As a small business owner selling online to U.S. customers, it’s essential to verify the validity of your buyers’ resale certificates. A resale certificate allows buyers to make tax-exempt purchases, assuming they will resell the goods and collect sales tax from the final consumer. Resale certificates are also known as sales tax exemption certificates, reseller’s permits, or seller’s permits.

Reseller’s Permit, Resale Number Verification, and Exemption Certificate Lookup by State (2024)

Overview of Resale Certificate Verification by State

Sales tax compliance can be a complex task, especially when dealing with customers across various US states, but one important aspect of ensuring compliance involves verifying the validity of resale certificates.

A resale certificate, also known as a sales tax exemption certificate, allows qualified businesses to purchase goods exempt from sales tax. These businesses typically resell the purchased items or use them as components in further manufacturing. As an e-commerce seller, accepting a valid resale certificate allows you to forgo collecting sales tax on these transactions.

However, the importance of verifying resale certificate validity cannot be overstated. Accepting an invalid reseller certificate or license can result in your business being held liable for the uncollected sales tax. This can lead to significant financial penalties and audit headaches down the road.

There are several verification methods available, and they differ depending on the specific state. We’ll explore these methods in detail later in the post.

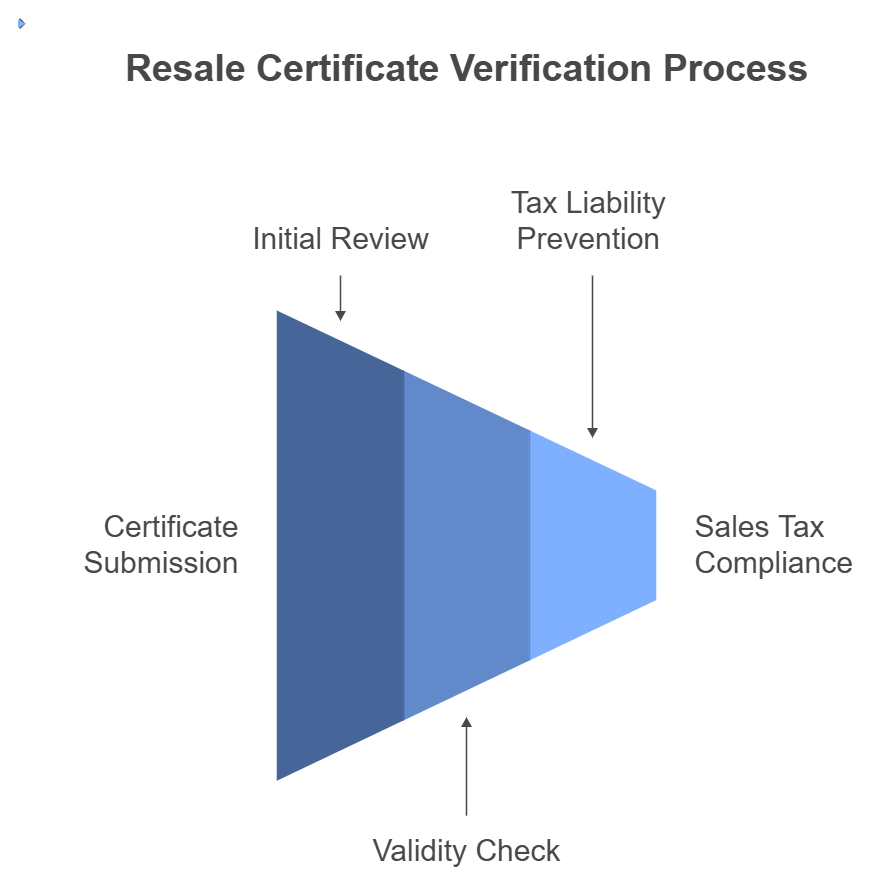

What is the Importance of Resale Certificate Verification

Verifying resale certificates protects sellers from sales tax liability. When a buyer claims a sales tax exemption with a resale certificate, the seller is responsible for ensuring its validity. Failing to verify a fraudulent certificate could result in the seller owing the unpaid sales tax. Verification helps prevent this costly mistake.

What are the Risks of Accepting Invalid Resale Certificates

Accepting invalid resale certificates can trigger sales tax liability for your business. This means you’d be responsible for paying taxes you didn’t collect, plus potential penalties and interest during an audit. To minimize risk, verify all resale certificates carefully before exempting sales tax.

How Resale Certificates Work in the US

Resale certificates save businesses money on tax by allowing them to buy items tax-free for resale. The seller collects sales tax from the end customer instead. To use one, a business typically needs a sales tax permit and to be registered in the state they’re buying from (exceptions apply). Not all states accept out-of-state certificates.

What are Resale Certificates

Resale certificates are official documents issued by a state tax authority to qualifying businesses. They authorize the holder to purchase certain goods exempt from sales tax, provided the items are intended for resale or further manufacturing. Essentially, the resale certificate acts as a proof of exemption, allowing the seller to avoid collecting sales tax on the transaction.

