Running an e-commerce business can be exciting, but navigating the world of sales tax can feel overwhelming. If you’re selling products to Ohio customers, understanding Ohio’s sales tax laws is crucial for staying compliant and avoiding penalties. This comprehensive guide will equip you with the knowledge you need to conquer Ohio sales tax.

Get Your Ohio Sales Tax Permit Faster: A Step-by-Step Guide Explained

What is the Sales Tax in Ohio

The state sales tax rate in Ohio is 5.75%, and localities can add on additional taxes up to a maximum of 2.25%. This means the total sales tax rate in Ohio can range from 5.75% to 8%. So it’s combined rate of state and local taxe

Is Ohio Sales Tax the Same as Ohio Use Tax

No, but they are closely related. Ohio sales tax is collected at the point of purchase for certain goods and services within the state while Ohio use tax applies when you buy something from an out-of-state seller (without sales tax collected) and use it in Ohio. Essentially, if you’re an Ohio resident and buy something online from a seller without a physical presence in Ohio (and they don’t collect sales tax), you’re responsible for paying use tax directly to the state of Ohio.

Does Ohio Have Sales Tax

Yes, Ohio has a sales tax, and most tangible personal property sold in the state is subject to it. There are, however, some exemptions we’ll cover later.

Is Ohio Seller’s Permit the Same as Ohio Resale Certificate

No, these are two distinct concepts. An Ohio seller’s permit, also known as a vendor’s license in Ohio, allows you to collect sales tax from your customers on behalf of the state while a resale certificate in Ohio, on the other hand, allows you to purchase items tax-free for resale.

Is Ohio Sales Tax an Origin or Destination Based

Ohio uses a hybrid sales tax system, combining elements of both origin-based and destination-based sourcing. Generally, for in-state sales (Ohio seller, Ohio buyer), the tax is based on the seller’s location (origin-based). However, for out-of-state sales (out-of-state seller, Ohio buyer), the tax applies where the buyer receives the goods (destination-based)

Collecting Sales Tax in Ohio

In this section we went into the nitty-gritty of collecting sales tax in Ohio:

Does Ohio Charge Sales Tax on Services

Generally, Ohio doesn’t tax services. In Ohio, sales tax generally applies to the sale of tangible personal property, but certain services are also taxable. Examples include landscaping or lawn care (if exceeding $5,000 annually), private investigations, hotel stays under 30 days, and car washes. Generally, haircuts, legal services, and repairs are not taxable.

What Triggers Ohio Sales Tax Nexus

In Ohio, sales tax nexus is triggered by either exceeding a sales threshold or having a physical presence in the state, or even having affiliate marketers promote your products to Ohio residents.

- Sales Threshold: If your online business makes more than $100,000 in sales or has more than 200 transactions to Ohio customers in a year (either current or previous), you have economic nexus and must collect sales tax.

- Physical Presence: Owning a warehouse, office, store, or having employees in Ohio creates physical nexus, requiring you to register for a seller’s use tax license and collect sales tax.

What Do I Need to Collect Sales Tax in Ohio

To collect sales tax in Ohio, you’ll need an Ohio vendor’s permit ( (free for remote sellers, $25 for in-state businesses) and meet economic nexus requirements. This means having enough sales or activity in the state to trigger sales tax collection.

Does Etsy Collect Sales Tax for Ohio

No, Etsy itself doesn’t collect sales tax. As the seller, you’re responsible for collecting and remitting the appropriate sales tax based on your location and your customers’ locations.

Does Ohio Require Internet Sales Tax Collection

Yes, Ohio requires all sellers with nexus in the state to collect sales tax on internet sales, regardless of the seller’s physical location.

Can Counties in Ohio Collect a Sales Tax

Yes, Ohio counties can add a sales tax on top of the state’s base rate of 5.75%. These local rates vary by county and can be up to 2.25%, bringing the total sales tax to a maximum of 8%.

How to Collect Sales Tax in Ohio

To collect sales tax in Ohis, you first have to obtain your seller’s permit, then you’ll need to find & determine, and collect the appropriate sales tax rate from your Ohio customers (add the calculated sales tax to your customer’s online order total). and then remit it to the state (electrically file and submit it).

