If you’re doing business in Maine, understanding sales tax nexus is essential to keeping your operations running smoothly. Whether you’re selling locally or online, we’ll walk you through everything you need to know—from determining if you have a nexus in Maine to registering for a sales tax permit and filing your returns. Together, we’ll simplify the process so you can focus on growing your business while staying compliant with Maine’s tax laws.

Chapter 1: Introduction to Maine Sales Tax

Understanding Maine sales tax is crucial for businesses operating within the state or engaging in transactions that involve Maine customers. Sales tax regulations impact various aspects of business operations, from compliance to financial planning. This comprehensive guide will walk you through everything you need to know about Maine sales tax, covering key concepts, practical steps, and common questions about Maine sales tax laws and rules and general compliance..

Overview of Maine Sales Tax

Maine’s sales tax system is designed to collect revenue on goods and services purchased within the state. It helps fund public services and infrastructure. As of the latest update, Maine’s sales tax rate is 5.5%. This rate applies to most tangible goods and certain services, though there are notable exceptions and exemptions.

The Maine Revenue Services (MRS) administers sales tax regulations, ensuring businesses comply with state laws. Understanding these regulations is essential for avoiding penalties and maintaining smooth business operations.

Importance of Understanding Maine Sales Tax Regulations

For businesses, especially those selling goods and services both within and outside Maine, understanding sales tax regulations is crucial. Proper management of sales tax helps:

- Avoid legal and financial penalties

- Ensure compliance with state laws

- Maintain accurate financial records

- Provide correct information to customers and authorities

Chapter 2: Understanding Sales Tax Nexus in Maine

What is Sales Tax Nexus?

Sales tax nexus refers to the connection between a business and a state that justifies the state’s requirement for the business to collect and remit sales tax. Nexus establishes the legal basis for a state to impose tax obligations on a business.

Physical Nexus vs. Economic Nexus

- Physical Nexus: This occurs when a business has a physical presence in Maine, such as an office, warehouse, or employees. Businesses with a physical nexus are required to collect Maine sales tax on sales made to customers within the state.

- Economic Nexus: An economic nexus is established when a business surpasses certain sales thresholds within Maine, even without a physical presence. Maine’s economic nexus threshold is met if a business makes over $100,000 in sales or conducts 200 or more transactions in the state annually.

What Triggers or Creates a Sales Tax Nexus in Maine?

Several factors can trigger sales tax nexus in Maine:

- Physical Presence: Having an office, store, or employees in Maine.

- Economic Activity: Exceeding the economic nexus threshold of $100,000 in sales or 200 transactions annually.

- Affiliate Relationships: Partnering with affiliates who refer customers to your business.

Maine Sales Tax Nexus Calculator

To help businesses determine their nexus status, Maine offers online tools and calculators. These resources can evaluate your sales data and assess whether you meet the nexus thresholds. Utilizing a sales tax nexus calculator ensures that you accurately gauge your obligations and avoid potential compliance issues.

Chapter 3: Maine Sales Tax Permits

Do You Need a Sales Tax Permit to Sell Online in and out of Maine?

Yes, businesses engaging in sales within Maine, whether online or in-person, must obtain a sales tax permit if they have nexus in the state. This permit authorizes businesses to collect and remit sales tax.

How to Apply for a Sales Tax Permit in Maine

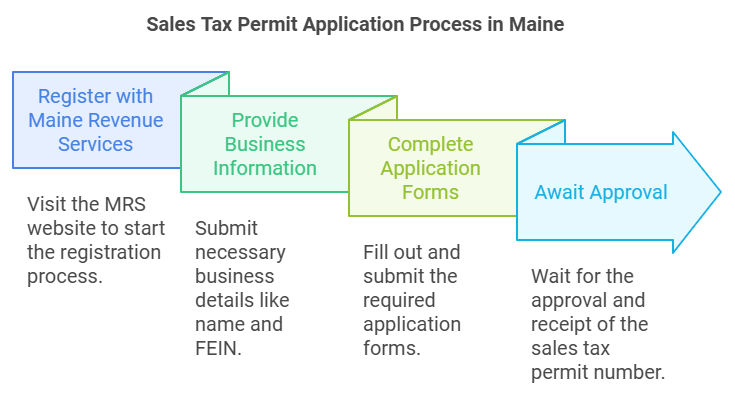

Applying for a sales tax permit in Maine involves several steps:

- Register with Maine Revenue Services (MRS): Visit the MRS website and complete the online registration form.

- Provide Business Information: Submit details about your business, including legal name, address, and Federal Employer Identification Number (FEIN).

- Complete Application Forms: Fill out the required forms and submit them electronically or by mail.

- Await Approval: Once approved, you’ll receive a sales tax permit number, allowing you to collect sales tax.

