Registering for a Florida Sales Tax Permit in 2024

In Florida, you can register for a sales tax permit online or by mail. The online method is generally faster and recommended by the Florida Department of Revenue.

Don’t let the worry of the sales tax application process slow you down. Obtaining a Florida sales tax permit is a straightforward process and this guide will walk you through the steps, and every other important thing you need to know to ensure you can operate your business with confidence and avoid the pains of non-compliance

Before you devolve into this blog post proper, here are few key takeaways or overview in the blog post

Key Takeaways on Florida Sales Tax License Application

Below are the important takeaways from this blog post that you need to know about the entire application process of Florida seller’s permit.

Nexus Determination in Florida

Determining your sales tax nexus in different jurisdictions is the first step to understanding your filing obligations.

Florida Sales Tax Registration Qualification: Who Qualifies and Need to Pay & File Sales Tax in Florida

Registering to collect and remit sales tax is mandatory once you have nexus in a specific location.

How to Check you Florida Application Status and Retrieve your Certificate Number:

- Online: If you submitted your application electronically, log in to the Florida Business Tax Application using your credentials. You should be able to see the status and retrieve your certificate number after three business days (Florida Dept. of Revenue – Account Management and Registration).

Application Cost: How Much Does it Cost to Register for a Sales Tax Permit in Florida

- Online: Free.

- Mail: $5 processing fee.

Processing Time: How Long Does It Take to Receive Your Sales Tax Permit in Florida

- Allow three business days for processing after submitting your application.

Renewal Requirement: Do You Have to Renew Your Florida Sales Tax Permit

- No renewal needed: Florida sales tax permits are valid indefinitely.

Certificate Number Search: How do You Find Your Florida Sales Tax Certificate Number

- Online method above (refer to Checking Application Status section).

- Your certificate number may also be included in any approval documentation you receive from the Florida Department of Revenue.

How to Obtain Your Florida Sales Tax Number:

- Getting a sales tax number is the same process as applying for a sales tax permit. You can register online for free at the Florida Department of Revenue’s website

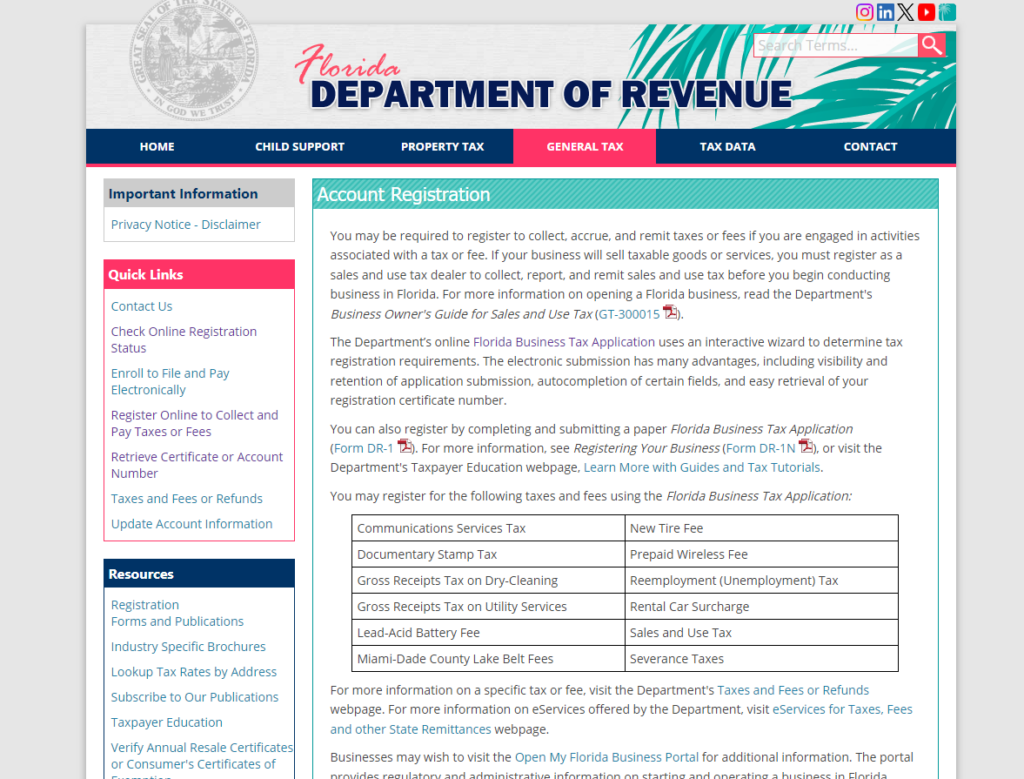

Account Registration – Florida Department of Revenue).