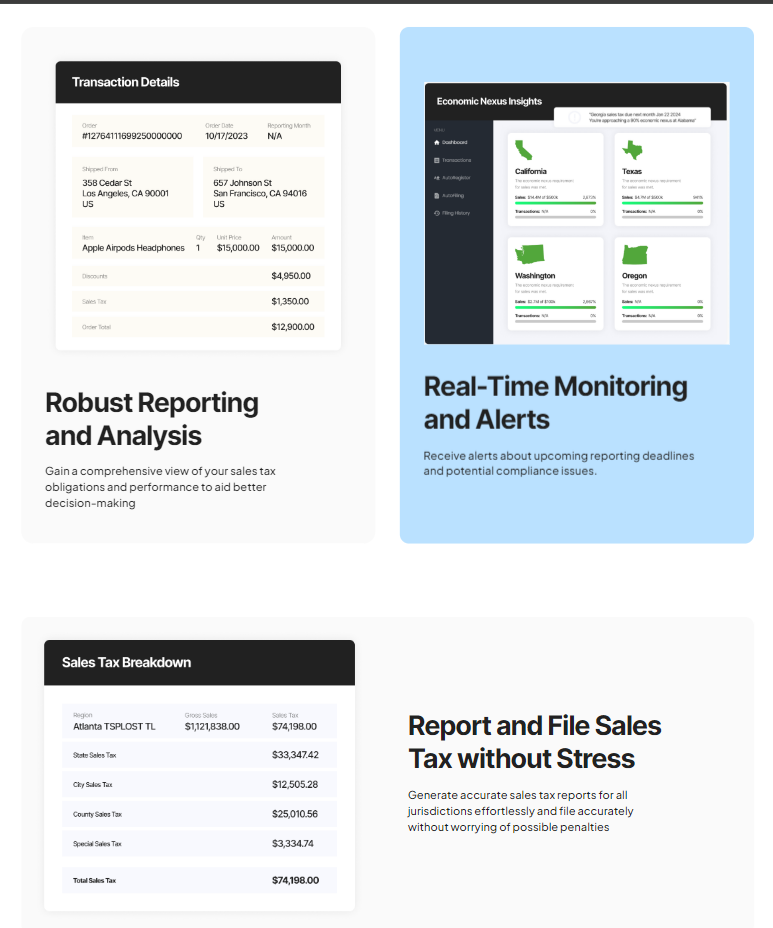

Most e-commerce platforms have built-in sales tax automation features to streamline this process. For example, you can automate your sales tax calculations, filing and reporting with Atomic Tax sales tax software and they offer a 30 days free trial for first time user

Does a Nonprofit Have to Collect Ohio Sales Tax

In Ohio, nonprofits generally don’t collect sales tax on sales made for charitable purposes. But, if they sell taxable items on more than six days a year, they need a vendor’s license and must collect tax.

Does Sales Tax Apply on Used Equipment in Ohio

In Ohio, sales tax generally applies to the sale of used equipment, with a few exceptions. The standard rate is 5.75%, but localities can add additional taxes. Manufacturers may be exempt on equipment used directly in production.

In the next part where we’ll explore Ohio Sales Tax Registration!

Ohio Sales Tax Registration

Obtaining a seller’s permit is your first step towards Ohio sales tax compliance. Here’s a breakdown of the registration process

What Information Do You Need to Register for a Sales Tax License in Ohio

The basic information you will need to register for a sales tax license (vendor’s license) in Ohio are;

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

- Business legal structure (sole prop., LLC, etc.)

- Business name and address

- Estimated annual sales tax liability

- Ohio locations where you’ll collect and remit sales ta

How to Register a Seller’s Permit in Ohio

You can register for Ohio seller’s permit (vendor’s license) either via online or mail. To apply online, register through the Ohio Business Gateway. For In-state businesses choose “County Vendor’s License,” while out-of-state sellers choose “Sellers Registration. And to apply via mail: download and mail the ST-1 application form.

Both methods require your business information and a Federal Tax ID. Registering online is generally faster.

How Much Does it Cost to Apply for a Sales Tax Permit in Ohio

The cost of applying for a sales tax permit in Ohio for in-state businesses is a $25 fee for a vendor’s permit (ST-1 form), while for out-of-state sellers, it’s free to register for an Ohio Out-of-State Seller Permit (UT-1000 form).