Cost of Obtaining a Sales Tax Permit

The cost of obtaining a sales tax permit in Maine is generally minimal. The application process is free, but businesses may incur additional costs for compliance and reporting requirements. It’s important to stay updated on any changes in fees or regulations.

Chapter 4: Economic Nexus Threshold in Maine

Maine’s Sales Tax Economic Nexus Threshold

Maine’s economic nexus threshold is set at $100,000 in annual sales or 200 transactions. This means that if your business exceeds these limits, you are required to collect and remit sales tax on transactions made to customers in Maine.

How to Determine If You Have Economic Nexus in Maine

To determine if you have economic nexus:

- Track Sales and Transactions: Regularly monitor your sales figures and transaction volumes for Maine.

- Use Nexus Tools: Employ online calculators or consult with tax professionals to assess your nexus status.

- Review Annual Reports: Analyze your annual sales reports to ensure you remain compliant with Maine’s economic nexus requirements.

Chapter 5: Taxable Goods and Services in Maine

What Goods Are Taxable in Maine?

In Maine, most tangible goods are subject to sales tax. This includes:

- Retail Goods: Clothing, electronics, furniture, and more.

- Specialty Items: Books, jewelry, and certain collectibles.

However, some goods are exempt from sales tax, such as:

- Prescription Drugs: Medication prescribed by a licensed physician.

- Food for Home Consumption: Groceries and certain food items intended for home use.

What Services Are Taxable in Maine?

Certain services are subject to sales tax in Maine. These include:

- Telecommunications Services: Phone and internet services.

- Lodging Services: Hotel and motel accommodations.

Services that are generally not taxable include professional services, such as legal and medical services.

What Is Excluded From Sales Tax in Maine?

Exclusions from sales tax include:

- Educational Materials: Textbooks and educational supplies.

- Certain Nonprofits: Purchases made by qualified nonprofit organizations.

Chapter 6: Sales Tax Exemptions in Maine

Who Is Exempt From Sales Tax in Maine?

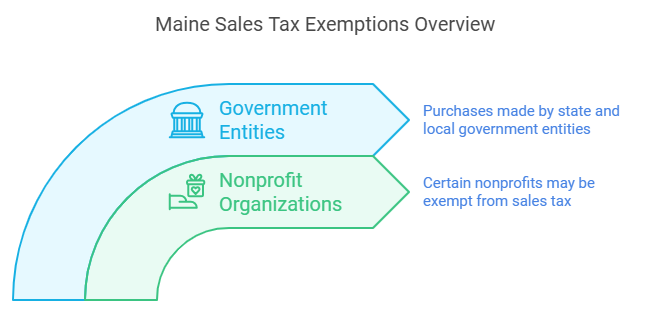

Exemptions are available for:

- Nonprofit Organizations: Certain nonprofits may be exempt from sales tax.

- Government Entities: Purchases made by state and local government entities.

What Is a Sales Tax Exemption Certificate in Maine?

A sales tax exemption certificate allows qualified entities to make tax-exempt purchases. To obtain one:

- Apply for a Certificate: Submit an application to Maine Revenue Services.

- Provide Required Documentation: Include proof of eligibility, such as nonprofit status or government affiliation.

Maine Sales Tax Exemption Rules

- Verification: Exemption certificates must be verified for validity.

- Renewal: Regular renewal of certificates is necessary to maintain exemption status.

Maine Sales Tax Exemption Certificate for Nonprofits

Nonprofits can apply for an exemption certificate to make purchases without paying sales tax. The process involves:

- Submitting an Application: Provide documentation proving nonprofit status.

- Renewing Periodically: Ensure timely renewal of the certificate to continue benefiting from tax exemptions.

Chapter 7: Maine Sales Tax Rate

What is Maine Sales Tax Rate?

Maine’s standard sales tax rate is 5.5%. This rate applies to most sales of goods and certain services.

How to Find or Lookup Your Maine Sales Tax Rate

- Maine Revenue Services Website: Check for the latest rate and updates.

- Online Tools: Utilize sales tax rate lookup tools available online.

How to Calculate Maine Sales Tax Rate

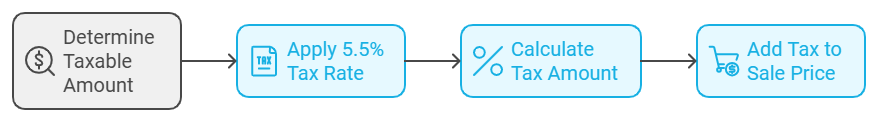

To calculate sales tax:

- Determine the Taxable Amount: Identify the total amount of the taxable sale.

- Apply the Rate: Multiply the taxable amount by 5.5% (0.055).

- Add Tax to Sale Price: Include the tax amount in the total sale price.

What City Has the Highest Sales Tax Rate in Maine?

Maine generally maintains a uniform sales tax rate across the state. However, local jurisdictions may have additional taxes or fees.