When to Use Resale Certificates

As an e-commerce seller, you should request a resale certificate from a buyer whenever they claim exemption from sales tax on a purchase. Common situations where this might occur include:

- A buyer who identifies themselves as a reseller on your online store.

- A buyer who purchases large quantities of goods, suggesting potential resale intentions.

- A buyer who explicitly mentions using the purchased items for further manufacturing.

Information Included on a Valid Resale Certificate

A valid resale certificate should contain essential information to verify its legitimacy. This typically includes:

- Seller Information: The name and permit number of your business.

- Buyer Information: The name and permit number of the buyer claiming the exemption.

- Product Description: A description of the products being purchased for resale or further manufacturing.

Why do you Need to Verify any US State Resale Certificates

Verifying a resale certificate is crucial for several reasons:

- Sales Tax Compliance: It ensures you’re not inadvertently forgoing sales tax that should be collected.

- Audit Protection: Valid resale certificates serve as documentation during a potential sales tax audit, demonstrating your due diligence in verifying exemption claims.

- Reduced Liability: By verifying certificates, you minimize the risk of being held responsible for uncollected sales tax on invalid exemptions.

State-by-State Resale Certificate Verification Methods

Verifying resale certificates can be a necessary but time-consuming task for e-commerce businesses. While the importance is clear, the process itself varies depending on the state where the buyer’s resale certificate originates. Here’s a breakdown of the commonly used verification methods across different states:

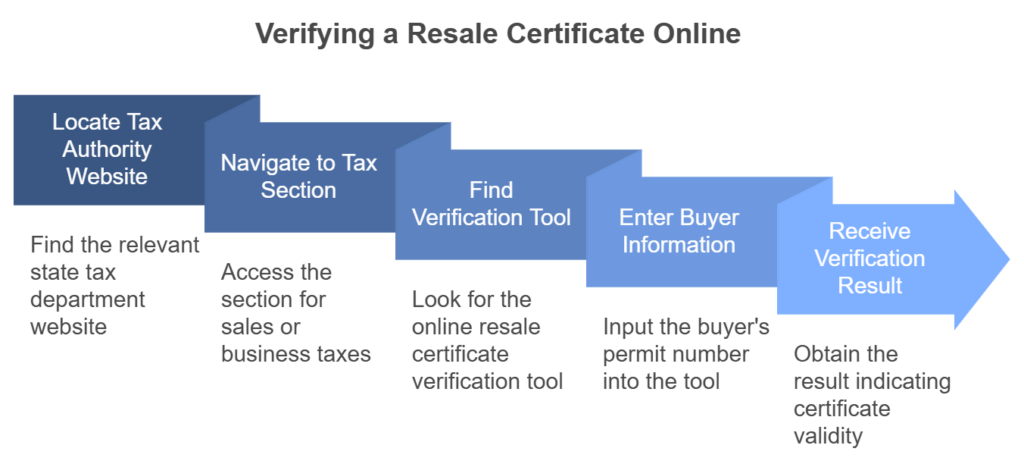

How to Verify a Resale Certificate for US States with Online Verification Method

These typically require entering the buyer’s reseller permit or sales tax ID number, along with your own seller ID, on the state’s tax department website.

Here’s a step by step breakdown of how to verify a resale certificate in the US

- Locate the relevant tax authority’s website for the buyer’s state. Most state government websites will have a dedicated tax department section.

- Look for a section related to “sales tax,” “business taxes,” or “resale certificates.” These sections often contain a link to an online verification tool.

- The online tool will typically require you to enter the buyer’s permit number or other identifying information from the resale certificate.

- The system will then return a result indicating whether the certificate is valid or invalid.

Limitations of Using Online Verification System to Verify your Resale Certificate

While online verification is a convenient option, it’s important to understand its limitations:

- Outdated Information: There’s a possibility that the online system might not reflect the most recent status of the resale certificate, especially if the buyer hasn’t renewed it.

- System Errors: Technical glitches or system outages can occur, potentially leading to inaccurate results.

Therefore, it’s wise to consider these limitations and potentially employ additional verification methods for added security.

How to Verify a Resale Certificate for US States with Phone Verification Method

Some states, particularly those without online verification tools, require contacting the buyer’s state tax department directly by phone to verify the resale certificate. Here’s what you should do:

- Locate the contact information for the state tax department on their website. Look for phone numbers dedicated to business tax inquiries or resale certificate verification.

- Call the relevant phone number and explain your need to verify a resale certificate. You’ll likely be asked to provide details from the certificate, such as the buyer’s permit number and the issuance date.

- A tax department representative will then verify the certificate’s validity in their system and provide you with the results.

