Navigating New York’s sales tax registration process can feel overwhelming, especially if you’re a new business owner. But understanding the costs, application steps, and potential fees for obtaining a Certificate of Authority doesn’t have to be complicated.

In this guide, we’ll break down everything you need to know to get your sales tax permit in New York, ensuring your business stays compliant and avoids costly penalties. Let’s simplify the process and get you one step closer to running your business with confidence!

New York Sales Tax Registration Fees for Online Sellers

Did you know that operating without a seller permit in New York can result in fines up to $10,000? A seller permit, officially known as a Certificate of Authority, is mandatory for businesses selling taxable goods or services in New York. Without it, you cannot legally collect sales tax from customers, a crucial aspect of maintaining compliance with state regulations.

This article will guide you through the New York seller permit cost and the expenses associated with maintaining the permit. It will also outline the application process and highlight common pitfalls to avoid.

What is the Cost to Getting a Seller Permit in New York?

So, how much does a seller’s permit cost in New York? Absolutely nothing. In New York, applying for and obtaining a sales tax permit is free of charge. This is a significant advantage for new businesses as it eliminates the initial sales tax permit application fee that might be found in other states. However, there are other cost components to consider when we talk about New York seller permit cost and they are:

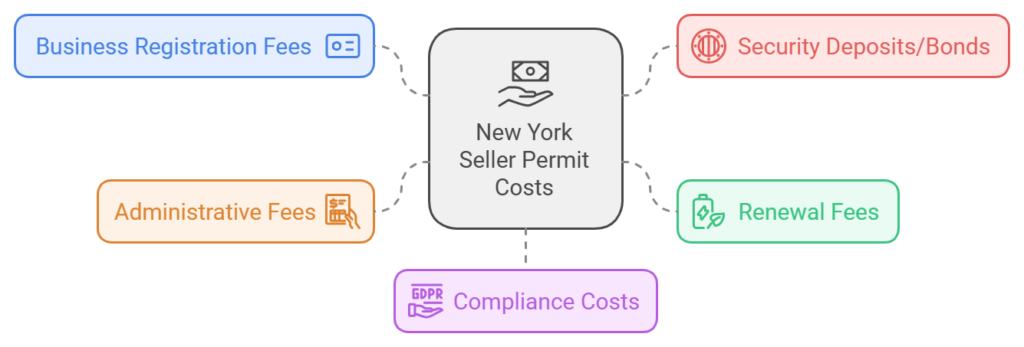

Additional New York Seller Permit Cost

1. Business Registration Fees

While the sales tax permit itself is free, there are other New York business registration fees depending on your business structure. For instance, filing a Certificate of Incorporation for a corporation costs $125, forming an LLC is $200, and the biennial statement for LLCs and corporations is $9 every two years.

2. Security Deposits/Bonds

Unlike some states, New York does not typically require a security deposit or bond when issuing a sales tax permit. However, in other states, businesses might be required to provide a security deposit based on their estimated tax liability. For example, California may require a deposit to ensure that businesses can cover their sales tax obligations.

3. Renewal Fees

New York does not impose sales tax permit NY renewal fees, as the Certificate of Authority remains valid until it is canceled or revoked by the state. This is a cost-saving feature compared to other states that may require periodic renewals with associated fees.

4. Administrative Fees

There may be administrative fees for obtaining duplicate certificates or making amendments to the permit. For instance, if you lose your Certificate of Authority or need to update business information, you might incur small administrative charges. These fees ensure that the state can maintain accurate records for all registered businesses. Examples include:

- Duplicate certificate fee: $10

- Amendment filing fee: $60

5. Compliance Costs

Ensuring sales tax compliance New York involves ongoing costs, including maintaining proper records, using accounting or e-commerce sales tax software, and potentially hiring professional services for tax filings and audits. Compliance costs may include:

- Accounting software: Varies widely based on features and usage

- Professional services for tax filings: Hourly rates for accountants can range from $100 to $500, depending on the complexity of services required

By understanding these components, you can better prepare for the financial obligations associated with obtaining and maintaining a New York seller permit.

New York Seller’s Permit vs Surety Bond

In New York, a seller’s permit and a surety bond are two different things that serve distinct purposes for businesses. Here’s a breakdown:

Seller’s Permit:

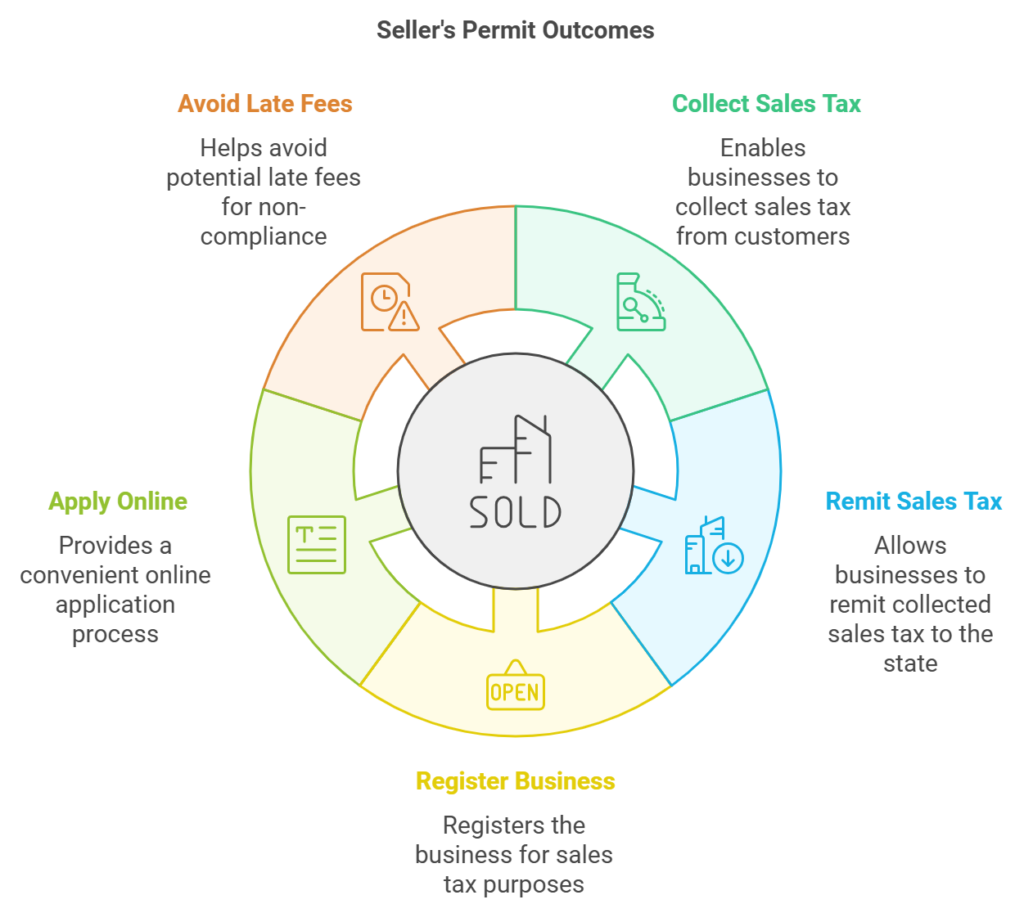

- What it is: A seller’s permit, also known as a sales tax permit, is a license issued by the New York Department of Taxation and Finance.

- Who needs it: Businesses that sell taxable goods or services in New York State are required to obtain a seller’s permit. This includes online sellers with a physical presence in New York or exceeding a certain amount of sales within the state.

- What it does: A seller’s permit allows you to collect sales tax from your customers and remit it to the state. It essentially registers your business with the state for sales tax purposes.

- Obtaining a seller’s permit: The process is typically done online through the Department of Taxation and Finance website. It’s usually free to apply, although there may be a small late fee if you don’t obtain it before you start selling.

Surety Bond:

- What it is: A surety bond is a financial guarantee issued by a surety company on behalf of a business.

- Who needs it: Surety bonds are not universally required for all businesses in New York. However, certain professions or industries may be mandated to have one by the state or local municipality to operate. Examples include car washes, collection agencies, and contractors in some situations.

- What it does: The surety bond serves as a financial guarantee that the business will comply with specific laws, regulations, or license requirements. If the business fails to comply, the state or aggrieved party can claim the bond amount to cover damages or losses.

- Obtaining a surety bond: The cost of a surety bond depends on the bond amount required and the perceived risk of the business. Typically, the business owner pays a premium to the surety company, which is a percentage of the total bond amount.

Here’s an analogy to understand the difference:

- Seller’s permit: Think of it as a library card. It grants you permission to participate in an activity (collecting sales tax) but also holds you responsible for following the rules (properly collecting and remitting tax).

- Surety bond: This is more like a security deposit for an apartment. It provides financial assurance to the state or municipality that you’ll comply with the regulations of your business license. If you break the rules, the “deposit” (bond amount) can be claimed to cover damages.

| Table summarizing the key differences between a New York business permit and surety bond | ||

| Feature | Seller’s Permit | Surety Bond |

| Purpose | Authorizes collection of sales tax | Financial guarantee for fulfilling business obligations |

| Issued by | Department of Taxation and Finance | Surety company |

| Cost | Free | Premium paid to the surety company |

| Applies to | Businesses selling taxable goods | Specific industries or licensing requirements |

How Zero-Cost Sales Tax Permit Benefit New York

Keeping the sales tax permit cost-free in New York offers several benefits for both businesses and the state:

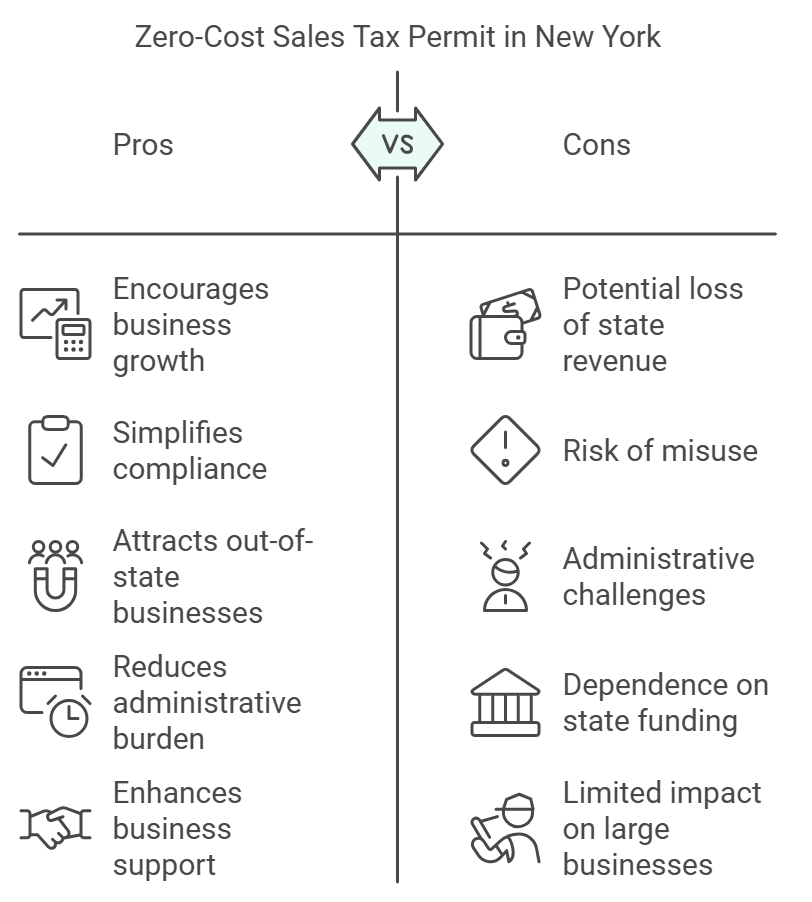

Encourages Business Formation and Growth

By eliminating the initial sales tax permit application fee, New York reduces the financial barriers to starting a business. This is particularly beneficial for small businesses and startups, which often operate with limited initial capital.

The ease of obtaining a free sales tax permit can encourage more entrepreneurs to establish their businesses in New York, fostering economic growth and innovation.

Simplifies the Compliance Process

A cost-free permit simplifies the compliance process for new businesses. Entrepreneurs can focus on setting up and operating their businesses without worrying about the upfront costs associated with obtaining a permit. This ease of compliance ensures that more businesses operate within the legal framework, thereby increasing the overall compliance rate in the state.

Attracts Out-of-State Businesses

For businesses looking to expand into new markets, the absence of a permit fee in New York is an attractive incentive. Out-of-state businesses may be more inclined to establish operations in New York knowing that they can obtain a sales tax permit without incurring additional costs. This can lead to increased business activity and economic diversification within the state.

Reduces Administrative Burden

The absence of a fee reduces the administrative burden on both businesses and the state. Businesses save time and resources that would otherwise be spent on processing payments for the permit. For the state, managing a fee-free application process simplifies administration and reduces the need for handling and processing payments, allowing resources to be allocated more efficiently.

Enhances Business Support

By keeping the New York seller permit cost at zero, the state demonstrates its support for businesses. This policy can be seen as part of a broader initiative to create a business-friendly environment, encouraging entrepreneurship and economic development. The positive perception of state support can enhance the business climate and attract more investment.

Thus, maintaining a fee-free sales tax permit in New York benefits both new and existing businesses, contributing to a dynamic and growing economy.

Other Costs and Penalties to Consider

When it comes to running your business smoothly, you must consider the potential penalties tied to the New York sales tax permit, which can become quite costly. Ignoring these penalties is not an option, as they can significantly impact your business’s financial health and legal standing.

Penalties for Non-Compliance

Failing to Register: If you fail to register for a sales tax permit before conducting taxable sales, you could face severe penalties. The fines can be up to $500 for the first day and $200 for each subsequent day, not exceeding $10,000. This underscores the importance of early registration and compliance with state requirements.

Late Filing: Timely filing of sales tax returns is necessary. Penalties for late filing include 10% of the tax due for the first month, plus 1% for each additional month, up to a maximum of 30%. Ensuring timely filings helps avoid these penalties and maintains good standing with the state.

