Understanding the varying sales tax rates across New York’s counties is crucial for both consumers and businesses. These rates can significantly impact purchasing decisions and compliance requirements. This guide provides a comprehensive overview of New York’s county-specific sales tax rates, ensuring you’re well-informed and compliant with state regulations.

New York State Sales and Use Tax Rates by Jurisdiction

Do you know how the varying sales tax rates across New York counties can affect your business operations? You must know these rates to avoid fines and stay compliant with tax regulations.

In New York, each county has its own sales tax rate, which can vary greatly due to local taxes and special district levies. This guide is designed to help you know these variations, correctly use the sales tax jurisdiction codes, and ensure your business adheres to all tax requirements.

Once you understand New York’s sales tax system, you can keep your business running smoothly and legally. Let’s explore the details of these county-specific rates, understand the factors that influence them, and outline the necessary steps to stay compliant with state tax laws.

Role of Nexus in Determining NY Sales Tax Rate

Because it dictates the sales tax rate you need to charge! Each state has its own sales tax rate, so understanding your nexus in each location ensures you’re collecting the correct amount.

What Does Sales Tax Nexus Mean for Online Sellers in and Out of New York

Sales tax nexus in NY is a key concept that helps businesses selling in multiple locations to determine whether they’re obligated or need to collect and remit sales tax in New York. It essentially defines the connection between your business and a specific state, in this case, New York.

There are two main types of nexus that establish this connection

- Physical Presence Nexus: This applies if your business has a physical presence in New York, such as a warehouse, office, store, or even regular employees working remotely within the state. Having a physical presence automatically establishes a nexus and requires you to collect sales tax.

- Economic Nexus: This applies even without a physical presence. New York follows an economic nexus threshold, meaning you must collect sales tax if your business exceeds a certain sales volume within the state. Currently, New York’s economic nexus threshold is met if your business has:

- More than $500,000 in gross revenue from sales of tangible personal property delivered to New York. AND

- Conducted more than 100 sales of tangible personal property delivered to New York in the preceding four quarters.

What is the Difference Between Sales Tax and Use Tax in New York?

In New York, both sales tax and use tax apply to tangible personal property for purchase, but they differ in when the tax is collected:

- For Sales Tax: This is collected by the seller at the time of purchase within New York State. It applies to retail sales of certain goods and services.

- For Use Tax: This applies to tangible personal property you buy outside New York and use within the state. Since the seller didn’t collect sales tax, you, the buyer, are responsible for paying use tax at the same rate as sales tax.

Here’s a table summarizing the key differences of New York Sales Tax vs Use Tax

| Tax Type | When Collected | Applies to |

| Sales Tax | At the time of purchase | Tangible personal property and certain services purchased within New York |

| Use Tax | Self-reported by the buyer | Tangible personal property purchased outside New York and used within the state |

How New York Sales Tax Works

New York’s sales tax works in a two-tier system. In New York, the sales tax rate is determined by a combination of the state and local government. The New York state sales tax rate is 4% while the local sales tax rate varies depending on the location. Commonly the total sales tax can range from 4% (base state rate) to 8.875% (highest rate in New York City).

For example, in New York City, the local sales tax rate is 4.5%. This means that the total sales tax rate in New York City is 8.5%.

The New York state sales tax rate of 4% is what is consistently applied across the state while the additional NY county and local sales tax rates is what significantly increases the total rate when added

For example, if you purchase a piece of furniture in New York, the store will add the applicable sales tax to your purchase price at checkout. This tax is then collected by the retailer and remitted to the New York Department of Taxation and Finance. The exact rate you pay can depend on the county in which the purchase is made, as detailed in the New York sales tax chart.

How New York Use Tax Works

Use tax is a counterpart to sales tax, designed to capture tax on transactions where sales tax was not collected at the point of purchase. This typically applies to out-of-state purchases where the retailer did not charge New York sales tax. The use tax rate is the same as the combined sales tax rate that would have been applied if the purchase was made within the state.

For instance, if you buy a computer online from a retailer outside New York and do not pay any sales tax, you are responsible for paying use tax. This ensures that out-of-state purchases do not give consumers an unfair advantage over in-state retailers who are required to collect sales tax. It’s crucial for businesses to track these transactions to stay compliant with New York local sales tax rates and avoid penalties.