Remember, it’s always best to document your verification efforts. Keep a record of the verification method used (online or phone), the date of verification, and the results obtained. This documentation can be crucial during a potential sales tax audit.

We’ve covered the two most common verification methods: online and phone verification. In the next section, we’ll discuss situations where contacting the state tax department directly might be necessary.

How to Verify a Resale Certificate for US States by Contacting the Buyer’s State Tax Department

Not all states offer convenient online or phone verification options. In some cases, directly contacting the buyer’s state tax department might be the only way to verify a resale certificate. Here’s what you should consider:

- Limited Verification Options: Some states might not have online or phone verification tools readily available.

- Out-of-State Buyers: For buyers located in states with limited verification options, contacting their tax department might be necessary.

- Red Flags: If the resale certificate raises any red flags (discussed in section D), contacting the tax department is a prudent course of action.

Before contacting the buyer’s state tax department, it’s crucial to obtain written permission from the buyer. This protects your business and demonstrates transparency in your verification efforts.

Here’s the process for contacting the tax department:

- Gather Information: Locate the contact information for the buyer’s state tax department on their website. Look for phone numbers or email addresses dedicated to business tax inquiries or resale certificate verification.

- Obtain Written Permission: Request written consent from the buyer authorizing you to contact their state tax department regarding the resale certificate.

- Contact the Tax Department: Once you have written permission, use the obtained contact information to reach the tax department and explain your need to verify a resale certificate. Be prepared to provide details from the certificate and the buyer’s written permission.

- Verification Results: The tax department representative will verify the certificate’s validity and provide you with the results.

It’s important to note that contacting the tax department can be a time-consuming process. Wait times can vary depending on the state and their workload.

We recommend using online or phone verification whenever available for quicker results. However, directly contacting the tax department becomes necessary in specific situations, especially when dealing with out-of-state buyers or red flag scenarios.

In the next section, we’ll discuss some red flags to watch out for when verifying resale certificates.

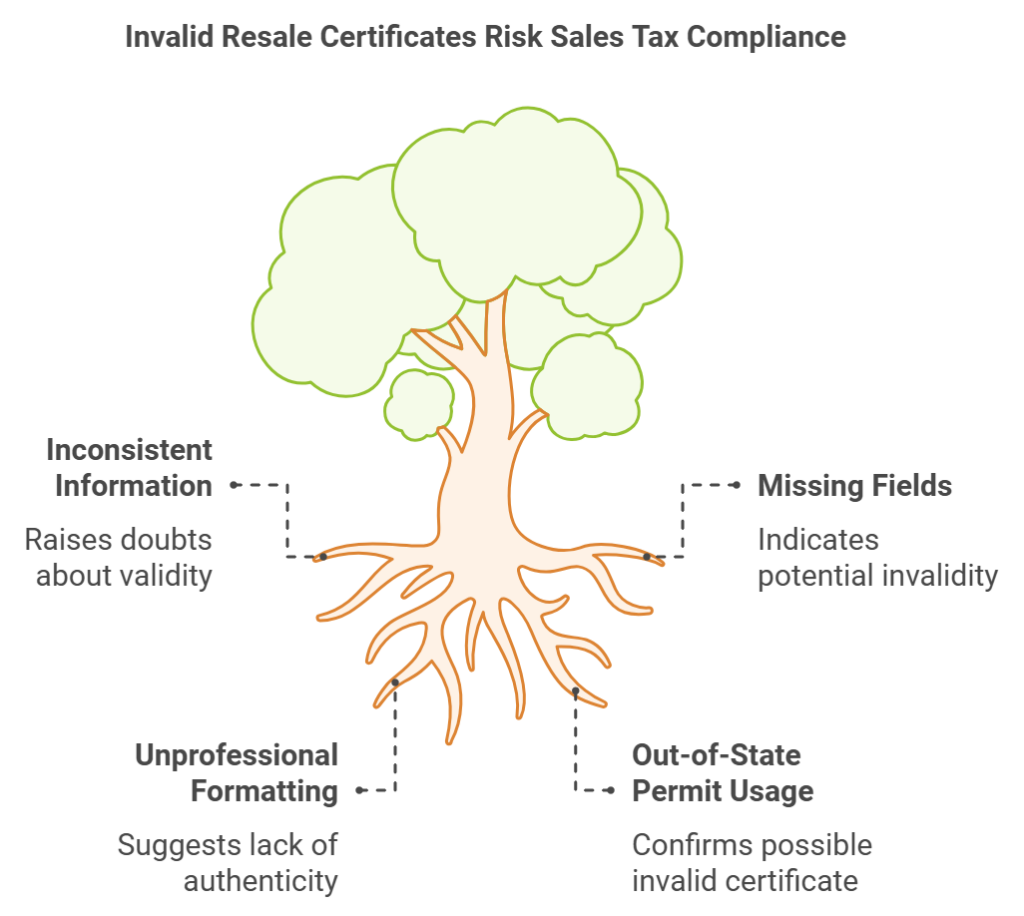

Red Flags to Watch Out For When Verifying the Validity of a Resale Certificate (Invalid Certificate) for US States

Verifying resale certificates is an essential step in ensuring sales tax compliance. However, not all certificates are created equal. Here are some red flags that might indicate a potentially invalid resale certificate:

- Inconsistencies in Information: Carefully review the information on the certificate for any inconsistencies. This includes mismatched names or permit numbers between the seller and buyer information, or product descriptions that don’t align with the buyer’s typical business activities.