Inadequate Records: Maintaining proper records is essential for sales tax compliance. Failing to keep adequate records can result in fines of up to $1,000 per quarter. These records are necessary for audits and verifying tax amounts collected and remitted. For assistance with maintaining accurate records, you can use tools like the Reverse Sales Tax Calculator to simplify calculations and compliance.

Criminal Offenses: Submitting false information or failing to keep required records can lead to serious legal consequences, including fines and potential jail time. These offenses can severely impact your business operations and reputation. Ensuring accuracy and integrity in your filings and records is critical to avoid such severe penalties.

Reseller Permit Ny Cost:

Obtaining a reseller permit (also known as a Certificate of Authority) in New York State does not have any associated fees.

These permits are issued by the New York Department of Taxation and Finance and allow businesses to purchase items for resale without paying sales tax.

How to Register for a Reseller Permit in New York

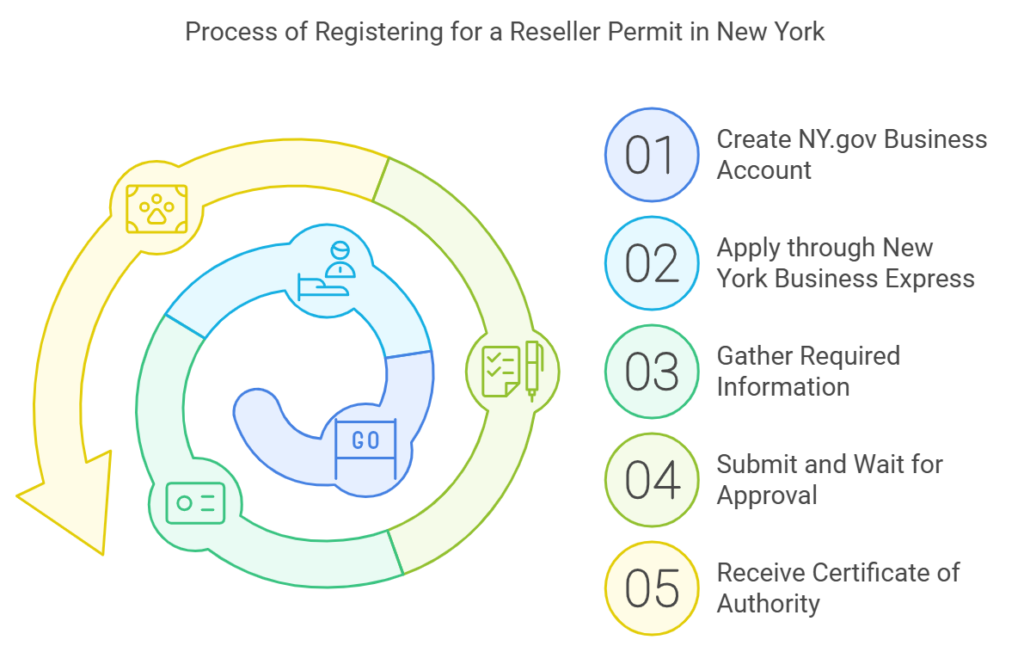

In New York, a reseller permit is also called a Certificate of Authority. Here’s how to register for one:

1. Create a NY.gov Business Account:

This is the first step and can be done on the New York State website. Search for “NY.gov ID” and register for a Business Account.

2. Apply through New York Business Express:

Once you have your NY.gov Business Account, use the New York Business Express online portal to apply for your Certificate of Authority.

3. Gather Required Information:

While applying online, you’ll need some information like your business details and responsible person contact information. Form DTF-17.1, Business Contact and Responsible Person Questionnaire, might be helpful to gather this information beforehand.

4. Submit and Wait for Approval:

The application process is free, and after submitting, the Department of Taxation and Finance will review it. Upon approval, they’ll mail you your official Certificate of Authority.

Key Points:

- Don’t collect sales tax until you receive your Certificate of Authority.

- You might need a separate Certificate of Authority for each business location.

Final Thoughts

With zero cost for a sales tax permit in New York, your business can seamlessly integrate into New York’s dynamic market, supported by a system that promotes economic growth and entrepreneurial success. Leveraging the state’s free permit policy, you can focus on growth and innovation, contributing to a vibrant and diverse economic landscape.

This approach underscores New York’s commitment to fostering a business-friendly environment, making it an attractive destination for entrepreneurs and established companies alike.

Need assistance with your New York sales tax registration? Contact us today via our chat to ensure compliance and avoid costly fines.

You may love to read more with the following

How Sales Tax Work in the US – State by State in 2024 (Definitive Guide)

New York Sales Tax | Calculator and Local Rates | 2024 – AtomicTax

How to File and Remit New York Sales Tax