Why You Need a Florida Sales Tax Permit: Avoiding Compliance Headaches

Consequences of Operating Without a Sales Tax Permit in Florida

Running a business in Florida often involves collecting sales tax on your products or services. To ensure you’re following the rules, a Florida Sales Tax Permit is essential. Operating without one can lead to a number of headaches, including:

- Penalties and Fines: The state of Florida imposes penalties on businesses caught collecting sales tax without a permit. These can include a minimum $50 fine and a 10% penalty on the total sales tax owed.

- Audit Issues: If you’re audited and don’t have a permit, the process can be stressful and time-consuming. You’ll likely face demands for back taxes, penalties, and interest.

- Cash Flow Disruptions: Unexpected tax bills due to non-compliance can significantly disrupt your cash flow, making it difficult to manage your business finances.

The Consequences Beyond Financial Pain

The repercussions of not having a Sales Tax Permit go beyond financial penalties. Here’s what you risk:

- Business License Suspension: In severe cases, the state can suspend your business license, forcing you to temporarily close your doors.

- Damaged Reputation: Non-compliance can damage your business reputation and erode customer trust..

Understanding Florida Sales Tax Permit and Nexus

What is Florida Sales Tax Permit

A Florida sales tax permit, also referred to as a Certificate of Registration (Form DR-11), is issued by the Florida Department of Revenue to businesses that sell taxable goods or services within the state. This permit authorizes you to collect sales tax from customers on behalf of the state.

Florida Sales Tax License vs. Permit & Number – What’s the Difference

The terms “Florida sales tax license,” “permit,” and “number” are often used interchangeably, but there’s a subtle difference:

- Florida Sales Tax Permit (Certificate of Registration): This is the official document issued by the state that authorizes you to collect sales tax.

- Florida Sales License: “License” is a general term sometimes used to refer to the permit.

- Florida Sales Tax Number: The permit will have a unique identification number associated with it, which is also sometimes referred to as the “sales tax number.”

In essence, they all refer to the same thing: your authorization to collect sales tax in Florida.

What is Florida Sales Tax Nexus

Sales tax nexus refers to a business’s connection to a state that creates a legal obligation to collect and remit sales tax. In Florida, a business can establish a nexus through physical presence or economic activity within the state.

How Nexus Applies to Online Sellers in Florida

There are two main ways online sellers can create nexus in Florida:

- Physical Presence Nexus: This occurs if the seller has a physical location in Florida, such as a warehouse, store, or office.

- Economic Nexus Thresholds: Established in 2021, Florida also imposes economic nexus. This means that out-of-state sellers exceeding a certain sales threshold within the state must collect and remit sales tax.

What is Florida’s Economic Nexus Thresholds:

Currently, Florida’s economic nexus threshold is $100,000 in sales of tangible personal property within the previous calendar year. It’s important to note that thresholds can change, so for the latest information, refer to the Florida Department of Revenue’s website

Common Misconceptions About Florida’s Sales Tax Nexus

- “Occasional Seller” Exception: There is no specific exemption for “occasional sellers” in Florida. If you meet the physical presence or economic nexus thresholds, you are generally obligated to collect and remit sales tax

Who Needs a Florida Sales Tax Permit?

There are three main categories of businesses that need a Florida Sales Tax Permit:

1. Businesses with a Physical Presence in Florida:

This applies to businesses with any of the following in Florida:

- Employees, agents, or independent contractors conducting business activities.

- An office or storefront.

- Inventory stored or assembled in the state.

- Delivering goods to customers using company-owned vehicles.

2. Online Sellers Meeting Economic Nexus Thresholds:

Florida has an economic nexus statute. This means that even if you don’t have a physical presence in the state, you may still need a permit if you exceed a certain amount of sales within Florida. As of July 1st, 2021, the threshold is $100,000 in retail taxable sales (excluding marketplace sales) in the previous calendar year.

3. Businesses Fulfilling Orders from Florida:

This includes situations like:

- Dropshipping: If your dropshipping supplier is located in Florida and they directly fulfill orders to your customers, you likely need a permit.

- Third-Party Logistics (3PL): If you use a 3PL provider that stores your inventory in Florida and fulfills orders to customers there, you’ll likely need a permit.

In Summary:

If you plan on selling taxable goods or services in Florida, having a physical presence, exceeding the economic nexus thresholds, or fulfilling orders from within the state, you’ll need a Florida Sales Tax Permit.