- Missing Fields: A valid resale certificate should contain all the necessary information as outlined in section B. Missing fields, especially permit numbers, could be a sign of an invalid certificate.

- Unprofessional Formatting: While formatting isn’t everything, a poorly formatted or low-quality certificate with typos or grammatical errors could raise suspicion. State-issued certificates typically have a professional appearance.

- Out-of-State Permit Used for In-State Purchases: A buyer from State A shouldn’t be using a resale certificate with a permit number from State B for purchases within State A. This discrepancy suggests the certificate might be invalid for the intended purchase location.

If you encounter any of these red flags, it’s best to exercise caution. Consider requesting additional documentation from the buyer, such as a business license or permit verification from their state tax department. Alternatively, you can choose not to accept the resale certificate and require the buyer to pay sales tax on the purchase.

By being vigilant and recognizing these red flags, you can minimize the risk of accepting invalid resale certificates and ensure proper sales tax compliance for your e-commerce business.

In the next section, we’ll discuss the importance of establishing clear verification procedures within your business.

Establishing Verification Procedures for Your Business

Verifying resale certificates can feel like a constant hurdle for e-commerce businesses. However, establishing clear internal controls and verification procedures can streamline the process and minimize errors. Here’s why having a system in place is crucial:

- Consistency and Efficiency: Defined procedures ensure consistent verification across all sales transactions, preventing potential mistakes and missed red flags.

- Reduced Risk of Errors: A clear process helps avoid overlooking crucial details during verification, minimizing the chance of accepting invalid certificates.

- Improved Audit Preparedness: Documented verification procedures demonstrate your commitment to sales tax compliance and can be valuable evidence during a potential audit.

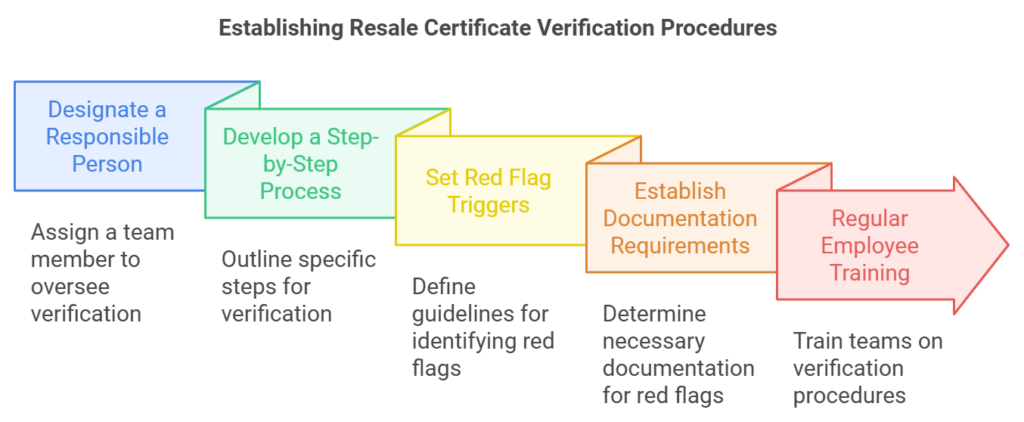

How you can establish verification procedures for your business:

- Designate a Responsible Person: Assign a team member or department the responsibility of overseeing resale certificate verification.

- Develop a Step-by-Step Process: Outline the specific steps for verifying resale certificates, including which method to use (online, phone, or direct contact) based on the buyer’s state.

- Set Red Flag Triggers: Define clear guidelines for identifying red flags on resale certificates, as discussed in section D.

- Establish Documentation Requirements: Determine what documentation you’ll require from the buyer in case of red flags or invalid certificates.

- Regular Employee Training: Train your sales and customer service teams on your verification procedures and how to identify red flags.

State by State Specific Instruction for Resale Certificate Validity Verification

Alabama Resale Certificate Verification

Verify an Alabama resale certificate online through My Alabama Taxes:

- Login to your My Alabama Taxes account.

- Click “Verify a Resale Certificate.”

- Enter the buyer’s tax ID (FEIN, ITIN, or SSN) and their Exempt Sales Account Number.

- Submit the request for verification.

Number. You can also verify a resale certificate by calling the Alabama Department of Revenue at (334) 242-1490.

