales tax collected and reported income, and frequent amendments to sales tax returns.

Businesses operating in high-risk or complex industries, such as construction or hospitality, are also more likely to face audits.

Additionally, economic nexus issues (where businesses conduct substantial sales without a physical presence in the state) and whistleblower reports can lead to an audit.

The Kentucky Department of Revenue typically conducts audits to ensure proper tax collection and compliance

What Is the Penalty for an Audit After the Due Date in Kentucky?

If you are audited and found to owe additional sales tax after the audit is complete, you may face significant penalties.

For late payment of taxes, Kentucky imposes a 2% penalty for each 30-day period that the payment is late, with a maximum penalty of 20% of the unpaid taxes. If a jeopardy assessment has been issued, meaning the Department of Revenue believes immediate collection is necessary, a minimum penalty of $100 may apply.

What Is Kentucky Sales Tax Penalty Waiver?

Kentucky offers a sales tax penalty waiver for businesses that can demonstrate reasonable cause for their failure to pay or file taxes on time. This waiver is not automatic—you must apply for it and provide valid reasons, such as a natural disaster, serious illness, or other extenuating circumstances that prevented timely compliance.

The Kentucky Department of Revenue evaluates each request on a case-by-case basis and may waive part or all of the penalties if the reasons are deemed sufficient.

Does Kentucky Do Sales Tax Refunds?

Yes, Kentucky offers sales tax refunds under certain circumstances. A sales tax refund is the process by which a business or individual can recover sales tax that was mistakenly paid on a transaction that should have been exempt or excluded from sales tax.

For example, if a purchase was made by a nonprofit organization or for resale purposes but sales tax was erroneously charged, a refund may be requested. To obtain a refund, you must submit a request with supporting documentation, such as invoices and proof of exemption, to the Kentucky Department of Revenue.

Does Kentucky Refund Sales Tax to Foreigners?

No, Kentucky does not refund sales tax to foreign visitors. Once sales tax is paid on purchases in the state, it is typically non-refundable, even if the buyer is a foreign national. Kentucky, unlike some states, does not have a tourist refund program in place, which would allow foreigners to reclaim sales tax paid on retail purchases when they leave the country.

Is It Illegal Not to Refund Sales Tax in Kentucky?

Yes, it is illegal not to refund sales tax in Kentucky when a customer is entitled to it. If a customer returns a purchased item and meets the conditions for a refund, the sales tax they paid should be refunded as part of the transaction. This applies whether the item was bought in-store or online.

Failing to return the sales tax alongside the purchase price is a violation of Kentucky’s consumer protection laws.

How to Claim Sales Tax Refund in Kentucky?

To claim a sales tax refund in Kentucky, you need to submit a formal request to the Kentucky Department of Revenue. The process typically involves filing a Sales and Use Tax Refund Application (Form 51A209), which you will complete and submit along with proof of overpayment, such as invoices or receipts.

You must also provide documentation showing that the original sales tax was paid. If your refund is related to a larger project, such as a manufacturing or construction exemption, you will need additional documentation, including certificates and proof of exemption.

Does Kentucky Give Sales Tax Holiday?

Currently, Kentucky does not offer any sales tax holidays. A sales tax holiday is a period, often a weekend or a few days, during which the state temporarily suspends sales tax on certain items like clothing, school supplies, or electronics. Many states offer these holidays as a way to ease the burden on consumers, especially around back-to-school seasons. However, Kentucky has not implemented such a tax-free period in recent years

Chapter 8: Kentucky Sales Tax Software

Chapter 8 is divided into two sections for better organization. The first section provides a list of popular Kentucky sales tax software options, while the second section offers guidance on choosing the right software and using it effectively.

Comparison of Kentucky Sales Tax Software

When selecting the best Kentucky sales tax software for your business, it’s crucial to compare the features and benefits of different options. Here’s a breakdown of key features to consider:

1. Tax Calculation Accuracy:

- Ensure the software can accurately calculate sales tax rates based on the location of the sale and any applicable exemptions.

- Look for software that regularly updates its tax rate database to keep up with changes in Kentucky’s tax laws.

2. Tax Nexus Determination:

- The software should be able to determine if your business has a nexus in Kentucky, meaning you’re required to collect sales tax in the state.

- Consider software that can automate nexus calculations based on your business’s activities, such as physical presence, sales volume, or affiliate networks.

3. Tax Compliance Features:

- Check if the software offers features to help you comply with Kentucky’s sales tax laws, such as generating sales tax reports, filing returns, and managing tax payments.

- Look for software that integrates with Kentucky’s Department of Revenue systems for seamless reporting.

4. Sales Tax Permit Management:

- If your business requires a Kentucky sales tax permit, ensure the software can assist in the application process and manage your permit information.

- Consider software that can help you track your permit expiration date and renewal requirements.

5. Integration with Other Business Systems:

- If your business uses accounting software or e-commerce platforms, look for sales tax software that integrates seamlessly with these systems to streamline your workflow.

- Integration can help automate data transfer and reduce the risk of errors.

Choosing the Best Kentucky Sales Tax Software

When selecting the best Kentucky sales tax software, consider the following factors:

- Business Size and Complexity: The software should be suitable for your business’s size and complexity. Smaller businesses may require simpler features, while larger businesses may need more advanced capabilities.

- Budget: Determine your budget for sales tax software and compare pricing options from different vendors. Consider factors such as subscription fees, additional charges, and implementation costs.

- Customer Support: Look for software with excellent customer support to assist you with any questions or issues. Consider factors such as response time, availability, and the quality of support provided.

- Scalability: Choose software that can grow with your business. If your business expands or changes, the software should be able to accommodate your evolving needs.

Conclusion

Understanding and managing Kentucky’s sales tax system doesn’t have to be overwhelming. Armed with this guide, you’ve gained valuable insights into navigating every step—from determining when to collect tax, to filing, paying, and even understanding potential exemptions. This knowledge allows you to operate with confidence, knowing you’re compliant and protected from unexpected penalties.

But beyond just compliance, embracing your sales tax responsibilities gives you clarity and control over your business finances. With a streamlined approach, you’re not just ticking off a legal requirement—you’re building a more organized, sustainable operation. It’s not about just avoiding mistakes; it’s about creating a foundation for growth.

Now is the time to put your newfound understanding into practice, ensuring your business stays on track and ready for whatever comes next.