How Long Does it Take to Receive Your Ohio Sales Tax Permit

When you apply online, you will get your temporary account ID immediately, and your permanent permit typically arrives within 10 business days while for paper applications, it can take up to 4-6 weeks to process

So the processing time for your Ohio Sales Tax Permit depends on how you apply.

While processing times can vary, you can generally expect to receive your seller’s permit within 10 business days.

What is a Sales Tax ID Number in Ohio

An Ohio Sales Tax ID Number, also called a Taxpayer Identification Number (TIN), is unique and identifies your business with the Ohio Department of Taxation. Your seller’s permit number acts as your sales tax ID number in Ohio.

How to Get a Sales Tax ID Number in Ohio

In Ohio, you don’t actually receive a separate Sales Tax ID Number. Instead, you’ll get a Vendor’s License if you have a physical presence in Ohio, or a Seller’s Use Tax Account if you’re an out-of-state seller meeting certain criteria. Both act as your sales tax registration and allow you to collect and remit sales tax in Ohio. You can register online quickly through the Ohio Business Gateway.

How to Register a Business in Ohio

To register your business in Ohio, you will need to, choose your business structure, register your business name (Ensure it’s available with the Ohio Secretary of State), obtain an EIN (Employer Identification Number) from the IRS, register for state taxes (this often includes a vendor’s license for sales tax) and check for specific or additional licenses or permits that your industry or location may require.

Do I Need to Renew My Sales Tax Permit in Ohio

No, you don’t need to renew your Ohio sales tax permit. Once you obtain a vendor’s license in Ohio, it remains valid as long as your business operates.

How to Cancel Your Sales Tax Permit in Ohio

To cancel your Ohio sales tax permit, you’ll need to file a final sales tax return and indicate account closure. This can be done electronically through the Ohio Business Gateway or by mail using the Ohio Business Account Update Form.

How to Check the Status of Your Ohio Sales Tax Permit

You can check the status of your permit application or manage your existing permit through your account on the Ohio Business Gateway.

How to Reactivate Your Ohio Sales Tax Permit

To reactivating an inactive Ohio sales tax permit you will need to the Ohio Department of Taxation, file any outstanding tax returns and pay any overdue taxes or penalties, submit a reactivation request, potentially with a fee, resolve any issues that led to the permit’s inactivation.

Once you’ve addressed these steps, the Ohio Department of Taxation will process your request and reactivate your permit.

Ohio Sales Tax Rates by County & Zip Code and Look-Up Tool

There’s no one-size-fits-all answer. There is helpful tool to find the applicable rate for any county or location sales tax rate in Ohio; Ohio Sales Tax Finder

Ohio Business Gateway County and Municipal Rates List

This downloadable list provides a general overview of sales tax rates by county: https://gateway.ohio.gov/

Examples of Specific County Sales Tax Rates in Ohio

To give you an idea of the variations, here are some sales tax rates for major Ohio counties (as of April 30, 2024):

What is Toledo, Lucas County Sales Tax Rate

In Toledo, Lucas County, Ohio, the combined sales tax rate is 7.75%. This is made up of the Ohio state sales tax (5.75%) and the Lucas County sales tax (1.5%).

What is Montgomery County (Dayton) Sales Tax Rate

The combined sales tax rate in Montgomery County (Dayton, Ohio) is 7.5%. This is made up of the Ohio state sales tax (5.75%) and the Montgomery County sales tax (1.75%).

What is Butler County Sales Tax Rate

The sales tax rate in Butler County, Ohio is a combination of the state and local rates, totaling 6.5%.

What is Hamilton County (Cincinnati) Sales Tax Rate

Generally, the combined sales tax rate in Hamilton County (Cincinnati, Ohio) falls between 6.5% and 7.8%.

What is Columbus, Franklin County Sales Tax Rate

The combined sales tax rate in Columbus, Franklin County, Ohio is 7.5%

What is Akron, Summit County Sales Tax Rate

The combined sales tax rate in Akron, Summit County, Ohio is 6.75%. This is made up of the Ohio state sales tax rate (5.75%) and the Summit County sales tax rate (1%).

What is Lorain County Sales Tax Rate

The sales tax rate in Lorain County, Ohio is a combination of state and county rates, totaling 6.5%.

What is Dayton, Montgomery County Sales Tax Rate

The combined sales tax rate in Dayton, Montgomery County, Ohio is 7.5%. This is made up of the Ohio state sales tax rate (5.75%) and the Montgomery County sales tax rate (1.75%).