Verify Alaska Resale Certificate

Alaska issues resale certificates at the local level, so the verification process depends on the seller’s location. For remote sellers exceeding Alaska’s economic nexus threshold, contact the Alaska Remote Seller Sales Tax Commission (ARSSTC) for verification.

Arizona Resale Certificate Verification

Verify an Arizona resale certificate using the Arizona Department of Revenue’s License Verification tool. Enter the eight-digit Arizona Transaction Privilege Tax (TPT) number on the certificate and submit it. This quick online tool will confirm if the TPT license is valid. Remember, Arizona resale certificates themselves aren’t submitted to the state. You can also verify a resale certificate by calling the Arizona Department of Revenue at (602) 255-2060.

Arkansas Sales Tax Exemption Certificate Verification

Verify an Arkansas resale certificate online through the Arkansas Taxpayer Access Point (ATAP):

- Visit ATAP.

- Under “Inquiries,” click “Validate Sales Tax Permit.”

- Choose the permit type (usually “Sales & Use Tax Permit”).

- Enter the reseller’s permit ID number.

- Click “Submit” to see if the certificate is valid.

You can also verify a resale certificate by calling the Arkansas Department of Finance and Administration at (501) 682-7104.

California Resale Certificate Verification

To verify a resale certificate in California, you need to:

- Visit the [California Department of Tax and Fee Administration] website.

- Enter the buyer’s seller’s permit number, business name, and/or city in the fields, and click Search. You can enter partial or complete information for each field.

- If the information matches a valid seller’s permit, you will see the buyer’s name, address, and permit status. If the information does not match a valid seller’s permit, you will see a message that says “No records were found that match your search criteria.”

You can also verify a resale certificate by calling the California Department of Tax and Fee Administration at (800) 400-7115.

Colorado Resale Certificate Verification

Verify a Colorado resale certificate online:

- Visit the Colorado Department of Revenue website.

- Under “Sales Tax License,” click “Verify a License or Exemption Certificate.”

- Choose “Yes” to verify a single certificate.

- Enter the buyer’s 8-digit Colorado Account Number (CAN) in the “Verify a License or Certificate” section.

- The system will display the verification status of the CAN

You can also verify a resale certificate by calling the Colorado Department of Revenue at (303) 238-7378.

Connecticut Resale Certificate Verification

Verify a Connecticut resale certificate online through the CT.gov License Lookup:

- Visit the CT.gov License Lookup: [State of Connecticut License Lookup website].

- Scroll down and choose “Lookup a License.”

- Enter the seller’s permit number provided on the resale certificate.

- Click “Submit” to see if the permit is active.

You can also verify a resale certificate by calling the Connecticut Department of Revenue Services at (860) 297-5962.

Delaware Resale Certificate Verification

Delaware doesn’t issue resale certificates. Since Delaware has no state or local sales tax, there’s no need for businesses to obtain or verify them. If you’re a seller concerned about sales tax collection, you may want to request proof of a valid sales tax permit from another state instead.

District of Columbia Resale Certificate Verification

To verify a resale certificate in the District of Columbia, you need to:

- Log in to the [My Tax DC] portal with your username and password. If you do not have an account, you can register for one [here].

- Click Verify Exemption Certificate from the menu.

- Enter the buyer’s sales and use tax account number and certificate number, and click Verify. The account number should have 9 digits, and the certificate number should have 10 digits.

- If the numbers are valid, you will see the buyer’s name, address, and certificate status. If the numbers are invalid, you will see an error message.

You can also verify a resale certificate by calling the District of Columbia Office of Tax and Revenue at (202) 727-4829.

Florida Resale Certificate Verification

To verify a resale certificate in Florida, you need to:

- Visit the [Florida Department of Revenue] website.

- Enter the seller’s information, such as name, address, and phone number, in the fields, and click Next.

- Enter the buyer’s sales tax certificate numbers for verification in the fields, and click Next. You can enter up to 10 certificate numbers at a time.

- If the certificate numbers are valid, you will see the buyer’s name, address, and certificate status. If the certificate numbers are invalid, you will see an error message.

You can also verify a resale certificate by calling the Florida Department of Revenue at (877) 357-3725.

Georgia Resale Certificate Verification

To verify a resale certificate in Georgia, you need to:

- Visit the [Georgia Department of Revenue] website.

- Follow the steps listed that lead you to the form. You will need to enter your own sales tax account number and password, and agree to the terms and conditions.

- Enter the buyer’s sales tax certificate number for verification in the field, and click Submit. The certificate number should have 9 digits.

- If the certificate number is valid, you will see the buyer’s name, address, and certificate status. If the certificate number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Georgia Department of Revenue at (877) 423-6711.

Hawaii Resale Certificate Verification

To verify a resale certificate in Hawaii, you need to:

- Visit the [Hawaii Department of Taxation] website.