Next, we’ll explore the current base state sales tax rate in New York and how it forms the foundation for all combined rates across the state.

How Do Local Governments Add to the Sales Tax?

In New York, local governments add to the state sales tax through a two-step process:

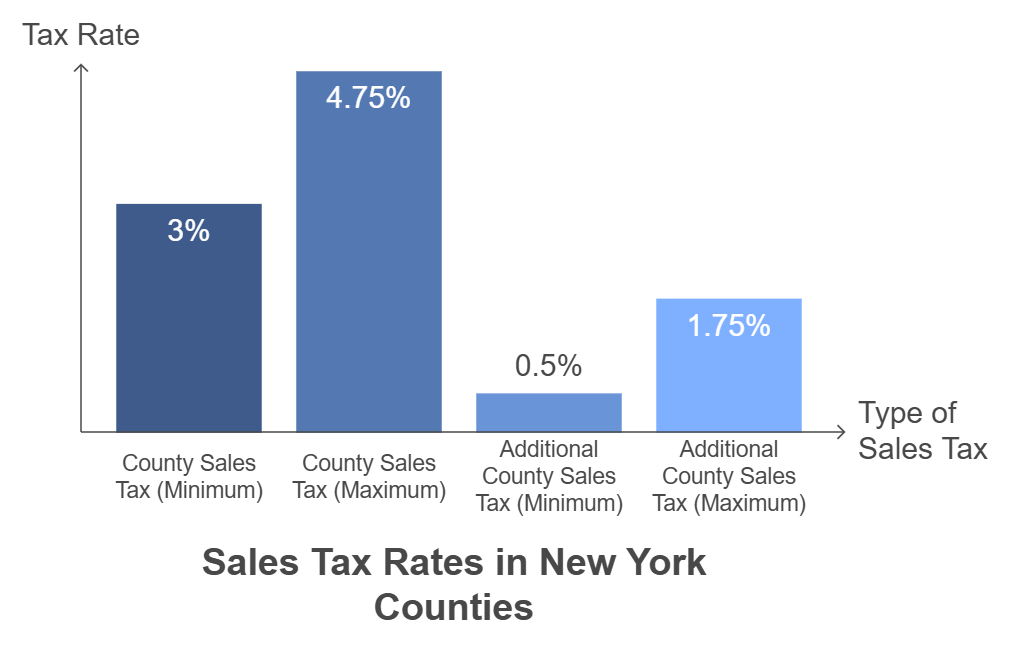

- County Sales Tax: All 62 counties in New York and New York City itself impose a local sales tax ranging from 3% to 4.75%. This levy is authorized by state law and enacted by local ordinances.

- Additional County Sales Tax (Optional): In addition to the base rate, most counties have obtained special permission from the state to impose an “additional” sales tax, ranging from 0.5% to 1.75%. These additional taxes are temporary and require periodic reauthorization by the state legislature.

What is the Base and Combined State Sales Tax Rate in New York:

- The state of New York has a base sales tax rate of 4%.

- This is added to the local county sales tax to determine the total sales tax rate.

Check your NY county rate: New York City Sales Tax Rate and Calculator

Metropolitan Commuter Transportation District (MCTD) Surcharge (For Specific Areas):

The term “Metropolitan Commuter Transportation District (MCTD) Surcharge” used to be an additional tax on top of the base Metropolitan Commuter Transportation Mobility Tax (MCTMT) for certain areas within the MCTD.

What is MCTD: This refers to the Metropolitan Commuter Transportation District, which includes New York City and several surrounding counties.

What is MCTMT: This is the current tax imposed on employers and self-employed individuals within the MCTD.

What is Surcharge: This term is no longer used for the MCTMT. Previously, some areas had an additional surcharge on top of the base MCTMT rate.

What are the MCTD area: The five boroughs of New York City and the counties of Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.

What happened?

As of July 1, 2023, the MCTMT structure changed. Instead of a base rate with a separate surcharge for specific areas, the tax rate for New York City and certain counties increased to incorporate the previous surcharge. Essentially, it became a single, higher tax rate.

Current MCTMT Rates:

The current MCTMT has different rates depending on location within the MCTD and payroll/earnings level but below are the common rates

- New York City (Manhattan, Bronx, Brooklyn, Queens, Staten Island): The highest rate is 0.60% for employers and self-employed individuals with payroll expense exceeding $437,500 in any calendar quarter or net earnings from self-employment exceeding $50,000 for the tax year.