What is Erie County Ohio Sales Tax Rate

The combined sales tax rate in Erie County, Ohio is at least 6.75%. This includes the Ohio state sales tax rate of 5.75% and a minimum local rate of 1%.

What is Lake County Ohio Sales Tax Rate

The combined sales tax rate in Lake County Ohio is typically 7.25% as of May 2024. This consists of the 5.75% Ohio state sales tax and a 1.5% Lake County rate. This 7.25% is planned to decrease to 7.00% effective July 1, 2024

Ohio Sales Tax Exemptions and Resale Certificates

Understanding sales tax exemptions and resale certificates is essential for minimizing your Ohio sales tax burden. Let’s break it down:

What is Ohio Sales and Use Tax Blanket Exemption Certificate

This certificate allows you to avoid paying sales tax on qualifying purchases made for resale or use directly in the production of a product for sale. It simplifies the process by eliminating the need to provide a separate exemption certificate for each purchase.

Items Exempt from Sales Tax in Ohio

Several items that are exempt from Ohio sales tax include:

- Groceries (most unprepared food items for human consumption)

- Prescription drugs and medical devices

- Educational services

- Certain non-profit sales

- Machinery and equipment used directly in manufacturing (with some limitations)

- Certain farm equipment and supplies

How to Apply for Tax Exemption in Ohio

The Ohio Department of Taxation provides various exemption certificates depending on your specific exemption reason. You can download the forms and instructions from their website: https://tax.ohio.gov/

Here’s a general process for applying for tax exemption:

- Determine your exemption reason: Identify the specific exemption that applies to your purchase.

- Download the appropriate exemption certificate: The website offers various certificates for different exemptions.

- Complete the form: Fill out the form accurately, including your business information and the exemption reason.

- Provide the certificate to your seller: Present the completed certificate to the seller at the time of purchase to avoid paying sales tax.

What Information are Required in Ohio Sales Tax Exemption Form

The specific information required on the exemption certificate can vary depending on the exemption type. However, some common elements include:

- Your business name and address

- Your seller’s permit number (if applicable)

- The exemption reason (e.g., resale, manufacturing equipment)

- A description of the items being purchased

Ohio Sales Tax Exemption Reasons

There are various reasons why a purchase might be exempt from Ohio sales tax. Common reasons include:

- Resale: You’re purchasing items to sell in your business without substantial modification.

- Manufacturing equipment: You’re buying machinery and equipment used directly in manufacturing a product for sale.

- Educational services: You’re purchasing educational services for yourself or your employees.

- Non-profit organizations: You’re a qualified non-profit organization making exempt purchases.

What is an Ohio Resale Certificate

A resale certificate is a simplified version of the blanket exemption certificate used for a single purchase. It allows you to inform the seller that you’re buying an item for resale and exempt from sales tax.

How to Get a Resale Certificate in Ohio

There’s no formal process to “get” a resale certificate in Ohio. You can download a blank resale certificate form from the Ohio Department of Taxation website or create your own document that includes the following information:

- Your business name and address

- Your seller’s permit number

- A statement that you’re registered with the Ohio Department of Taxation and hold a valid seller’s permit.

- A description of the item being purchased

- Your signature

What is exempt from sales tax in Ohio

The common items that are exempted from sales tax in Ohio are groceries and unprepared food (including fruits, vegetables, bakery items, meat, and dairy products, but generally not prepared meals or restaurant food.), prescription drugs and medical equipment, educational supplies (used directly in the classroom by students or teachers), housing-related utilities (electricity, natural gas, water, and steam used in homes).

What are Ohio Sales Tax Exemption Form Instructions

Ohio Sales Tax Exemption Forms come in two main types: Unit Exemption Certificate (STEC U) and Blanket Exemption Certificate (STEC B). Both require information like the purchaser’s name, address, and reason for exemption. The STEC U is for one-time purchases, while the STEC B is for ongoing exempt purchases from a specific vendor.

How do I Claim Sales Tax Exempt in Ohio

To claim sales tax exemption in Ohio, you’ll need to provide a completed exemption certificate to your seller. This certificate verifies your eligibility for tax-exempt purchases based on the items purchased and their intended use. Ohio accepts various exemption certificates, including their own and the Multistate Tax Commission uniform certificate.