- Enter the buyer’s general excise tax (GET) license number, business name, and/or island in the fields, and click Search. You can enter partial or complete information for each field.

- If the information matches a valid GET license, you will see the buyer’s name, address, and license status. If the information does not match a valid GET license, you will see a message that says “No records were found that match your search criteria.”

You can also verify a resale certificate by calling the Hawaii Department of Taxation at (808) 587-4242.

Idaho Resale Certificate Verification

To verify a resale certificate in Idaho, you need to:

- Visit the [Idaho State Tax Commission] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 9 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Idaho State Tax Commission at (800) 972-7660.

Verify Illinois Resale Certificate

To verify a resale certificate in Illinois, you need to:

- Visit the [Illinois Department of Revenue] website.

- Enter the buyer’s registration number or certificate of registration number in the field, and click Verify. The registration number should have 8 digits, and the certificate of registration number should have 14 digits.

- If the number is valid, you will see the buyer’s name, address, and certificate status. If the number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Illinois Department of Revenue at (217) 785-3707.

Indiana Resale Certificate Verification

To verify a resale certificate in Indiana, you need to:

- Visit the [Indiana Department of Revenue] website.

- Enter the buyer’s registered retail merchant certificate (RRMC) number in the field, and click Verify. The RRMC number should have 10 digits.

- If the RRMC number is valid, you will see the buyer’s name, address, and certificate status. If the RRMC number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Indiana Department of Revenue at (317) 233-4015.

Iowa Resale Certificate Verification

To verify a resale certificate in Iowa, you need to:

- Visit the [Iowa Department of Revenue] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 9 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Iowa Department of Revenue at (515) 281-3114.

Kansas Resale Certificate Verification

To verify a resale certificate in Kansas, you need to:

- Visit the [Kansas Department of Revenue] website.

- Enter the buyer’s sales tax registration number in the field, and click Verify. The registration number should have 10 digits.

- If the registration number is valid, you will see the buyer’s name, address, and registration status. If the registration number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Kansas Department of Revenue at (785) 368-8222.

Kentucky Resale Certificate Verification

To verify a resale certificate in Kentucky, you need to:

- Visit the [Kentucky Department of Revenue] website.

- Enter the buyer’s sales and use tax permit number in the field, and click Verify. The permit number should have 10 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Kentucky Department of Revenue at (502) 564-5170.

Louisiana Resale Certificate Verification

To verify a resale certificate in Louisiana, you need to:

- Visit the [Louisiana Department of Revenue] website.

- Enter the buyer’s sales tax account number in the field, and click Verify. The account number should have 10 digits.

- If the account number is valid, you will see the buyer’s name, address, and account status. If the account number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Louisiana Department of Revenue at (855) 307-3893.

Maine Resale Certificate Verification

To verify a resale certificate in Maine, you need to:

- Visit the [Maine Revenue Services] website.

- Enter the buyer’s sales tax registration number in the field, and click Verify. The registration number should have 7 digits.

- If the registration number is valid, you will see the buyer’s name, address, and registration status. If the registration number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Maine Revenue Services at (207) 624-9693.

Maryland Resale Certificate Verification

To verify a resale certificate in Maryland, you need to:

- Visit the [Maryland Comptroller] website.

- Enter the buyer’s sales and use tax license number in the field, and click Verify. The license number should have 8 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Maryland Comptroller at (410) 260-7980.

Massachusetts Resale Certificate Verification

To verify a resale certificate in Massachusetts, you need to:

- Visit the [Massachusetts Department of Revenue] website.

- Enter the buyer’s sales tax registration number in the field, and click Verify. The registration number should have 10 digits.

- If the registration number is valid, you will see the buyer’s name, address, and registration status. If the registration number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Massachusetts Department of Revenue at (617) 887-6367.

Michigan Resale Certificate Verification

To verify a resale certificate in Michigan, you need to:

- Visit the [Michigan Department of Treasury] website.

- Enter the buyer’s sales tax license number in the field, and click Verify. The license number should have 10 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Michigan Department of Treasury at (517) 636-6925.

Minnesota Resale Certificate Verification

To verify a resale certificate in Minnesota, you need to:

- Visit the [Minnesota Department of Revenue] website.

- Enter the buyer’s sales tax ID number in the field, and click Verify. The ID number should have 9 digits.

- If the ID number is valid, you will see the buyer’s name, address, and ID status. If the ID number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Minnesota Department of Revenue at (651) 282-5225.

Mississippi Resale Certificate Verification

To verify a resale certificate in Mississippi, you need to:

- Visit the [Mississippi Department of Revenue] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 9 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Mississippi Department of Revenue at (601) 923-7700.

Missouri Resale Certificate Verification

To verify a resale certificate in Missouri, you need to:

- Visit the [Missouri Department of Revenue] website.