Chapter 8: Sales Tax Collection and Remittance in Maine

What Does It Mean to Charge Sales Tax vs. Collect Sales Tax in Maine?

- Charging Sales Tax: Adding sales tax to the sale price of goods or services at the point of sale.

- Collecting Sales Tax: Gathering the tax from customers and holding it until remitted to the state.

When to Charge Sales Tax in Maine?

Sales tax should be charged on all taxable goods and services at the time of purchase.

How to Charge and Collect Sales Tax in Maine?

- Incorporate Tax into Pricing: Include sales tax in the final price shown to customers.

- Collect Tax at Checkout: Ensure accurate collection of tax from customers during the transaction.

Does Maine Collect Sales Tax on Out-of-State Sales?

Maine requires businesses with nexus to collect sales tax on out-of-state sales if the transaction meets the economic nexus threshold.

Chapter 9: Sales Tax Reporting and Filing in Maine

What is Sales Tax Reporting vs. Payment vs. Filing vs. Remittance?

- Reporting: Documenting the amount of sales tax collected.

- Payment: Transferring collected sales tax to the state.

- Filing: Submitting required forms to Maine Revenue Services.

- Remittance: Sending payment of the collected sales tax to the state.

How to Report Sales Tax in Maine?

Report sales tax through the Maine Revenue Services website or by mail. Ensure accuracy in reporting amounts collected and due.

How to File Sales and Use Tax in Maine?

- Online Filing: Use the MRS online portal for electronic filing.

- Paper Forms: Submit paper forms if preferred or required.

What is the Deadline to Pay Sales Taxes in Maine?

Sales tax payments are typically due on a monthly or quarterly basis, depending on the business’s filing frequency.

Chapter 10: Penalties and Audits for Maine Sales Tax

What Is the Penalty for Paying Sales Tax Late in Maine?

Late payments of sales tax in Maine can result in penalties and interest charges. The state imposes:

- Late Payment Penalties: Generally, a percentage of the unpaid tax amount, with additional charges accruing daily.

- Interest Charges: Interest is calculated on the overdue tax amount, compounding daily until payment is made.

To avoid penalties, ensure timely payment of sales tax and accurate filing of reports.

Does Maine Conduct Sales Tax Audits?

Yes, Maine Revenue Services conducts sales tax audits to ensure compliance with state tax laws. Audits help verify that businesses are correctly reporting and remitting sales tax.

What Triggers a Sales Tax Audit in Maine?

Common triggers for a sales tax audit include:

- Inconsistent Reporting: Discrepancies between reported sales and actual sales.

- Significant Changes: Sudden changes in sales volume or business operations.

- Random Selection: Routine audits may be conducted randomly.

What Is the Penalty for an Audit After the Due Date in Maine?

Penalties for audits conducted after the due date may include:

- Additional Fines: For late payment or underreporting discovered during the audit.

- Increased Interest: On unpaid or underpaid tax amounts.

What Is Maine Sales Tax Penalty Waiver?

In some cases, Maine may offer a penalty waiver if the business can demonstrate reasonable cause for the late payment or reporting. Requesting a waiver involves:

- Submitting a Request: Provide documentation and reasons for the delay.

- Review by MRS: Maine Revenue Services will review the request and determine eligibility for a waiver.

Does Maine Offer Sales Tax Refunds?

Maine provides refunds for overpaid sales tax or tax paid in error. To claim a refund:

- Submit a Refund Request: File the appropriate forms with Maine Revenue Services.

- Provide Supporting Documentation: Include proof of the overpayment or error.

Does Maine Refund Sales Tax to Foreigners?

Maine does not typically offer sales tax refunds to foreign visitors. Refund policies generally apply to residents and businesses within the state.