How to Fill Out Ohio Sales Tax Exempt Form

To fill out an Ohio Sales Tax Exempt Form (STEC U), enter the vendor’s Name (the business name of the seller you’re buying from), purchaser information (your business name, type of business, address, and signature with title), the reason for exemption (stating clearly why your purchase qualifies for tax exemption, e.g., resale, used for production in agriculture), signature and date, and the vendor’s license number (optional)

Is Equipment used in Manufacturing exempt from Sales Tax

In most states, manufacturing equipment can be exempt from sales tax, but there can be variations. Exemptions often apply to machinery used directly in production.

How to Apply for and get Sales Tax Exemption in Ohio

Ohio doesn’t require a formal application for sales tax exemption. Instead, businesses obtain an exemption by providing a properly filled-out Sales and Use Tax Exemption Certificate (STEC) to their seller. This certificate verifies your eligibility for tax-free purchases. You can find the STEC form on the Ohio Department of Taxation website.

We’ll cover Ohio sales tax payment, filing, and reporting in the next section!

Ohio Sales Tax Payment, Filing, and Reporting

Once you’ve collected sales tax from your Ohio customers, you’re responsible for remitting it to the state. Here’s what you need to know:

How to Pay Ohio Sales Tax

Ohio sales tax is typically paid electronically through the Ohio Business Gateway (OBG) or via mail. To pay Ohio sales tax online, you will need to register for an OBG account (if you don’t have one), log in, select “Sales Tax (UST-1)”, choose your filing period, submit your return, and pay using a credit card, ACH debit/credit, or complete the UST-1 form and mail it along with your payment.

How to File Ohio Sales Tax

Ohio requires online sales tax filing. You have three options:

- File electronically: This is the preferred method. Use the Ohio Business Gateway to submit your UST-1 form and pay any tax due.

- File by mail: Fill out a paper UST-1 form and mail it with your payment.

- Use a third-party tax service: These services can automate filing and payment for you. No matter which method you choose, keep good records of your sales and tax collected.

How to File Ohio Sales Tax Online

To file Ohio sales tax online, go through the Ohio Business Gateway and follow these steps

- Register (if new) or log in with your existing credentials.

- Select “Sales Tax (UST-1)”.

- Choose your filing period and click “Next”.

- Enter your sales and tax details electronically or upload a file.

- Review and submit your return.

- Make your payment electronically using ACH or credit card.

Tip: Ohio encourages online filing for faster processing and fewer errors.

What is the Ohio Sales Tax Filing Frequency

Generally in Ohio, high-volume sellers file more frequently (monthly), while lower-volume businesses may file quarterly or even annually. All filers, regardless of frequency, must submit returns by the 23rd of the month following the reporting period.

When are Ohio Sales Tax Due Dates

Ohio sales tax returns are generally due on the 23rd of the month following the reporting period. This applies to both monthly and semi-annual filers. If the due date falls on a weekend or holiday, the next business day becomes the deadline.

For example, January sales tax is due by February 23rd. If the due date falls on a weekend or holiday, it’s moved to the next business day.

We’ll cover Ohio sales tax refunds and FAQs in the final section!

Ohio Sales Tax Discounts

Ohio doesn’t offer direct discounts on its statewide sales tax rate. However, some Ohio counties and cities have additional local sales taxes on top of the base state rate. These local rates vary by location. So, the total sales tax you pay might be lower or higher depending on where you’re shopping in Ohio

What is the Ohio Sales Tax Timely Filing Discount

There is currently no sales tax filing discount offered by the Ohio Department of Taxation. However, filing your returns and paying your sales tax on time helps you avoid penalties and interest charges.

Ohio Sales Tax Holiday

The Ohio Sales Tax Holiday is a three-day weekend in early August where certain back-to-school items are exempt from state sales tax. This means you won’t pay sales tax on qualifying clothes, school supplies, and instructional materials priced under specific limits. It’s a great opportunity to save money on essential school items!

Does Ohio Have a Sales Tax Holiday

Yes, Ohio has an annual sales tax holiday specifically for back-to-school shopping! It takes place on the first weekend in August each year. During this tax-free weekend, you can buy certain items like clothing (under $75), school supplies (under $20), and school instructional materials (under $20) without paying sales tax.

Is there Sales Tax on Discounts in Ohio

In Ohio, sales tax is applied to the final selling price of an item, after any discounts are applied. This means you’ll pay sales tax on the discounted amount you owe, not the original price.