- Enter the buyer’s sales tax license number in the field, and click Verify. The license number should have 8 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Missouri Department of Revenue at (573) 751-5860.

Montana Resale Certificate Verification

Montana does not have a statewide sales tax, so there is no need to verify resale certificates in this state. However, some local jurisdictions may impose their own sales taxes, and may require you to obtain or verify resale certificates from your buyers. You can find more information about local sales taxes in Montana [here].

Nebraska Resale Certificate Verification

To verify a resale certificate in Nebraska, you need to:

- Visit the Nebraska Department of Revenue website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 10 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Nebraska Department of Revenue at (800) 742-7474.

Nevada Resale Certificate Verification

To verify a resale certificate in Nevada, you need to:

- Visit the [Nevada Department of Taxation] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 10 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Nevada Department of Taxation at (866) 962-3707.

New Hampshire Resale Certificate Verification

New Hampshire does not have a statewide sales tax, so there is no need to verify resale certificates in this state. However, some local jurisdictions may impose their own sales taxes, and may require you to obtain or verify resale certificates from your buyers.

New Jersey Resale Certificate Verification

To verify a resale certificate in New Jersey, you need to:

- Visit the [New Jersey Division of Taxation] website.

- Enter the buyer’s sales tax identification number in the field, and click Verify. The identification number should have 12 digits.

- If the identification number is valid, you will see the buyer’s name, address, and identification status. If the identification number is invalid, you will see an error message.

You can also verify a resale certificate by calling the New Jersey Division of Taxation at (609) 292-6400.

New Mexico Resale Certificate Verification

To verify a resale certificate in New Mexico, you need to:

- Visit the [New Mexico Taxation and Revenue Department] website.

- Enter the buyer’s nontaxable transaction certificate (NTTC) number in the field, and click Verify. The NTTC number should have 10 digits.

- If the NTTC number is valid, you will see the buyer’s name, address, and NTTC status. If the NTTC number is invalid, you will see an error message.

You can also verify a resale certificate by calling the New Mexico Taxation and Revenue Department at (866) 285-2996.

New York Resale Certificate Verification

To verify a resale certificate in New York, you need to:

- Visit the [New York Department of Taxation and Finance] website.

- Enter the buyer’s sales tax identification number in the field, and click Verify. The identification number should have 9 digits.

- If the identification number is valid, you will see the buyer’s name, address, and identification status. If the identification number is invalid, you will see an error message.

You can also verify a resale certificate by calling the New York Department of Taxation and Finance at (518) 485-2889.

North Carolina Resale Certificate Verification

To verify a resale certificate in North Carolina, you need to:

- Visit the [North Carolina Department of Revenue] website.

- Enter the buyer’s sales and use tax registration number in the field, and click Verify. The registration number should have 9 digits.

- If the registration number is valid, you will see the buyer’s name, address, and registration status. If the registration number is invalid, you will see an error message.

You can also verify a resale certificate by calling the North Carolina Department of Revenue at (877) 252-3052.

North Dakota Resale Certificate Verification

To verify a resale certificate in North Dakota, you need to:

- Visit the [North Dakota Office of State Tax Commissioner] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 10 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the North Dakota Office of State Tax Commissioner at (701) 328-1246.

Verify Ohio Resale Certificate

To verify a resale certificate in Ohio, you need to:

- Visit the [Ohio Department of Taxation] website.

- Enter the buyer’s vendor’s license number or streamlined sales tax (SST) number in the field, and click Verify. The vendor’s license number should have 8 digits, and the SST number should have 10 digits.

- If the number is valid, you will see the buyer’s name, address, and number status. If the number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Ohio Department of Taxation at (888) 405-4039.

Oklahoma Resale Certificate Verification

To verify a resale certificate in Oklahoma, you need to:

- Visit the [Oklahoma Tax Commission] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 9 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Oklahoma Tax Commission at (405) 521-3160.

Oregon Resale Certificate Verification

Oregon does not have a statewide sales tax, so there is no need to verify resale certificates in this state. However, some local jurisdictions may impose their own sales taxes, and may require you to obtain or verify resale certificates from your buyers.

Pennsylvania Resale Certificate Verification

To verify a resale certificate in Pennsylvania, you need to:

- Visit the [Pennsylvania Department of Revenue] website.

- Enter the buyer’s sales tax license number in the field, and click Verify. The license number should have 10 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Pennsylvania Department of Revenue at (717) 787-1064.

Rhode Island Resale Certificate Verification

To verify a resale certificate in Rhode Island, you need to:

- Visit the [Rhode Island Division of Taxation] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 9 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Rhode Island Division of Taxation at (401) 574-8955.

South Carolina Resale Certificate Verification

To verify a resale certificate in South Carolina, you need to:

- Visit the [South Carolina Department of Revenue] website.

- Enter the buyer’s retail license number in the field, and click Verify. The license number should have 9 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the South Carolina Department of Revenue at (803) 898-5000.