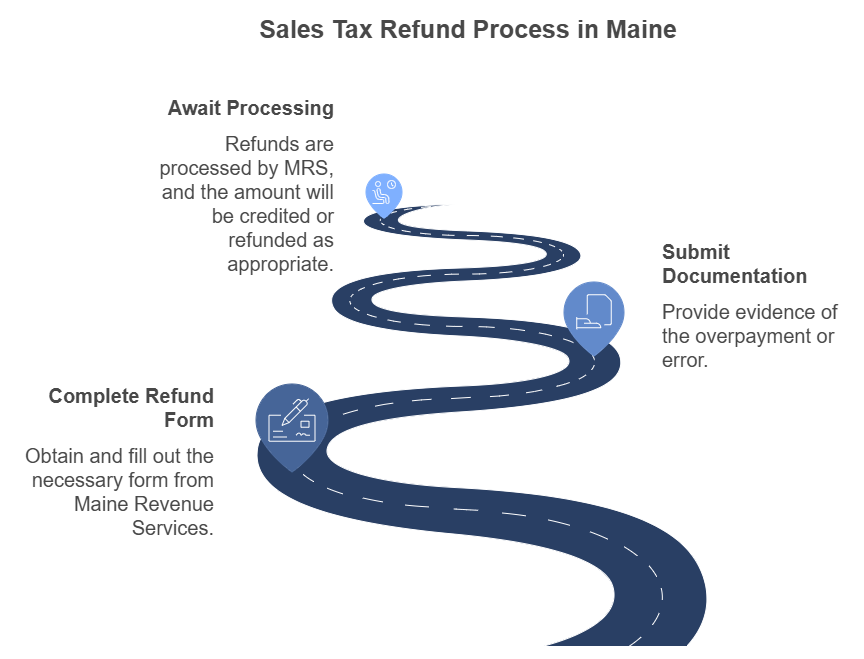

How to Claim Sales Tax Refund in Maine?

To claim a sales tax refund:

- Complete the Refund Form: Obtain and fill out the necessary form from Maine Revenue Services.

- Submit Documentation: Provide evidence of the overpayment or error.

- Await Processing: Refunds are processed by MRS, and the amount will be credited or refunded as appropriate.

Does Maine Have Sales Tax Holidays?

Maine does not currently offer sales tax holidays. However, it’s important to check for any updates or changes to tax policy that may introduce temporary tax relief periods.

Chapter 11: Maine Sales Tax for Specific Scenarios and Frequently Asked Questions (FAQs)

Do Contractors Charge Sales Tax on Labor in Maine?

In Maine, labor charges are generally not subject to sales tax. However, if a contractor provides taxable goods or materials as part of their service, sales tax should be charged on those items.

Does Maine Charge Sales Tax on Shipping?

Shipping and handling charges are not subject to sales tax in Maine if the charges are separately stated on the invoice. If included in the price of the goods, they may be subject to tax.

Does Maine Charge Sales Tax on Services?

Maine imposes sales tax on certain services, including:

- Telecommunications Services: Phone and internet services.

- Lodging Services: Charges for hotel and motel accommodations.

Does Maine Charge Sales Tax on Food?

Food for home consumption is generally exempt from sales tax in Maine. However, prepared foods and meals sold in restaurants are taxable.

Do Photographers Charge Sales Tax in Maine?

Photographers in Maine must charge sales tax on tangible items sold, such as printed photos and albums. Services related to photography, such as photo shoots, are not subject to sales tax.

Does Amazon Charge Sales Tax in Maine?

Amazon charges sales tax on purchases made by Maine residents, as the company has nexus in the state and is required to comply with Maine’s sales tax laws.

Does eBay Charge Sales Tax in Maine?

eBay also collects sales tax on transactions involving Maine buyers, in accordance with state tax regulations.

Does Wayfair Charge Sales Tax in Maine?

Wayfair, like other online retailers with nexus in Maine, collects sales tax on sales made to Maine customers.

Do You Charge Sales Tax on Rental Equipment in Maine?

Rental equipment is subject to sales tax in Maine. Businesses renting out equipment must collect sales tax on the rental charges.

Can You Charge Sales Tax on Delivery in Maine?

Delivery charges are not subject to sales tax in Maine if separately stated on the invoice. If included in the price of the goods, they may be subject to tax.

Do I Charge Sales Tax to Nonprofits in Maine?

Nonprofits may be exempt from sales tax on purchases made for charitable purposes. However, businesses should verify the nonprofit’s tax-exempt status and request a sales tax exemption certificate if applicable.

Do Restaurants Charge Sales Tax in Maine?

Restaurants in Maine must charge sales tax on meals and beverages served to customers. This applies to dine-in and take-out orders.

What happens if I accidentally overcharge sales tax in Maine?

If you accidentally overcharge sales tax, you must refund the excess to the customer or remit it to the state if the customer cannot be located.

Are there any special rules for online sellers in Maine?

Yes, online sellers must comply with Maine’s economic nexus rules, which require them to collect sales tax if they exceed $100,000 in sales or 200 transactions annually.

How do I update my sales tax permit information in Maine?

You can update your sales tax permit information online through the Maine Revenue Services portal or by contacting them directly.

Can I be audited by Maine Revenue Services?

Yes, the Maine Revenue Services can audit your business to ensure compliance with sales tax laws. Keeping accurate records is essential to pass an audit smoothly.

Are services subject to sales tax in Maine?

Certain services that involve tangible personal property, like auto repairs or cleaning services, are subject to sales tax in Maine.

Conclusion

Navigating Maine’s sales tax regulations is essential for businesses to ensure compliance and avoid penalties. By understanding the sales tax rules, nexus, exemptions, rates, and reporting requirements, businesses can manage their sales tax obligations effectively. Whether you’re a new business or an established one, staying informed about Maine’s sales tax rules is key to avoiding penalties and maintaining smooth operations.