Ohio Sales Tax Interest and Penalty

Ohio does not offer a discount for filing sales tax returns on time. However, they do impose penalties for late filing and late payment of sales tax.

What is the Penalty for Late Filing or Non-Payment of Ohio Sales Tax

The penalty is the greater of $50 or 10% of the tax owed, with a maximum penalty of 50% of the tax due. Interest is also charged on any unpaid tax at the current rate set by the state.

Does Ohio Refund Sales Tax to Foreigners

No, Ohio doesn’t offer sales tax refunds to foreign visitors for purchases made in the state.

Ohio Sales Tax Audits

An Ohio Sales Tax Audit is a formal review conducted by the Ohio Department of Taxation to verify a business’s sales tax filings. This ensures the business collected and remitted the correct amount of sales tax on taxable goods and services. Audits can focus on sales tax collected from customers (sales audit) or purchases made by the business (use tax audit).

Ohio Sales FAQs

Does Ohio Issue Sales Tax Refunds

In general, Ohio doesn’t issue sales tax refunds to customers. However, there are some exceptions, such as:

Out-of-state purchases: If you purchase an item from an out-of-state vendor and pay sales tax in error (because you’ll be using it in Ohio), you may be eligible for a use tax refund by filing a use tax return with the Ohio Department of Taxation.

Tax-exempt organizations: Non-profit organizations exempt from sales tax may be able to claim a refund for sales tax they mistakenly paid on qualifying purchases.

How Do I Get a Sales Tax Refund in Ohio

In Ohio, you can get a sales tax refund for taxes erroneously or illegally paid. To claim a refund, you’ll need to file an application (Form ST AR) with the Ohio Department of Taxation. Include proof of purchase (invoices), payment (receipts), and a detailed explanation of why the tax was incorrect

What Does Ohio Sales Tax Reciprocity Mean

Ohio sales tax reciprocity simplifies income tax for residents of neighboring states who work in Ohio. These agreements mean Ohio won’t tax wages earned in Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia, as long as those states offer the same courtesy to Ohio residents working there. However, it doesn’t apply to sales tax or other income sources.

What’s on an Ohio Sales Tax Form

An Ohio Sales Tax Form (UST-1) collects information from businesses to report and pay sales tax they’ve collected from customers. Key details on the form include:

- Vendor information: Business name, address, and tax ID number

- Sales activity: Total taxable sales during the reporting period

- Tax breakdown: State, county, and transit authority sales tax collected (varies by location)

- Payment details: Indication of electronic payment or accompanying check remittance

Is Freight Taxable in Ohio

The taxability of freight charges depends on the specific circumstances of the transaction. It’s recommended to consult with a tax professional for guidance.

Is Shipping Taxable in Ohio

In Ohio, generally, the freight charges are considered part of the sales price and therefore taxable if the items being shipped are taxable. This applies whether the freight cost is listed separately or included in the overall price. There are some exceptions, like situations where the customer pays the delivery company directly.

How Does Ohio Sales Tax Out-of-State Buyer Work

You’re responsible for collecting sales tax on sales to Ohio customers regardless of your business location, as long as you have nexus in Ohio.

Does One Ohio Sales Tax Permit Cover Multiple Businesses

No, you’ll need a separate seller’s permit for each business you operate in Ohio.

What Happens to My Ohio Seller’s Permit if I Sell My Business

The seller’s permit is tied to the business owner. If you sell your business, the new owner will need to obtain their own seller’s permit

Do Contractors Charge Sales Tax on Labor in Ohio

Generally, Ohio doesn’t tax labor charges. However, if the contractor provides materials along with labor, the sale of the materials may be subject to sales tax.

Does the Ohio Sales Tax Permit Expire

No, Ohio seller’s permits don’t expire.

Can My Ohio Sales Tax License Application Be Delayed or Rejected

There are reasons why your application might be delayed or rejected, such as missing information or outstanding tax liabilities. The Ohio Department of Taxation will notify you of any issues with your application.

Conclusion

Understanding Ohio sales tax is crucial for e-commerce businesses selling to Ohio customers. By following the guidance in this comprehensive guide, you can ensure compliance and avoid penalties. Remember, this information is intended for general educational purposes and shouldn’t be a substitute for professional tax advice.