Read Also: Sales Tax Permit Costs for Every US State

How to Register for a Florida Sales Tax Permit

There are two ways to register for a Florida Sales Tax Permit: online and by mail. The Florida Department of Revenue recommends registering online for faster processing.

What are the Two Main Sales Tax Registration Methods in Florida:

Online Application (Recommended):

This is the fastest and most convenient method. There is no fee to register online.

Paper Application (Alternative):

You can submit a paper application by mail, but there is a $5 fee and processing times may be longer.

Step-by-Step Guide on How to Apply for Florida Sales Tax Permit Online:

- Visit the Florida Department of Revenue’s Registration and Account Maintenance portal.

- Click on “Register Online to Collect and Pay Taxes or Fees”.

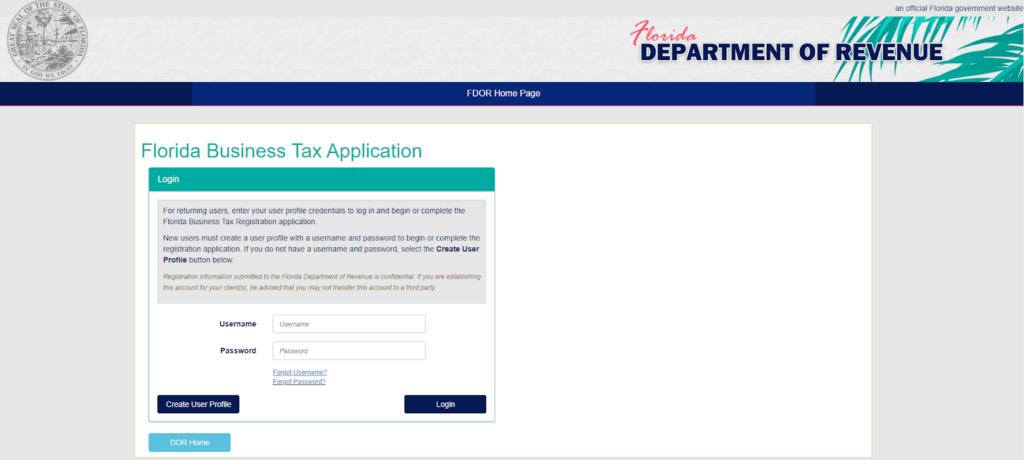

- Click on the “Create User Profile”

- Follow the on-screen instructions to fill in and complete the application.

- Once you submit the application, you will receive a confirmation number. You can usually retrieve your certificate number(s) online after three business days.

Here’how the Florida Department of Revenue’s Registration and Account Maintenance portal.

Here’s the page to create your profile

What Information Do You Need to Register for the Florida Sales Tax Permit Online (Online Application Requirement)

- Federal Employer Identification Number (EIN)

- Business Legal Structure (Sole Proprietorship, LLC, etc.)

- Owner Information (Name, Social Security Number)

- NAICS Code (North American Industry Classification System code for your business type)

- Estimated Annual Sales Tax Liability

- Business Contact Information (Address, Phone Number, Email)

Link to Florida Department of Revenue Website:

For more information and to register online, visit the Florida Department of Revenue website:

Florida Department of Revenue Account Management and Registration

What Should You Do After Florida Sales Tax Permit Registration

Once you’ve registered to collect and remit sales tax, these are the ongoing obligations you need to ensure compliance.

- Sales Tax Filing Frequency and Deadlines:

Understanding how often you need to file sales tax returns and the corresponding due dates is crucial. Filing frequencies can vary by jurisdiction, ranging from monthly to annually. Deadlines can also differ based on the filing method (electronic vs. paper) or fall on weekends/holidays, so staying informed is essential.

- Sales Tax Reporting and Remittance Procedures:

Knowing how to accurately report your sales tax collections and remit the tax owed to the appropriate authorities is vital. This may involve specific procedures for electronic filing or payment methods accepted by each jurisdiction.

- Keeping Accurate Sales Records:

Maintaining detailed sales records is fundamental for calculating sales tax liability and preparing accurate returns. These records should include the date of sale, item description, sales price, sales tax collected, and any relevant exemptions applied.

Read Also: How to Register for Sales Tax Permit in Every State in US

Conclusion

Sales tax compliance can be complex but yy following these steps and staying informed about sales tax regulations, you can ensure your business remains compliant and avoids potential penalties in Florida. Additionally, consider consulting with a tax professional or using sales tax software like AtomicTax to ensure accurate calculations, early filing, and remittance.