South Dakota Resale Certificate Verification

To verify a resale certificate in South Dakota, you need to:

- Visit the [South Dakota Department of Revenue] website.

- Enter the buyer’s sales tax license number in the field, and click Verify. The license number should have 10 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the South Dakota Department of Revenue at (800) 829-9188.

Tennessee Resale Certificate Verification

To verify a resale certificate in Tennessee, you need to:

- Visit the Tennessee Department of Revenue website.

- Enter the buyer’s sales and use tax account number in the field, and click Verify. The account number should have 9 digits.

- If the account number is valid, you will see the buyer’s name, address, and account status. If the account number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Tennessee Department of Revenue at (615) 253-0600.

Texas Resale Certificate Verification

To verify a resale certificate in Texas, you need to:

- Visit the [Texas Comptroller of Public Accounts] website.

- Enter the buyer’s sales tax permit number in the field, and click Verify. The permit number should have 11 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Texas Comptroller of Public Accounts at (800) 252-5555.

Utah Resale Certificate Verification

To verify a resale certificate in Utah, you need to:

- Visit the [Utah State Tax Commission] website.

- Enter the buyer’s sales tax license number in the field, and click Verify. The license number should have 14 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Utah State Tax Commission at (801) 297-2200.

Vermont Resale Certificate Verification

To verify a resale certificate in Vermont, you need to:

- Visit the [Vermont Department of Taxes] website.

- Enter the buyer’s sales tax license number in the field, and click Verify. The license number should have 8 digits.

- If the license number is valid, you will see the buyer’s name, address, and license status. If the license number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Vermont Department of Taxes at (802) 828-2551.

Virginia Resale Certificate Verification

To verify a resale certificate in Virginia, you need to:

- Visit the [Virginia Department of Taxation] website.

- Enter the buyer’s sales tax registration number in the field, and click Verify. The registration number should have 9 digits.

- If the registration number is valid, you will see the buyer’s name, address, and registration status. If the registration number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Virginia Department of Taxation at (804) 367-8037.

Washington Resale Certificate Verification

To verify a resale certificate in Washington, you need to:

- Visit the [Washington Department of Revenue] website.

- Enter the buyer’s unified business identifier (UBI) number in the field, and click Verify. The UBI number should have 9 digits.

- If the UBI number is valid, you will see the buyer’s name, address, and UBI status. If the UBI number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Washington Department of Revenue at (800) 647-7706.

West Virginia Resale Certificate Verification

To verify a resale certificate in West Virginia, you need to:

- Visit the [West Virginia State Tax Department] website.

- Enter the buyer’s sales tax account number in the field, and click Verify. The account number should have 9 digits.

- If the account number is valid, you will see the buyer’s name, address, and account status. If the account number is invalid, you will see an error message.

You can also verify a resale certificate by calling the West Virginia State Tax Department at (304) 558-3333.

Wisconsin Resale Certificate Verification

To verify a resale certificate in Wisconsin, you need to:

- Visit the [Wisconsin Department of Revenue] website.

- Enter the buyer’s seller’s permit number in the field, and click Verify. The permit number should have 15 digits.

- If the permit number is valid, you will see the buyer’s name, address, and permit status. If the permit number is invalid, you will see an error message.

You can also verify a resale certificate by calling the Wisconsin Department of Revenue at (608) 266-2776.

Wyoming Resale Certificate Verification

Wyoming does not have a statewide sales tax, so there is no need to verify resale certificates in this state. However, some local jurisdictions may impose their own sales taxes, and may require you to obtain or verify resale certificates from your buyers.

Conclusion

Recap of the Importance of Resale Certificate Verification

Verifying resale certificates is a crucial step for e-commerce businesses selling across various US states. By ensuring the validity of these certificates, you can:

- Maintain Sales Tax Compliance: This protects your business from potential tax liabilities and audit issues.

- Minimize Financial Risk: Avoiding uncollected sales tax reduces the risk of penalties and interest charges.

- Demonstrate Due Diligence: Proper verification procedures showcase your commitment to responsible sales tax practices.

Remember, a little effort upfront in verifying resale certificates can save you significant time, money, and headaches down the road.

Resources for Further Information on Resales License Validity Verification

For additional information on sales tax compliance and resale certificate verification, consider exploring these resources:

- Federation of Tax Administrators (FTA): Federation of Tax Administrators – The FTA provides a wealth of resources on various tax topics, including sales tax and resale certificates.

- State Tax Authority Websites: Each state’s tax authority website typically offers information on resale certificates and verification procedures specific to their state.

By leveraging these resources and implementing the strategies outlined in this blog post, you can confidently navigate the world of resale certificate verification and ensure your e-commerce business maintains optimal sales tax compliance.

Need assistance with verifying resale certificates across different states? Contact us today to ensure your business remains compliant and avoids potential tax liabilities.