- Other MCTD Areas: Lower rates apply to other counties within the MCTD and for those below the payroll/earnings threshold in New York City.

Read more on New York Department of Taxation and Finance on MCTMT

The Resulting Sales Tax Rates in New York

- This multi-layered system creates varying sales tax rates across New York, ranging from 7% to 8.875%.

- New York City has the highest combined sales tax rate at 8.875% (4% state + 4.5% city + 0.375% MCTD surcharge).

With these differences, it means that the NY county sales tax rates can range from as low as 4% to as high as 8.875% as mentioned earlier.

New York State Sales Tax Exemptions: Common Sales Tax Exempt Goods and Services in New York

There are some exceptions to the sales tax. For example, clothing and footwear under $110 are exempt from sales tax. In addition, certain services, such as haircuts and dry cleaning, are also exempt from sales tax.

Read more from the New York State Office of the State Comptroller: Understanding Local Government Sales Tax in New York State

To stay compliant and manage these varying rates effectively, you can use tools like a reverse sales tax calculator or ecommerce sales tax software, which help automate the process of calculating and applying the correct sales tax rates based on location.

New York Sales Tax Rates by County Breakdown

The total sales tax rate for each county in New York includes

- State Base Tax

- Additional Local Tax

Example: Sales Tax Rate in New York City

Total Sales Tax Rate: 8.875%

- State Base Rate:

- The state of New York imposes a uniform base sales tax rate of 4%. This is the foundational rate applied to most taxable sales throughout the state.

- Local County Rate:

- In addition to the state rate, New York County (Manhattan) imposes a local county sales tax rate. For New York City, this local rate is 4.5%.

- City Rate:

- New York City itself imposes a sales tax rate of 0.375% to fund various city services and projects. This is often included in the local county rate but can be separately identified for specific city needs.

- Special District Taxes:

- The Metropolitan Commuter Transportation District (MCTD) tax adds an additional 0.375%. This tax is specific to the counties within the New York City metropolitan area and funds transportation services like the Metropolitan Transportation Authority (MTA).

When combined, these layers form the total sales tax rate that consumers and businesses must pay on taxable goods and services in New York City:

- State Base Rate: 4%

- Local County Rate (New York County): 4.5%

- City Rate (New York City): 0.375%

- MCTD Special District Tax: 0.375%

Thus, the total combined sales tax rate in New York City is 8.875%.

Table of New York Sales Tax Rate by Location

The table below shows the breakdown of the New York county sales tax rates that consist of the state base tax and the additional local tax for each county:

| County Name | State Base Tax | Additional Local Tax | Total Tax Rate |

| Albany County | 4.00% | 4.00% | 8.00% |

| Allegany County | 4.00% | 4.50% | 8.50% |

| Bronx County | 4.00% | 4.875% | 8.875% |

| Broome County | 4.00% | 4.00% | 8.00% |

| Cattaraugus County | 4.00% | 4.75% | 8.75% |

| Cayuga County | 4.00% | 4.00% | 8.00% |

| Chautauqua County | 4.00% | 4.00% | 8.00% |

| Chemung County | 4.00% | 4.00% | 8.00% |

| Chenango County | 4.00% | 4.00% | 8.00% |

| Clinton County | 4.00% | 4.00% | 8.00% |

| Columbia County | 4.00% | 4.125% | 8.125% |

| Cortland County | 4.00% | 4.00% | 8.00% |

| Delaware County | 4.00% | 4.00% | 8.00% |

| Dutchess County | 4.00% | 4.375% | 8.375% |

| Erie County | 4.00% | 4.75% | 8.75% |

| Essex County | 4.00% | 4.00% | 8.00% |

| Franklin County | 4.00% | 4.00% | 8.00% |

| Fulton County | 4.00% | 4.25% | 8.25% |

| Genesee County | 4.00% | 4.75% | 8.75% |

| Greene County | 4.00% | 4.00% | 8.00% |

| Hamilton County | 4.00% | 4.25% | 8.25% |

| Herkimer County | 4.00% | 4.75% | 8.75% |

| Jefferson County | 4.00% | 4.00% | 8.00% |

| Kings County | 4.00% | 4.875% | 8.875% |

| Lewis County | 4.00% | 4.75% | 8.75% |

| Livingston County | 4.00% | 4.50% | 8.50% |

| Madison County | 4.00% | 4.75% | 8.75% |

| Monroe County | 4.00% | 4.625% | 8.625% |

| Montgomery County | 4.00% | 4.25% | 8.25% |

| Nassau County | 4.00% | 4.875% | 8.875% |

| New York County | 4.00% | 4.875% | 8.875% |

| Niagara County | 4.00% | 4.75% | 8.75% |

| Oneida County | 4.00% | 4.75% | 8.75% |

| Onondaga County | 4.00% | 4.00% | 8.00% |

| Ontario County | 4.00% | 4.00% | 8.00% |

| Orange County | 4.00% | 4.375% | 8.375% |

| Orleans County | 4.00% | 4.00% | 8.00% |

| Oswego County | 4.00% | 4.75% | 8.75% |

| Otsego County | 4.00% | 4.25% | 8.25% |

| Putnam County | 4.00% | 4.375% | 8.375% |

| Queens County | 4.00% | 4.875% | 8.875% |

| Rensselaer County | 4.00% | 4.00% | 8.00% |

| Richmond County | 4.00% | 4.875% | 8.875% |

| Rockland County | 4.00% | 4.375% | 8.375% |

| Saratoga County | 4.00% | 4.00% | 8.00% |

| Schenectady County | 4.00% | 4.00% | 8.00% |

| Schoharie County | 4.00% | 4.00% | 8.00% |

| Schuyler County | 4.00% | 4.00% | 8.00% |

| Seneca County | 4.00% | 4.00% | 8.00% |

| St. Lawrence County | 4.00% | 4.00% | 8.00% |

| Steuben County | 4.00% | 4.50% | 8.50% |

| Suffolk County | 4.00% | 4.625% | 8.625% |

| Sullivan County | 4.00% | 4.125% | 8.125% |

| Tioga County | 4.00% | 4.00% | 8.00% |

| Tompkins County | 4.00% | 4.00% | 8.00% |

| Ulster County | 4.00% | 4.125% | 8.125% |

| Warren County | 4.00% | 4.00% | 8.00% |

| Washington County | 4.00% | 4.375% | 8.375% |

| Wayne County | 4.00% | 4.00% | 8.00% |

| Westchester County | 4.00% | 4.875% | 8.875% |

| Wyoming County | 4.00% | 4.75% | 8.75% |

| Yates County | 4.00% | 4.00% | 8.00% |

By referring to the New York sales tax chart and keeping up-to-date with changes in tax rates, businesses can effectively manage their sales tax obligations across different counties, ensuring compliance and financial accuracy.

Which Counties Have the Highest Sales Tax Rates in New York?

In New York State, certain counties have notably higher combined sales tax rates due to additional local and special district taxes.

Here are some of the counties with the highest sales tax rates:

- New York County (Manhattan): 8.875%

- Kings County (Brooklyn): 8.875%

- Bronx County: 8.875%

- Queens County: 8.875%

- Richmond County (Staten Island): 8.875%

- Nassau County: 8.875%

- Westchester County: 8.375%

- Erie County: 8.75%

- Oneida County: 8.75%

- Niagara County: 8.75%

Counties like New York, Kings, Bronx, Queens, and Richmond have the highest combined rates primarily because of their inclusion in the MCTD and additional local taxes that fund city services and infrastructure projects. Nassau County also has a high rate due to significant local taxes.

In comparison, the state average sales tax rate is about 8.52% when considering both the state and local components. The higher rates in these counties are often due to the dense population, higher demand for public services, and extensive infrastructure needs.

Final Thoughts

Being aware of the New York sales tax rates by county is essential for you because these rates can vary significantly, affecting your pricing and compliance. By knowing the specific rates in each county, you can avoid costly penalties and ensure you’re collecting the correct amount of tax from your customers.

This is vital for keeping your business running legally and without any complexities. Regularly updating your knowledge on local tax rates and using tools like sales tax calculators can make this task easier.

For personalized advice, consider consulting a tax professional to help you comprehend the tax rates and its implications effectively and ensure your business stays compliant and profitable. If you stay informed and proactive, you can save you time and money in the long run.